What does ‘Trading near fair value’ mean for investors in June 2025?

In June 2025, headlines across financial media are highlighting a key phrase: “U.S. stocks are trading near fair value.” But what does this actually mean for investors? Is it a green light to buy, a warning to hold back, or simply a sign to be more selective? Understanding the concept of fair value—and what it means when markets hover close to it—can help you make smarter, more disciplined investment decisions in today’s environment.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

What is fair value in stock investing? 🧮

Fair value is an estimate of what a stock (or the overall market) is truly worth, based on its underlying fundamentals—such as future earnings, cash flows, growth prospects, and risk profile. Unlike the market price, which is set by the latest trade and can swing wildly on news or emotion, fair value aims to reflect a stock’s intrinsic, long-term worth.

Fair value is the price that a knowledgeable, willing buyer and seller would agree on, given all available information and no pressure to transact.

Market price is simply what buyers and sellers are willing to pay right now, often influenced by short-term factors.

For example, if a company’s fair value is estimated at $100 per share and it’s currently trading at $100, it’s said to be “trading at fair value.” If it’s trading at $90, it’s “undervalued”; at $120, it’s “overvalued.”

How is fair value calculated? 🔍

There are several ways to estimate fair value, but the most common methods include:

Discounted Cash Flow (DCF) Analysis: Projects a company’s future cash flows and discounts them back to the present using a required rate of return.

Comparable Company Analysis: Compares valuation multiples (like P/E or EV/EBITDA) to similar businesses.

Asset-Based Valuation: Calculates the value of a company’s assets minus its liabilities.

For the overall market, analysts often use composite models that blend these approaches across many companies to estimate whether the market as a whole is overvalued, undervalued, or fairly valued.

Fair value vs. market value: Why the difference matters 💡

Fair value reflects what a stock should be worth based on fundamentals and long-term prospects.

Market value is what it’s actually trading for at any moment, shaped by supply and demand, sentiment, and news.

These values often diverge, sometimes significantly. When the market price falls below fair value, it may signal a buying opportunity. When it’s above, caution is warranted. But when prices are “near fair value,” the margin for error shrinks, and investors need to be more selective and disciplined.

What does ‘Trading near fair value’ mean in June 2025? 📊

As of late May 2025, major U.S. stock indexes were trading at only a 3% discount to fair value, according to leading valuation models56. This is close to the historical midpoint, where half the time the market trades higher and half the time lower56. In other words, stocks are neither screaming bargains nor wildly overpriced—they’re fairly valued by most fundamental measures.

Key implications:

Minimal margin of safety: With stocks close to fair value, there’s little cushion for unexpected bad news or economic shocks.

Market-weight stance: Many analysts recommend holding a neutral or “market weight” position—neither aggressively buying nor selling.

Selective opportunities: While the overall market may be fairly valued, individual stocks or sectors can still be over- or undervalued.

Why does it matter for your portfolio? 🧭

When the market trades near fair value:

Risk and reward are balanced: Upside potential is more limited, while downside risks are more pronounced if negative surprises hit.

Stock-picking becomes crucial: With fewer broad bargains, investors need to dig deeper into individual companies and sectors to find value.

Disciplined strategy pays off: Avoiding emotional decisions and sticking to a well-defined investment plan is more important than ever.

Example:

In April 2025, the market traded at a 17% discount to fair value—a strong buy signal for long-term investors. After a rapid rebound, stocks are now close to fair value, prompting many to lock in gains and return to a more neutral stance.

How should investors respond when markets trade near fair value? 🛠️

Stay diversified: Don’t bet heavily on any single sector or stock. Spread your risk across asset classes and geographies.

Focus on quality: Favor companies with strong balance sheets, consistent earnings, and sustainable competitive advantages.

Be selective: Look for individual stocks trading below their own fair value, even if the overall market is fairly priced.

Monitor risks: Pay attention to macro risks—like interest rates, inflation, and geopolitical events—that could tip the balance.

Rebalance regularly: As valuations change, adjust your portfolio to maintain your desired risk profile.

Avoid chasing hype: Don’t get drawn into overvalued “hot” stocks just because they’re in the news.

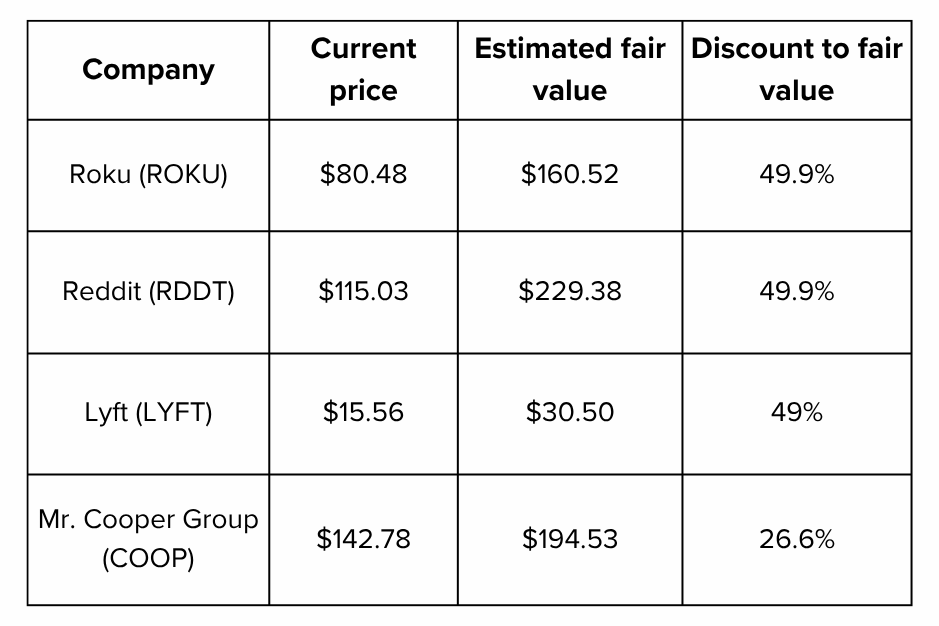

Case studies: Stocks trading near or below fair value in June 2025 📚

Even when the overall market is fairly valued, some stocks still trade at significant discounts to their estimated fair value, offering potential opportunities:

These examples show that even in a market trading near fair value, diligent research can uncover undervalued opportunities.

Risks and limitations of fair value analysis ⚠️

Estimates can be wrong: Fair value is based on assumptions about future growth, profitability, and risk. Unexpected events can quickly change the outlook.

Market sentiment dominates short-term: Prices can diverge from fair value for extended periods due to fear, greed, or speculation.

Macro risks remain: With stocks near fair value and volatility expected to rise, there’s less room for error if the economy stumbles or rates rise.

Key takeaways and final thoughts for June 2025 🚀

‘Trading near fair value’ means the U.S. stock market is close to its estimated intrinsic worth based on fundamentals—not cheap, but not expensive either.

Opportunities still exist: Even in a fairly valued market, individual stocks and sectors can be mispriced.

Risk management is crucial: With little margin of safety, focus on quality, diversification, and disciplined portfolio management.

Stay nimble: Monitor economic and market developments closely, and be ready to adjust your strategy as conditions change.

In summary, “trading near fair value” is a signal to be thoughtful, selective, and disciplined. It’s not a time for bold bets or panic selling, but for careful stock-picking, risk management, and sticking to your long-term plan. In the nuanced market landscape of June 2025, that’s the edge that will serve investors best.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.