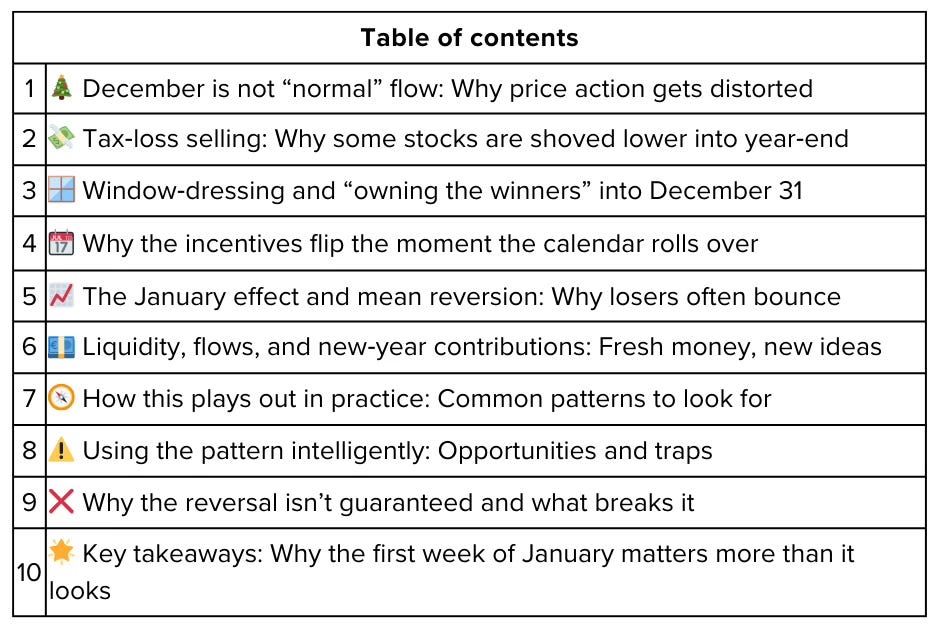

Why the first week of January often “reverses” December moves

Every year, the calendar flips and something strange often happens: stocks and sectors that were relentless winners into December suddenly stall or drop, while the ugly laggards of Q4 rip higher for no obvious “news” reason. Commentators badge this as “January effect,” “new‑year re‑positioning,” or “mean reversion,” but the mechanics are more specific than that.

This article breaks down why the first week of January so often pushes markets in the opposite direction of late‑December flows, what’s going on under the hood in terms of taxes, positioning, and liquidity, and how investors can use this recurring pattern to think more clearly about both risk and opportunity.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

December is not “normal” flow: Why price action gets distorted 🎄

To understand the early‑January “reverse,” start with the reality that December is not a typical month for flows or incentives:

Tax‑driven decisions dominate many portfolios:

Harvesting losses to offset gains.

Locking in profitable positions in the winners of the year.

Professional managers care about year‑end optics:

They want to show clients they own the right “names” in their December holdings reports.

They want to minimize visible losers on the sheet.

Liquidity thins out:

Many traders, PMs, and allocators take holidays.

Fewer active participants means a smaller volume of price‑insensitive flows can move prices more than they would in February or March.

Put simply: the last two to three weeks of December are often dominated by:

Selling pressure in:

Underperformers (tax‑loss selling).

Names that hurt year‑to‑date performance or look bad in reports.

Buying pressure in:

Year’s big winners (window‑dressing).

Broad index products as passive contributions go in.

By December 31, the market has digested a lopsided diet of “tax and optics” flows, which can push prices away from where they would sit if everyone were just thinking about fundamentals.

Tax‑loss selling: Why some stocks are shoved lower into year‑end 💸

Tax‑loss selling is one of the clearest mechanical drivers of December distortions:

Investors with realized gains elsewhere seek to:

Sell holdings that are deeply in the red.

Realize those losses to offset gains and reduce their tax bill.

They often focus on:

Positions where they’ve “given up” near‑term hope.

Names where they can temporarily switch into a similar exposure (e.g., sector ETF, peer stock) to keep the macro tilt but book the loss.

Characteristics of tax‑loss pressure:

Concentrated in:

Year‑to‑date losers.

Smaller or less‑liquid names (where institutional performance pain is worst).

Timing:

Intensifies through the first half of December.

Often peaks in the final full week before the holidays, as tax‑driven selling deadlines approach.

The key point: by the time the calendar turns, some of those losers are priced more by tax and psychology than by the latest fundamentals.

Window‑dressing and “owning the winners” into December 31 🪟

On the flip side, many professional managers have strong career incentives to look aligned with whatever worked over the past year:

They want their year‑end holdings to show:

Exposure to the big winners (mega‑cap tech, AI, quality growth, key sector leaders of the year).

Limited exposure to “embarrassing” names that underperformed or blew up.

This creates:

Fresh buying of winners:

Even if the valuation is stretched.

Even if the fundamental news has slowed.

Additional selling of losers:

On top of tax‑loss selling.

To improve the cosmetics of holdings reports and client decks.

When this overlaps with thin holiday liquidity, you can see:

Extended runs in already‑strong stocks into the last few sessions of the year.

Unrelenting drifts lower in laggards that look one‑way.

Those moves can look and feel like “momentum,” but they’re often driven by a very specific, non‑repeatable incentive set that vanishes on January 1.

Why the incentives flip the moment the calendar rolls over 📆

What changes on January 1 is not the economy, the earnings run‑rate, or the product roadmap. What changes is:

Tax year:

Realized gains and losses now belong to a new period.

No benefit to forcing extra losses just to book them in the old year.

Performance clock:

Every manager is back to 0% for the new year.

They no longer need to “protect” a 2025 number by hugging winners into December 31.

Reporting optics:

Year‑end holdings snapshots are done.

There is more freedom to rotate into unpopular, contrarian, or early‑cycle ideas without worrying how it looks this year.

In combination, that leads to:

Less incremental buying of the prior year’s winners solely for optics.

Less forced selling of losers solely for tax reasons.

More willingness to:

Take profits where positions are big and crowded.

Initiate or add to beaten‑up names with a better medium‑term risk/reward.

That is the core fuel of the “early‑January reversal.”

The January effect and mean reversion: Why losers often bounce 📈

The “January effect” is a classic market idea: small‑cap and beaten‑up stocks tend to outperform in early January. While it has weakened and evolved over time, the logic still has teeth:

Stocks pushed down by December tax‑loss selling:

Have fewer natural sellers once the tax year closes.

Can bounce on even modest new buying interest.

Investors with fresh performance targets:

Seek higher‑beta, higher‑upside names to try to get a fast start to the year.

Prefer undervalued or oversold situations with room for positive surprise.

Systematic and quant strategies:

Identify names that are:

Down the most over 3–12 months.

Starting to stabilize on shorter‑term price and liquidity measures.

Allocate to them as part of mean‑reversion or value factors.

The result:

Former losers often see:

Sharp outperformance in the first week or two of January.

Gains that look “unjustified” by news if you ignore the December tax and window‑dressing context.

Some of the prior year’s leaders may:

Stall or pull back as:

Tax‑motivated sellers flip (now they harvest gains early in the new year).

Crowded positioning is trimmed.

The marginal buyer at stretched multiples disappears.

Liquidity, flows, and new‑year contributions: Fresh money, new ideas 💶

January also brings fresh capital and a different mix of flows:

New contributions and allocations:

Retirement plans, systematic contributions, and institutional rebalancing send new money into markets.

Strategic shifts:

CIOs and asset allocators update:

Strategic sector tilts.

Factor exposures (value vs growth, small vs large, quality vs high‑beta).

Rebalancing from 2025’s winners:

Overweight positions in sectors that outran their targets (e.g., mega‑cap tech after a strong year) may be trimmed.

Underweights in unloved sectors (cyclicals, small caps, certain value pockets) may be lifted.

Because early‑January is usually more liquid than the holiday period, these flows:

Have a cleaner read‑through about what investors really want to own for the new macro and valuation setup.

Can more easily express views that were “queued up” in Q4 but not implemented because of tax and reporting constraints.

That’s another reason why the first week can look like “the opposite” of December:

December shows what people had to do.

Early January shows more of what they want to do next.

How this plays out in practice: Common patterns to look for 🧭

While every year is different, some recurring patterns in the first week of January include:

Bounce in oversold laggards

Particularly in:

Small caps.

Cyclicals and value names that were heavy tax‑loss targets.

“Old theme” stocks left behind by the prior year’s dominant narrative.

Often no fresh news—just a change in flow dynamics and risk appetite.

Pause or pullback in crowded winners

Prior year’s high‑flyers:

May face profit‑taking.

See their multiples tested against reality as the new‑year earnings season approaches.

This doesn’t mean the long‑term story is over, but the easy, forced‑buyer phase may be.

Factor rotations

Shifts like:

Growth → value.

Megacaps → equal‑weight and small caps.

Defensives → cyclicals.

These can begin in the first week and continue or fade depending on macro and earnings.

Volatility around macro and positioning resets

As traders re‑enter and macro data resumes, the first week can bring:

Sharper intraday swings than the sleepy December tape.

Faster repricing of sectors to reflect updated rate/landing expectations.

Using the pattern intelligently: Opportunities and traps ⚠️

The fact that early January often reverses December moves does not mean:

You should blindly short December winners and buy any loser.

You can ignore fundamentals and just chase the calendar.

Instead, use the pattern as a lens:

Separate flow from fundamentals

Ask:

“Is this stock down mainly because the story broke, or because it was a convenient tax‑loss candidate?”

“Is this winner still compounding real value, or did it just benefit from late‑year window‑dressing?”

Build a shopping list in December

Identify:

High‑conviction names that were battered for technical reasons.

Sectors where selling looks more flow‑driven than fundamentally justified.

Plan phased entries:

You don’t need to nail the exact bottom; you care about the next 12–24 months.

Be cautious about chasing December’s parabolic moves into the new year

If a name ran hard into 31 December on:

Little new information.

Obvious “everyone must own this” sentiment.

Consider:

Trimming or waiting for a better entry.

Using options or staggered buys to manage risk.

Align early‑January moves with your 2026 macro view

If you believe:

Soft‑landing and easing rates: early‑year reversals into cyclicals/small caps may have legs.

Hard‑landing risk rising: early rallies in junkier names might be fleeting “junk squeezes.”

Don’t fight your macro and risk framework just because of seasonality—but do use seasonality to time and size exposures more intelligently.

Why the reversal isn’t guaranteed and what breaks it ❌

There are years when the first week of January doesn’t reverse December, or not meaningfully. This usually happens when:

Macro shock overrides flow dynamics:

Big surprises in inflation, growth, or policy early in the year.

Geopolitical or credit events that dominate everything else.

December moves were already fundamentally driven:

For example, a company that blew up in Q4 with a real solvency problem is unlikely to stage a real “January effect” comeback.

Positioning was already heavily adjusted in Q4:

If investors pre‑positioned early, there’s less need to rotate aggressively in the first week.

That’s why the seasonal pattern should sit behind:

Your assessment of fundamentals.

Your read on macro risks.

Your understanding of current positioning and sentiment.

It’s a useful pattern, not a law.

Key takeaways: Why the first week of January matters more than it looks 🌟

December price action is often distorted by tax‑loss selling, window‑dressing, and thin liquidity, especially for losers and small caps.

When the calendar flips:

Tax incentives reset.

Performance clocks reset.

Reporting optics no longer constrain rotations.

The first week of January often shows:

Bounces in oversold laggards.

Consolidation or pullbacks in crowded winners.

Early hints of factor and sector shifts that may define the next phase of the cycle.

The opportunity is not in blindly assuming reversal, but in:

Using December to identify flow‑driven dislocations.

Using early January to start implementing your real 2026 thesis at better prices.

Respecting that what people had to do into December 31 often diverges from what they want to do once a new year, and a new performance race, begins.

Approached with that mindset, the first week of January becomes less of a superstition and more of a structured window to cleanly reset risk, lean into genuine mispricings, and start the year aligned with both fundamentals and flows rather than just with last year’s narrative.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.