Understanding cost of capital vs. WACC: The investor’s power tools

In the world of finance, two critical concepts stand out for investors and businesses alike: the cost of capital and the Weighted Average Cost of Capital (WACC). The cost of capital represents the minimum return required to justify an investment, encompassing both debt and equity costs. WACC provides a comprehensive view of a company's overall financing costs by averaging the costs of debt and equity based on their proportions in the capital structure. Understanding these concepts is essential for evaluating investment opportunities, determining financial health, and making strategic decisions. In this article, we will delve into the intricacies of cost of capital and WACC, exploring their definitions, calculations, applications, and implications for investors and businesses.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

Understanding cost of capital 📈

Cost of capital is a fundamental concept in finance that refers to the total cost of raising capital through debt and equity. It encompasses both the cost of debt (interest paid on borrowed funds) and the cost of equity (the return expected by shareholders). For an investment to be worthwhile, its expected return must exceed the cost of capital. This concept is essential for businesses as it helps in evaluating investment opportunities, capital budgeting, and determining the optimal mix of debt and equity financing.

Cost of debt

The cost of debt is the interest rate paid on borrowed funds. It is typically lower than the cost of equity because interest payments are tax-deductible, reducing the effective cost. Companies with strong credit ratings can borrow at lower rates, while those with weaker credit profiles face higher costs.

Cost of equity

The cost of equity is more complex and represents the return shareholders expect from their investment. It can be estimated using models like the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, market return, and the company's beta (a measure of volatility relative to the market).

What is weighted average cost of capital (WACC)? 🤔

WACC is a more nuanced metric that calculates the average cost of capital by weighting the costs of debt and equity based on their proportions in the company's capital structure. It provides a comprehensive view of the overall cost of financing and is widely used in financial decision-making, such as evaluating investment projects and valuing companies.

Calculating WACC

The WACC formula is as follows:

E = Market value of equity

D = Market value of debt

V = Total market value of the company (E+D)

Re = Cost of equity

Rd = Cost of debt

Tc = Corporate tax rate

Applications of cost of capital and WACC 📝

Both cost of capital and WACC are essential tools for investors and businesses. They help in evaluating investment opportunities, making capital budgeting decisions, and assessing financial health.

1. Investment evaluation

When considering an investment, comparing its expected return to the cost of capital or WACC is crucial. If the expected return exceeds the cost of capital or WACC, the investment is likely to generate positive returns and add value to the company.

2. Capital budgeting

In capital budgeting, WACC serves as a hurdle rate. Projects with expected returns above the WACC are considered viable, as they are expected to generate sufficient returns to cover the cost of capital and provide a positive net present value (NPV).

3. Business valuation

WACC is also used in business valuation, particularly in the Discounted Cash Flow (DCF) method. It helps estimate the present value of future cash flows by discounting them at the WACC rate.

Factors Influencing Cost of Capital and WACC 🌪️

Several factors can influence the cost of capital and WACC, including:

Interest rates: Changes in interest rates directly affect the cost of debt. Higher interest rates increase borrowing costs, which can lead to a higher WACC.

Market conditions: Stable markets typically offer lower funding costs compared to volatile ones. This stability can reduce both the cost of debt and equity.

Inflation: High inflation erodes purchasing power, leading to higher interest rates and increased costs of funds.

Financial leverage: Companies with more debt generally pay higher costs due to increased perceived risk, which can elevate WACC.

Credit rating: A company's creditworthiness affects borrowing costs; riskier firms face higher rates, impacting WACC.

Strategic decision-making with cost of capital and WACC 💭

Understanding cost of capital and WACC is vital for strategic decision-making in business. These metrics help companies optimize their capital structure, evaluate investment opportunities, and make informed decisions about mergers and acquisitions.

Capital structure optimization

By analyzing the cost of debt and equity, companies can determine the optimal mix of financing sources to minimize WACC and maximize shareholder value.

Mergers and acquisitions

When considering mergers and acquisitions, evaluating the cost of capital helps determine whether a deal is financially viable. The combined benefits and future cash flows must exceed the cost of capital used to fund the acquisition.

Risk management

WACC also helps in assessing the risk associated with investments. A higher WACC indicates higher investment risk, as the required return to meet the cost of capital is also higher.

Case studies: Applying cost of capital and WACC 🧑💻

Let's consider a few examples to illustrate how cost of capital and WACC are applied in real-world scenarios.

Example 1: New homes real estate investment trust

New Homes is analyzing a renovation project for 25 apartment homes. The project costs $30 million and is expected to save $5 million annually for five years. If the cost of capital is 10%, the project's return of 16% makes it a better investment than a five-year bond offering a 10% return.

Example 2: Gold company

Gold Company needs $1.5 million in capital to purchase an office and equipment. It raises $800,000 by selling stocks with a 5% cost of equity and $700,000 through bonds with a 10% cost of debt. With a corporate tax rate of 25%, Gold Company's WACC can be calculated to determine the viability of future investments.

The role of cost of capital and WACC in financial planning 🧮

Cost of capital and WACC play pivotal roles in financial planning by guiding investment decisions and capital allocation strategies.

Financial planning for investors

For investors, understanding cost of capital helps in evaluating the potential return on investments relative to the risk involved. WACC provides a comprehensive view of a company's financing costs, allowing investors to assess the financial health and potential for future growth.

Financial planning for businesses

Businesses use cost of capital and WACC to evaluate investment projects, optimize capital structures, and make strategic decisions about mergers and acquisitions. These metrics ensure that investments generate sufficient returns to justify the associated costs, supporting sustainable growth and profitability.

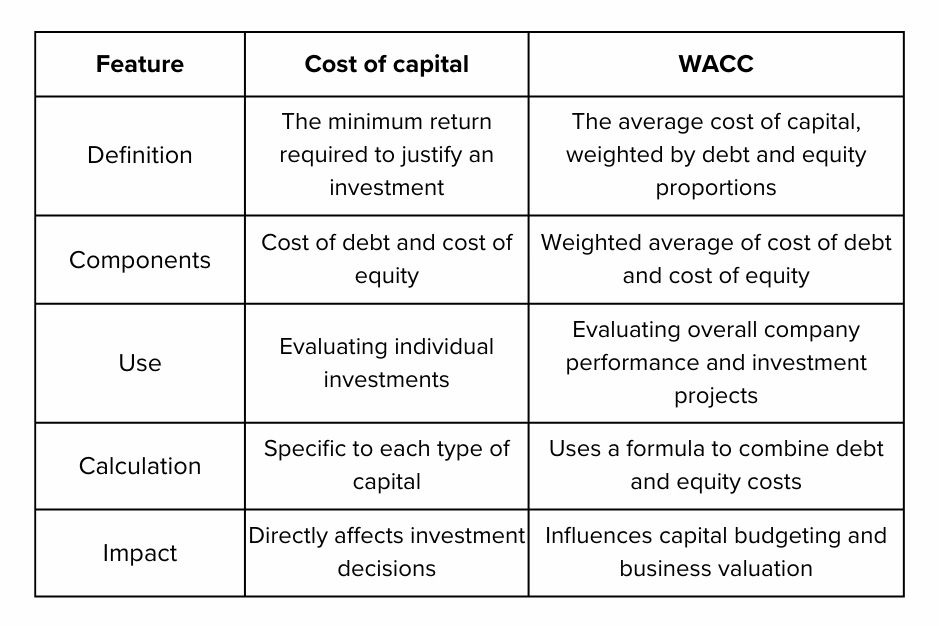

Comparison of cost of capital and WACC 📊

Here's a comparison of key aspects of cost of capital and WACC:

Final thoughts on mastering cost of capital and WACC 🚀

In conclusion, understanding the cost of capital and WACC is indispensable for both investors and businesses. These metrics provide critical insights into the financial health and viability of investments, guiding strategic decisions that can significantly impact profitability and growth. By leveraging these tools effectively, companies can optimize their capital structures, evaluate investment opportunities more accurately, and make informed decisions that align with their financial goals. Whether you're a seasoned investor or a business leader, mastering the concepts of cost of capital and WACC will empower you to navigate the complex world of finance with confidence and precision.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.