The rule of 72: How fast can your money double?

Ever wondered how long it will take for your investments to double in value? The Rule of 72 is a simple yet powerful formula that gives you a quick estimate of the time needed to grow your money—without a calculator or complex math.

But how does it work, and why is it so useful for investors? Let’s break it down and explore its applications, limitations, and how you can use it to make smarter financial decisions.

What is the rule of 72? 🔢

The Rule of 72 is a simple yet powerful mathematical shortcut used to estimate how long it takes for an investment to double in value, given a fixed annual rate of return. It helps investors make quick projections without the need for complex calculations. The formula is:

Years to double = 72 ÷ Annual rate of return

For example:

If your investment earns 6% per year, it will double in 72 ÷ 6 = 12 years.

If it earns 9% per year, it will double in 72 ÷ 9 = 8 years.

If it earns 12% per year, it will double in 72 ÷ 12 = 6 years.

This simple rule allows investors to make quick financial projections without needing spreadsheets or advanced calculations.

Why the rule of 72 works ⏳

The Rule of 72 is derived from the formula for compound interest, which calculates the exponential growth of an investment. The actual formula is:

FV = PV × (1 + r)^t

Where:

FV = Future value

PV = Present value

r = Interest rate (decimal form)

t = Time (years)

While the precise doubling formula involves logarithms, 72 provides a remarkably close estimate for interest rates between 6% and 10%. It’s widely used in finance because of its speed and accuracy.

Why use 72 instead of 70 or 69?

72 is highly divisible by many common interest rates (e.g., 6, 8, 9, and 12), making it easier for mental math.

69.3 is technically more precise (from logarithmic calculations), but 72 is used in practice because it provides more accurate estimates for typical growth rates.

For lower or higher rates, slight adjustments may be needed (e.g., using 69 for very low rates or 74 for higher rates).

How the rule of 72 applies to investing 📈

1. Stock market growth

Historically, the S&P 500 has averaged about 8-10% annual returns.

Using the Rule of 72, an investor in a 10% market can expect their money to double in 7.2 years.

If the market slows to 6% returns, doubling takes 12 years.

2. Real estate investments

If rental properties appreciate at 5% annually, it takes 14.4 years to double their value.

If appreciation is 8% annually, doubling happens in just 9 years.

3. Gold and commodities

Gold has historically returned 4-5% annually, meaning a doubling period of 14-18 years.

Commodities like oil may have more volatility, but long-term trends can still be assessed using this rule.

4. Retirement planning

If a 401(k) or IRA grows at 7% annually, the Rule of 72 estimates 10.3 years for money to double.

This helps retirement planners project how early they need to start investing to meet their goals.

5. Cryptocurrency & high-risk investments

Bitcoin and other cryptocurrencies have experienced returns exceeding 50%+ in some years, meaning theoretical doubling times as short as 1.5 years.

However, due to extreme volatility, such high returns are unsustainable long-term.

Limitations of the rule of 72 ⚖️

While the Rule of 72 is a great estimation tool, it has some limitations:

Only works for fixed rates

The rule assumes a constant annual return, but in reality, market returns fluctuate.

If an investment experiences volatile or irregular growth, the Rule of 72 becomes less reliable, and actual compounding calculations are needed for accuracy.

Less accurate for very high or low rates

For returns below 6%, the rule slightly underestimates doubling time.

For returns above 10%, it overestimates the time needed.

Adjustments can be made: use 69.3 instead of 72 for extreme precision.

Inflation isn’t considered

If inflation averages 3%, then your purchasing power isn’t actually doubling at the same rate.

Real returns must be adjusted for inflation to measure actual wealth growth.

Doesn't account for fees and taxes

Investment returns are often reduced by management fees, transaction costs, and taxes, which impact actual growth.

The Rule of 72 assumes gross returns, meaning investors need to factor in net returns after deductions.

Assumes annual compounding

The rule works best for investments that compound annually, but many investments (like stocks and mutual funds) compound daily, monthly, or quarterly.

More frequent compounding can lead to slightly different results compared to the Rule of 72 estimate.

Doesn't apply to non-compounding investments

The Rule of 72 only applies to compounding growth and doesn’t work for simple interest investments like bonds with fixed coupon payments.

For non-compounding returns, other formulas like simple interest calculations are more accurate.

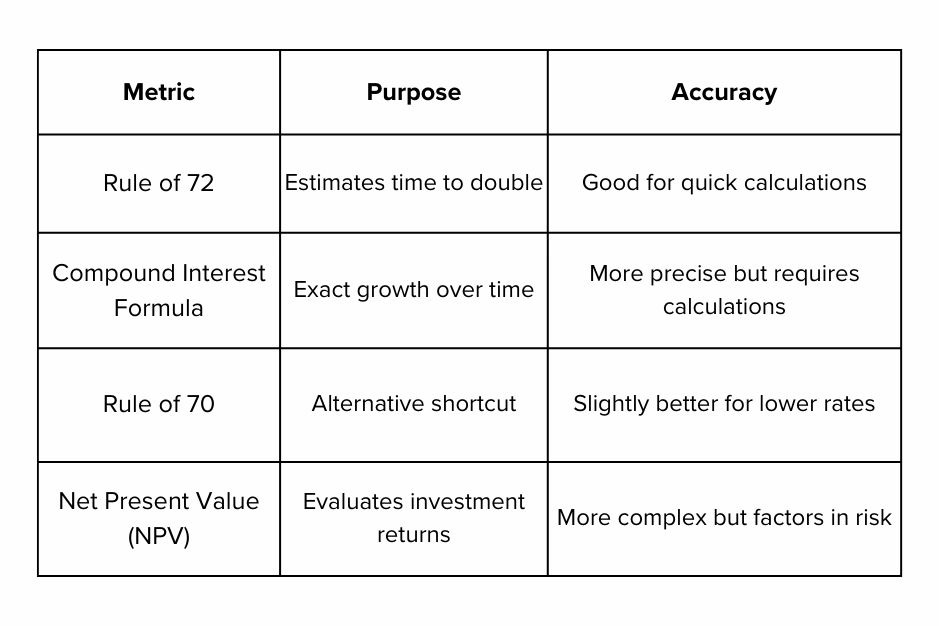

The rule of 72 vs. other financial metrics 📊

How to use the rule of 72 in financial planning 💡

Estimating your investment growth

If you invest $10,000 at 8% per year, you can quickly estimate that it will grow to $20,000 in approximately 9 years. If left untouched, it will continue to compound, reaching $40,000 in 18 years. This demonstrates the power of long-term investing and compounding growth, allowing investors to set realistic financial expectations.

Planning for retirement

For those planning for retirement, the Rule of 72 provides a useful benchmark. If you start saving at 30 years old and earn an average return of 7% per year, your investments will double every 10 years. This means by the time you turn 60, your initial investment will have quadrupled. This rule helps individuals assess how early they need to start saving and what return rates are required to reach their retirement goals.

Evaluating interest rates on debt

Debt can be a silent wealth destroyer, and the Rule of 72 makes it easier to understand how quickly it can accumulate. If you have a credit card charging 18% interest, your debt will double in just 4 years if left unpaid. This highlights the urgency of paying off high-interest debt as quickly as possible to prevent it from spiraling out of control. By comparing investment returns and interest rates, individuals can make more informed financial decisions.

Understanding inflation’s impact

Inflation erodes the purchasing power of money over time, and the Rule of 72 can be used to assess its long-term effects. If inflation averages 3% per year, the real value of money will halve in 24 years. This means that a dollar today will only be worth 50 cents in purchasing power terms after two and a half decades. This insight emphasizes the importance of choosing investments that at least match or exceed the rate of inflation to preserve wealth over time.

Comparing different investment options

Different investment vehicles yield different returns, and the Rule of 72 helps compare them quickly. A certificate of deposit (CD) earning 2% per year will take 36 years to double, making it a slow-growing asset. Meanwhile, a stock market index fund averaging 10% annual returns will double in just 7.2 years, significantly outpacing inflation and lower-yielding investments. This comparison explains why many investors prefer equities over low-yield fixed-income instruments for long-term growth.

The bottom line: Why the rule of 72 matters 🚀

The Rule of 72 is a powerful financial shortcut that helps investors, savers, and debt managers make quick, informed decisions about their money’s growth. While it isn’t perfect, it provides a fast and intuitive way to estimate investment returns and the impact of interest rates.

By using the Rule of 72 in financial planning, investors can better set goals, compare investment options, and prepare for long-term wealth accumulation. Whether you’re a seasoned investor or just starting out, mastering this simple rule can sharpen your financial strategy and boost your long-term success.

Poll 📊

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational purposes only and is not intended as investment advice. Please consult a financial advisor before making any investment decisions. Terms & conditions apply.