What is “smart beta” and how can it improve diversification?

For years, most investors faced a simple choice: try to “beat the market” using expensive active funds, or settle for traditional, capitalization-weighted index funds tracking major benchmarks like the S&P 500. Enter smart beta—an approach that sits between pure active and pure passive investing, promising better risk-adjusted returns and improved diversification. In recent years, smart beta strategies have become a popular buzzword, with hundreds of ETFs and mutual funds adopting this philosophy. But what does smart beta actually mean, how does it work, and can it truly upgrade your portfolio’s resilience in 2025’s unpredictable markets? Let’s break it down in practical, accessible terms.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

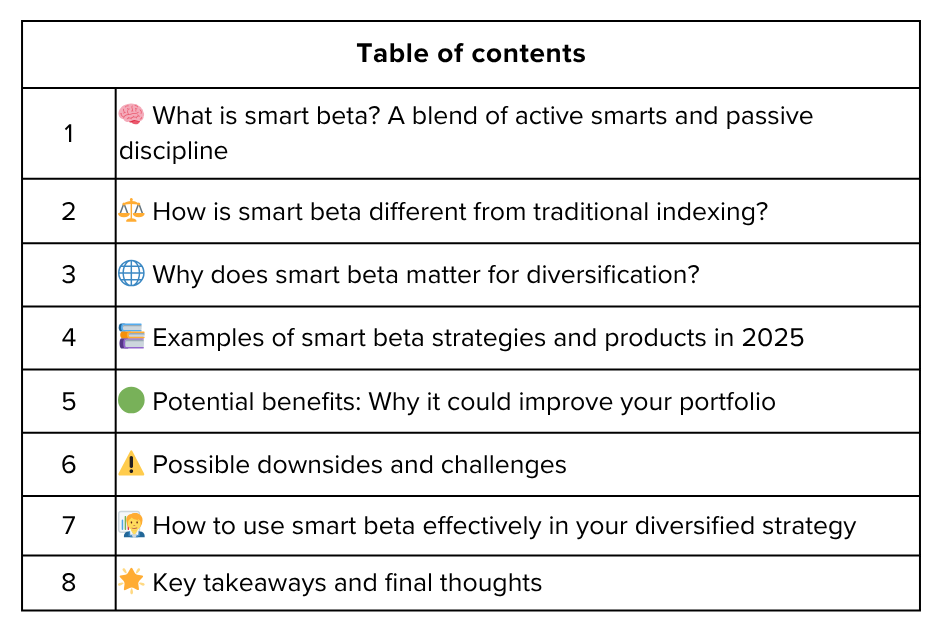

What is smart beta? A blend of active smarts and passive discipline 🧠

Smart beta refers to investment strategies that track indexes, but use rules-based methodologies to tilt portfolio weights according to desired factors—not simply by market capitalization (how big a company is). Instead of blindly investing more in the largest companies, smart beta funds systematically emphasize certain characteristics that have historically driven performance.

Popular smart beta factors include:

Value: Favors cheaper stocks, using measures like low price-to-earnings (P/E) or price-to-book ratios.

Momentum: Favors stocks with strong recent performance.

Low volatility: Prioritizes stocks with steadier returns and lower price swings.

Quality: Focuses on companies with strong profitability, low debt, and stable earnings.

Dividend yield: Targets companies with high or growing dividends.

These strategies aim to capture long-term drivers of return, using transparent and repeatable rules, all while avoiding much of the cost and potential bias of traditional active management.

How is smart beta different from traditional indexing? ⚖️

Traditional (Cap-Weighted) Indexes:

Companies are weighted by their total market value—large companies dominate, while smaller names have little influence.

This approach can lead to concentration risk when a few giants (like tech stocks in the S&P 500) take over.

Smart Beta Indexes:

Weights are based on investment factors, not just size.

Can be equal-weighted, volatility-weighted, factor-weighted, or use complex multi-factor blends.

Tries to avoid over-exposure to any single stock or sector, often reducing risk.

Offers systematic exposure to factors that can outperform over the long term.

Why does smart beta matter for diversification? 🌐

Smart beta can improve diversification in two key ways:

Reduces concentration risk by lowering exposure to the biggest stocks and sectors, especially important when a few names are driving most of the market’s returns.

Spreads risk across different styles and drivers of return—for example, mixing value and momentum, or combining low-volatility with dividend strategies, can cushion a portfolio when one factor underperforms.

When the market rotates from high-flying growth to value, or from winners to laggards, smart beta portfolios can capture more upside and avoid sharp drawdowns.

Examples of smart beta strategies and products in 2025 📚

Value ETFs: Funds that overweight “cheap” stocks, such as those with low P/E ratios (e.g., iShares Edge MSCI USA Value Factor ETF).

Low vol ETFs: Like Invesco S&P 500 Low Volatility ETF, which holds the least volatile S&P 500 names.

Multi-factor ETFs: Combine quality, value, and momentum (e.g., Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF).

Dividend-focused funds: Vanguard Dividend Appreciation ETF, targeting companies with consistent dividend growth.

International smart beta: Products focusing on factors in Europe, Asia, emerging markets, or across the globe for added diversification.

These products make it easy for investors to access factor-based strategies without the need for research or stock picking.

Potential benefits: Why it could improve your portfolio 🟢

Lower risk: Factor diversification can soften volatility compared to traditional market-cap-weighted portfolios.

Improved returns: Historical studies show certain factors, such as quality and value, beat the market over full cycles (though not every year).

Cost-effective: Most smart beta ETFs charge much less than active funds, while still aiming for market outperformance.

Transparency and rules: Clear criteria remove human bias and make risk easier to monitor.

Consistent discipline: Regular rebalancing and rules-based selection can fight the emotions/inertia that hold back many DIY investors.

Possible downsides and challenges ⚠️

Underperformance streaks: No factor wins every year—value, momentum, or low-volatility can each lag the market for long periods.

Higher turnover: Smart beta funds often trade more to maintain factors, possibly raising trading costs and taxes.

Complexity: With new strategies emerging all the time, understanding what’s actually in a fund—and how it may behave in different markets—can be tricky for casual investors.

Crowding: If too many investors pile into the same factor, it can get overpriced, temporarily diluting the edge.

False sense of safety: Some funds claim “smart beta” but simply use minor adjustments; always check what rules the ETF or mutual fund actually follows.

How to use smart beta effectively in your diversified strategy 🧑💼

1. Start with your goals and risk tolerance.

If you worry about tech concentration, try an equal-weight or low-volatility fund.

If you want steady income, test dividend or quality factors.

2. Mix factors for smoother returns.

Don’t put all your eggs in one factor basket; combine value, momentum, and quality for better balance.

3. Use smart beta alongside traditional funds.

Consider splitting your core portfolio between traditional index funds and smart beta funds for broader diversification.

4. Monitor performance, costs, and turnover.

Compare long-term results and watch for tax impact from frequent trading.

5. Keep it simple and transparent.

Stick with ETFs and products you understand; avoid complex structures just because they sound “advanced.”

Key takeaways and final thoughts 🌟

Smart beta bridges passive and active investing by using rules-based, factor-driven strategies (value, momentum, low-volatility, quality, etc.) to capture more diversified sources of return.

In 2025, as market shifts increase the risk of concentration or whipsaw corrections, smart beta may provide broader exposure and protection than traditional index funds alone.

Focus on mixing factors and funds, keeping costs low, and understanding what’s under the hood of any smart beta product or ETF you buy.

While not a magic bullet, smart beta is a valuable tool for building a resilient, modern portfolio able to ride out changing markets—and take advantage when the next rotation comes.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.