What is ‘multiple compression’ and why does it matter now?

A new buzzword is rattling the halls of finance in 2025: “multiple compression.” For investors and advisors worldwide, multiple compression is more than just financial jargon—it’s a central force shaping today’s markets and tomorrow’s outcomes. As stock valuations appear stretched and macroeconomic clouds linger, understanding multiple compression has become essential for anyone aiming to navigate the current investment landscape with confidence.

This article unpacks the what, why, and how of multiple compression—explaining the mechanics, the drivers, its present-day significance, the risks, and the opportunities that may emerge in a world where “paying up” for growth is no longer a given.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Understanding multiples and market valuation 🎯

At the heart of multiple compression lies the concept of “multiples”—financial ratios used to value companies. The most well-known is the price-to-earnings (P/E) ratio, which expresses how much investors are willing to pay for each dollar of a company’s earnings. Other key multiples include price-to-sales (P/S), price-to-book (P/B), and EV/EBITDA.

Multiples are shorthand for investor sentiment and expectations. When optimism is high, investors assign higher multiples, betting on strong future growth. When caution prevails, they pull back, demanding a discount and pushing multiples lower. In other words, multiples are as much about psychology and confidence as they are about cold, hard numbers.

Examples of valuation multiples:

Price-to-Earnings (P/E)

Price-to-Sales (P/S)

Price-to-Book (P/B)

Enterprise Value to EBITDA (EV/EBITDA)

What is multiple compression? Breaking down the phenomenon 🧮

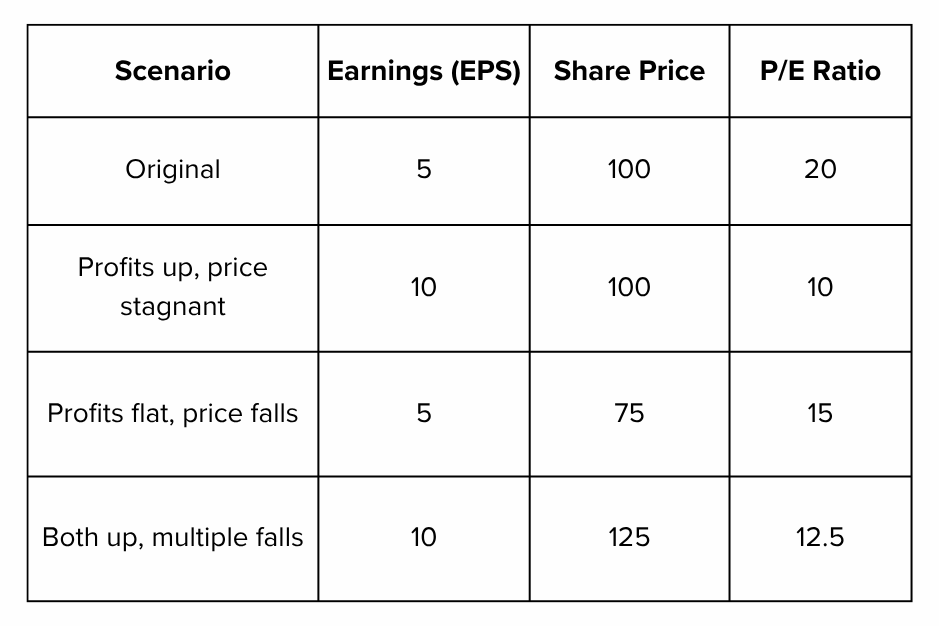

Multiple compression refers to a decline in the valuation multiple investors assign to a company or the broader market. This can happen for several reasons:

Stock price falls while earnings stay flat

Stock price remains steady while earnings rise

A combination of falling prices and rising earnings

In all cases, the ratio—such as the P/E—shrinks, or "compresses," even if the company’s fundamentals remain unchanged or even improve. It signals that investors are less willing to “pay up” for growth, perhaps due to fading confidence in future prospects or changing macroeconomic conditions.

A quick math example:

If a company trades at $100 and earns $2 per share, P/E is 50.

If earnings go to $4, but the share price stays at $100, P/E drops to 25.

That’s multiple compression, even as profits doubled.

Why is multiple compression happening now? The 2025 context 🗓️

In 2025, financial markets are wrestling with the aftershocks of years of easy money, a record-setting bull run, and the persistence of high valuations in popular stocks. Multiple compression has become a dominant risk—and, for some, an ever-present reality.

Key drivers today:

Interest rates and inflation: Rising or elevated interest rates raise the bar for equity returns, leading investors to demand higher earnings yields—and thus assign lower multiples.

Normalization after exuberance: Following years of “multiple expansion” (investors paying higher and higher prices for the same earnings), the pendulum is swinging back, especially for high-multiple growth stocks.

Economic and earnings uncertainty: Even as earnings outlooks for many blue-chip companies improve modestly, concerns about global growth, geopolitical instability, and changing fiscal policy have prompted collective caution.

Rotation and reallocation: Investors increasingly differentiate between companies and sectors, rewarding defensiveness and penalizing riskier business models.

These forces have led to a palpable sense of re-pricing in markets, with some of 2024’s top performers seeing their multiples squeezed hardest, regardless of their profitability.

The mechanics: How multiple compression impacts stock prices 🔧

Multiple compression can erode stock prices—even when underlying businesses are performing well. Here’s how:

Falling multiples offsetting earnings growth: If a company grows its profits by 10%, but its P/E multiple falls by 15%, its share price may drop, despite the business improving.

Weakness in high-multiple stocks: Stocks with the highest starting valuations—often fast-growing tech names—are most at risk for multiple compression. As expectations for future growth fade, their share price can fall sharply even with solid financials.

Contagion and sentiment swings: In times of market stress, entire sectors or markets can experience multiple compression, as investors rush to safety and demand discounts everywhere.

Illustrative example of multiple compression

Why multiple compression matters: Investor implications 🕵️

Multiple compression is no mere academic curiosity—its impact is felt across portfolios, strategies, and even economic confidence.

For investors, it means:

Less “easy” upside: Market gains that previously came from rising multiples (e.g., the tech boom’s P/E expansion) are no longer assured.

More focus on fundamentals: Stock selection and earnings quality become paramount, as the “rising tide” of multiple expansion ebbs.

Growth stocks vs. value stocks: Growth stocks with high P/Es are particularly vulnerable—value stocks with lower multiples may be somewhat insulated, though they’re not immune.

Risk of negative returns despite good earnings: Even firms that beat profit forecasts can see their share prices stagnate or sink if their multiples compress.

For market watchers:

Observing aggregate valuations (e.g., S&P 500 trading at 23x forward earnings vs. a long-run average of 16–17x in 2025) helps anticipate periods where multiple compression risk is highest.

What causes multiple compression? Macro and micro triggers 📉

Several factors can spark or accelerate multiple compression:

Monetary policy tightening: When central banks hike interest rates, the present value of future earnings and cash flows declines, putting downward pressure on multiples.

Inflation and higher risk premiums: Investors require a higher return to compensate for uncertainty, leading to lower stock valuations relative to earnings.

Earnings disappointments: If companies provide weak guidance or miss expectations, growth projections are revised down—and multiples follow.

Sector risks: Sectors that enjoyed outsized optimism (often tech and consumer discretionary) are most vulnerable.

Geopolitical and fiscal shocks: Wars, trade conflicts, or abrupt tax policy changes can spark risk aversion and trigger broad-based multiple compression.

End of speculative cycles: During bull markets, multiples tend to drift higher as risk appetite grows. When sentiment shifts, multiples revert quickly, often overshooting on the downside.

Multiple compression in action: Real-world examples in 2025 🏛️

Recent market action provides dramatic illustrations:

US mega-caps: At the end of 2024, stocks like Apple, Microsoft, and Nvidia saw historic valuation highs. In early 2025, even as earnings projections improved, price erosion and multiple contraction whittled away gains.

Growth-to-value rotation: Multiple compression has hit growth stocks first, as the premium for potential future profits narrows. Value stocks have been more resilient, but are not exempt.

Market-wide impact: After years of multiple expansion, strategists forecast a 5% contraction in S&P 500 valuation multiples for 2025, meaning stock returns will rely much more heavily on underlying earnings growth rather than “paying up for hope”.

How investors can manage and respond to multiple compression 🛡️

Managing through an era of multiple compression demands discipline and adaptability. Key approaches include:

Emphasizing earnings quality: Focus on companies with robust, sustainable earnings and limited reliance on speculative narratives.

Diversification: Reducing concentration in ultra-high-multiple sectors mitigates risk if sentiment sours.

Attention to valuation: Seek opportunities in companies or regions trading at historical average or below-average multiples.

Dynamic asset allocation: Consider shifting towards defensive sectors or value-tilted portfolios when multiple compression risk spikes.

Long-term perspective: Short-term multiple compression can create long-term buying opportunities for investors patient enough to wait out sentiment cycles.

Looking ahead: What to watch as multiples compress 📊

Going forward, several signposts will help investors stay ahead:

Interest rate outlook: Watch central bank moves and bond yields, which often set the tone for valuation multiples.

Corporate earnings trends: Strong, broad-based earnings growth can soften the blow of multiple compression, while weak profit growth compounds the pain.

Sentiment and positioning: Heavily crowded trades and “story stocks” may see sharper re-pricing as multiples rebase.

Policy and fiscal changes: Elections, tax reforms, and regulatory shifts can create quick pivots in market appetite for risk.

Global crosscurrents: Keep an eye on international markets—multiple compression isn’t just a US phenomenon.

Navigating the new multiples order 🏁

Understanding multiple compression isn’t just a tool for analysts or professionals—it’s a practical necessity for every investor in 2025. As market confidence ebbs from exuberance to caution and back again, the ability to recognize, adapt to, and even benefit from shifting valuations is integral to long-term success.

While multiple compression can feel unsettling—especially after years of market gains driven by expanding optimism—history shows it is a normal part of the market cycle. For those prepared, it’s a signal to refocus on quality, discipline, and value. And in the end, surviving and thriving during periods of adjustment lays the groundwork for stronger, more resilient portfolios in the cycles to come.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.