Sector rotation strategy: How investors shift between market sectors

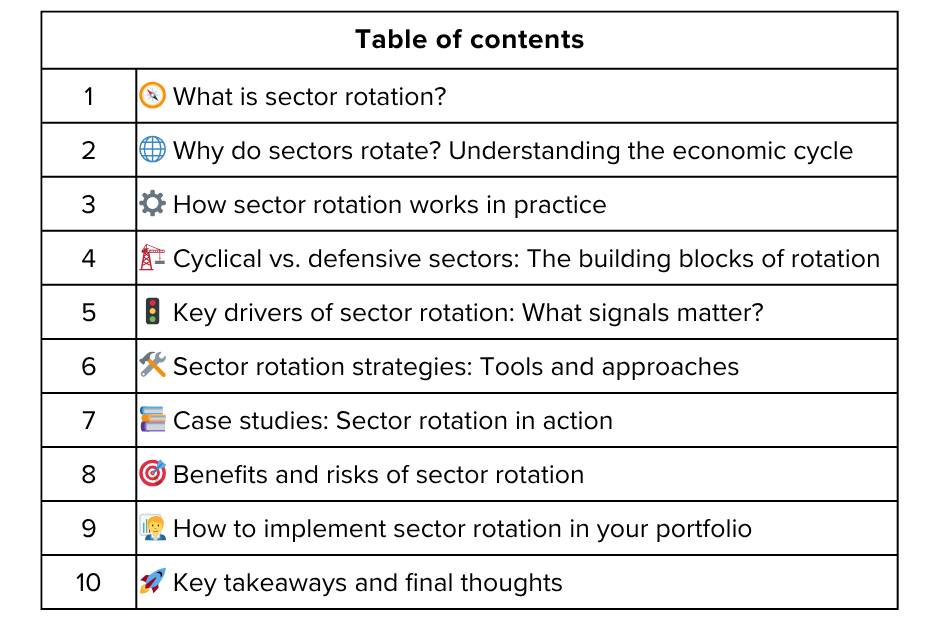

In the ever-evolving landscape of the U.S. stock market, investors are constantly searching for ways to maximize returns and manage risk. One of the most powerful-yet often misunderstood-strategies is sector rotation. This approach involves shifting investments among different market sectors in response to changes in the economic cycle, market trends, and investor sentiment. If you’ve ever wondered why technology stocks soar during booms while utilities shine in downturns, sector rotation holds the answer. This guide will break down the mechanics, logic, and practical steps behind sector rotation, helping you harness its potential for your own portfolio.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

What is sector rotation? 🧭

Sector rotation is an active investment strategy that involves moving money between different sectors of the stock market to take advantage of the changing phases of the economic cycle. The U.S. market is divided into 11 major sectors, including technology, healthcare, energy, financials, consumer discretionary, consumer staples, industrials, materials, utilities, real estate, and communication services. Each sector tends to outperform or underperform at different stages of the business cycle, depending on macroeconomic factors like growth, inflation, and interest rates.

The basic premise: by anticipating which sectors are poised to lead or lag as economic conditions shift, investors can “dance with the market”—positioning their portfolios to ride the waves of growth and shield against downturns.

Why do sectors rotate? Understanding the economic cycle 🌐

The heart of sector rotation lies in the economic cycle—a recurring pattern of expansion, peak, contraction, and recovery. Here’s how it works:

Expansion: As the economy grows, consumer confidence rises, spending increases, and businesses invest. Cyclical sectors like technology, financials, industrials, and consumer discretionary typically outperform.

Peak: Growth slows, inflation may rise, and interest rates often increase. Sectors like energy, materials, and communication services can benefit from late-cycle trends.

Contraction (Recession): Economic activity declines, unemployment rises, and consumers cut back. Defensive sectors such as healthcare, utilities, and consumer staples become safe havens.

Recovery: As the economy rebounds, investors begin shifting back to cyclical sectors in anticipation of renewed growth.

Sector rotation is about anticipating these shifts—often months in advance—and reallocating capital to the sectors best positioned for the next phase.

How sector rotation works in practice ⚙️

Sector rotation is not a passive, set-and-forget approach. It requires active monitoring of economic indicators, market trends, and sector performance. Here’s a step-by-step look at how investors implement sector rotation:

Analyze economic indicators: Track GDP growth, inflation, interest rates, employment, and consumer confidence to gauge the current phase of the cycle.

Identify leading and lagging sectors: Use relative strength analysis to compare sector performance and spot emerging trends.

Allocate and reallocate: Shift portfolio weights toward sectors expected to outperform and reduce exposure to those likely to lag.

Monitor and rebalance: Regularly review allocations and adjust as economic conditions evolve.

Many investors use sector ETFs or mutual funds to make these shifts efficiently, gaining exposure to entire sectors with a single trade.

Cyclical vs. defensive sectors: The building blocks of rotation 🏗️

A core concept in sector rotation is the distinction between cyclical and defensive sectors:

Cyclical sectors: These include technology, consumer discretionary, industrials, financials, and materials. They thrive during economic expansions but are more vulnerable in downturns.

Defensive sectors: These include healthcare, utilities, and consumer staples. They offer stability and steady demand even in recessions, making them attractive when growth slows.

By rotating between these groups, investors can pursue growth during booms and seek safety during busts.

Key drivers of sector rotation: What signals matter? 🚦

Several factors influence which sectors lead or lag at any given time. The most important include:

Economic growth: Expansions favor cyclical sectors, while slowdowns benefit defensives.

Interest rates: Rising rates often hurt rate-sensitive sectors like utilities and real estate, while financials may benefit.

Inflation: High inflation can boost energy and materials, while low inflation helps growth sectors.

Commodity prices: Changes impact sectors like energy and materials directly.

Consumer and business spending: Strong spending lifts discretionary and tech stocks; weak spending supports staples and healthcare.

Government policy: Regulations, fiscal stimulus, and tax changes can create sector winners and losers.

Investor sentiment: Shifts between “risk-on” and “risk-off” psychology often drive rotations.

Successful sector rotation strategies combine macro analysis, sector performance data, and market psychology to anticipate these shifts.

Sector rotation strategies: Tools and approaches 🛠️

There are several ways to implement sector rotation, each with its own strengths:

Top-down macro analysis: Start with the economic outlook to forecast which sectors should lead, then invest accordingly.

Relative strength analysis: Focus on sectors showing recent outperformance and momentum, rotating into leaders and out of laggards.

Active allocation: Proactively adjust sector weights based on rotation signals and rebalance periodically to stay aligned with trends.

Passive rotation funds: Use ETFs or mutual funds designed to automatically rotate between sectors based on quantitative models or economic rules.

Most investors combine these methods, using sector ETFs for flexibility and diversification while monitoring economic and market signals.

Case studies: Sector rotation in action 📚

Let’s look at how sector rotation plays out in real-world scenarios:

2008 Financial Crisis:

Defensive sectors like healthcare and consumer staples outperformed, while financials and real estate suffered heavy losses.

Post-pandemic recovery (2021-2022):

Technology and consumer discretionary stocks surged as economies reopened and demand rebounded.

Rising interest rates (2022-2024):

Financial stocks became attractive as banks benefited from higher loan margins and investment income, while utilities and real estate lagged.

Inflationary periods:

Energy and commodities outperformed as prices rose, while growth stocks faced headwinds.

These examples show how sector rotation can help investors capture opportunities and manage risk across different market environments.

Benefits and risks of sector rotation 🎯

Benefits:

Enhances returns: By moving into sectors poised to outperform, investors can potentially beat the market average.

Diversifies risk: Rotating reduces overexposure to lagging sectors and spreads risk across the market.

Adapts to change: Sector rotation keeps your portfolio aligned with evolving economic and market trends.

Risks:

Requires timing: Successfully anticipating sector shifts is challenging and mistakes can hurt returns.

Higher costs: Frequent trading can lead to increased transaction fees and taxes.

Market unpredictability: Unexpected events (like geopolitical shocks) can disrupt sector trends.

Concentration risk: Overweighting a few sectors may increase volatility if predictions are wrong.

How to implement sector rotation in your portfolio 🧑💼

Ready to try sector rotation? Here’s a practical roadmap:

Track economic indicators: Stay informed about GDP, inflation, interest rates, and employment trends.

Study sector performance: Use charts and tools to monitor which sectors are leading or lagging.

Use sector ETFs and funds: These make it easy to shift allocations without picking individual stocks.

Set rules and limits: Avoid emotional investing by having a clear plan for when to rotate and how much to allocate.

Rebalance regularly: Review your portfolio’s sector weights and adjust as conditions change.

Diversify: Don’t put all your eggs in one basket—spread investments across multiple sectors to manage risk.

Monitor costs: Watch out for trading fees and taxes that can eat into returns.

Key takeaways and final thoughts 🚀

Sector rotation is a dynamic strategy that shifts investments among market sectors to capitalize on economic cycles and market trends.

By understanding which sectors lead or lag during different phases, investors can enhance returns and manage risk.

Successful sector rotation requires active monitoring, discipline, and a willingness to adapt as the market evolves.

Using sector ETFs, macro analysis, and relative strength tools can make implementation easier and more effective.

While not without risks, sector rotation can help investors build resilient, opportunity-rich portfolios that thrive in changing markets.

Whether you’re a long-term investor or an active trader, mastering sector rotation can give you a powerful edge—helping you ride the waves of the economic cycle and keep your portfolio in step with the ever-changing rhythm of the market.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.