IPO hype vs. reality: What really happens after companies go public?

Initial Public Offerings (IPOs) inspire dreams of instant riches, media frenzy, and dramatic market debuts. From the iconic listings of decades past to the latest AI or fintech unicorns in 2025, the IPO narrative is usually packed with excitement and sky-high expectations. But is the hype justified? What actually happens to companies and their stock prices after the opening bell rings and the confetti settles? In this article, you’ll get a behind-the-scenes look at IPOs—how and why reality tends to diverge from the buzz, what real data shows about post-IPO performance, and how investors can approach newly public companies with realistic, informed strategies.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

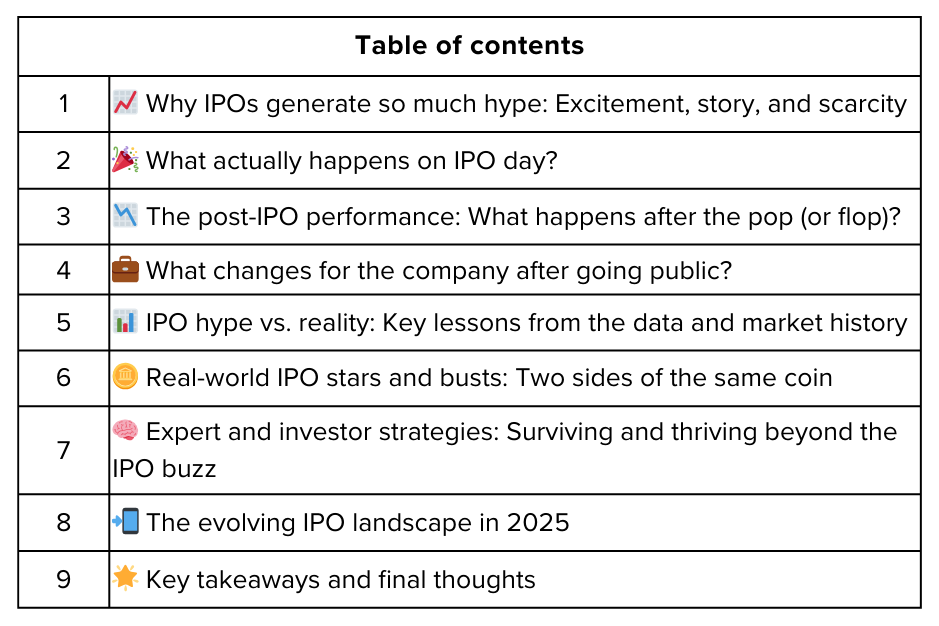

Why IPOs generate so much hype: Excitement, story, and scarcity 📈

IPOs are captivating events. They offer investors a chance to “get in early” on the next big thing, even if a company has already spent years in private hands with established revenue and a hefty valuation.

What fuels the IPO buzz:

Media attention and marketing campaigns raise awareness.

Investment banks and insiders drum up demand.

Promises of growth, disruptive technology, or a transformative story fuel FOMO (fear of missing out).

Shares are often limited, making initial allocations that much more in demand.

On listing day, the drama is real. IPO stocks can "pop," sometimes surging 20%, 40%, or even 100% above their offering price. Headlines follow every move, while social media amplifies every statistic.

What actually happens on IPO day? 🎉

The IPO pop:

“Listing gains” refer to the percentage change from the IPO’s offer price to its very first trading price. Sometimes these gains are dramatic, sometimes they disappoint.

Data snapshot (2025):

As of September 2025, almost half the IPOs tracked in India and the U.S. listed at a gain, with several showing first-day jumps between 7% and 40% or more.

Meanwhile, a number of IPOs slumped out of the gate, closing their first session below the offer price—sometimes by 10% or 20%.

Some companies, like Goel Construction Co., listed at ₹263 and closed at ₹317, up 21% on day one. Others, like Abril Paper, dropped over 21% on debut.

Volatility spike:

IPO day is typically highly volatile. Trading can be wild as institutional and retail investors battle for shares, while algorithms and traders hunt for quick profit. In some cases, circuit breakers are triggered by moves that would be unthinkable in mature stocks.

The post-IPO performance: What happens after the pop (or flop)? 📉

The cooling-off period:

After initial hype, a surprising number of IPOs slip into a period of underperformance. Many give up first-day gains, and some even fall well below the issue price.

Real 2025 numbers:

About 40% of 2025 IPOs are trading below their listing price a few weeks after going public.

Several major listings, after soaring at first, retraced back to earth or even posted negative returns by their three- or six-month mark.

A minority have delivered stellar returns, especially if they proved profits and beat expectations soon after debut.

Why does this happen?

Lock-up periods: A few months after IPO, early investors can sell, sometimes adding selling pressure.

Reality check: Markets adjust to real growth, profitability, and industry conditions, which might not live up to the initial promise.

Overvaluation: Many IPOs are priced for perfection, and any stumble invites sharp pullbacks.

What changes for the company after going public? 💼

Going public is a double-edged sword.

The upsides:

Access to capital: A fresh injection of funds powers expansions, acquisitions, and R&D.

Brand credibility: Public status boosts visibility and confidence among customers and partners.

Liquidity for insiders: Employees and founders can finally sell shares.

The challenges:

Constant public scrutiny: Quarterly earnings must be reported. Every miss or misstep is dissected by analysts.

Pressure for short-term results: Public shareholders expect quick wins, sometimes distracting from the company’s long-term vision.

Regulatory and disclosure demands: Reporting, compliance, and governance become more complex and expensive.

IPO hype vs. reality: Key lessons from the data and market history 📊

1. Most first-day pops fade:

Even large, heavily oversubscribed IPOs with massive first-day gains often lose their luster over the next year. Data shows that average returns for IPO cohorts typically lag the market, especially after the marketing machine switches off and reality sets in.

2. Lock-ups and insider selling matter:

A wave of shares usually hits the market 3-6 months after an IPO when “lock-up” periods expire for early insiders and VC funds. This can trigger big price drops, especially if initial expectations haven’t been met.

3. The “winner’s curse”:

Studies show that retail investors who only get IPO shares in hot markets or high-profile deals can sometimes overpay, absorbing losses as price reverts to more normal valuations.

4. Quality wins eventually:

Over the long term, companies with solid earnings, expanding revenue, and growing cash flow deliver best—not hype or headlines. Some legendary businesses (think Google, Microsoft) did well, but many more faded after splashy debuts.

Real-world IPO stars and busts: Two sides of the same coin 🪙

Superstars: Some IPOs like Google (now Alphabet) and NVIDIA went public, delivered on their promises, and became stock market royalty. Strong fundamentals met fair pricing, and the market rewarded patience.

Cautionary tales: Others—like WeWork, or various overhyped tech and consumer IPOs—flopped post-listing as business realities and unsustainable valuations caught up.

Mixed bag in 2025: In the current cycle, a handful of well-prepared companies have outperformed, but for every big win, there’s at least one IPO trading at a loss a few months later.

Expert and investor strategies: Surviving and thriving beyond the IPO buzz 🧠

1. Don’t chase the opening day hype:

If you didn’t get IPO shares at the offer price, wallet patience. Often, prices pull back within weeks or months, letting you buy on dips after the fast money exits.

2. Do your homework:

Scrutinize fundamentals: revenue growth, profitability, cash flow, market share—not just the sizzle or narrative.

3. Watch the lock-up expiration:

Monitor when “locked” shares can be sold by insiders. This calendar event often triggers significant volatility, sometimes even offering entry points for value-conscious buyers.

4. Diversify and limit allocation:

New IPOs can swing wildly on thin news or rumors. Keep position sizes small and within your overall risk limits.

5. Think long-term:

If the company has the right leadership, growth plans, and finances, short-term noise fades. Holding a quality business through its first years post-IPO is often more rewarding than day trading the opening week.

The evolving IPO landscape in 2025 📲

Direct listings, SPACs, and new funding routes have made the IPO process itself more competitive and transparent.

Regulators have increased scrutiny over IPO prospectuses and disclosures, a reaction to past scandals and flops.

Digital trading platforms and social media can magnify both hype and panic, influencing opening-day prices well beyond traditional investor circles.

Some companies are opting for more conservative pricing, emphasizing stability over a one-day pop to woo long-term institutional holders.

Key takeaways and final thoughts 🌟

IPO hype is real—but so is the post-listing letdown. Big pops make headlines, but many IPOs underperform after the initial excitement fades and real business performance comes under the spotlight.

Investors need discipline, skepticism, and rigorous analysis to sift the quality companies from the fleeting hot tickets.

Market data from 2025 confirms the trend: some IPOs soar, others flop, and plenty land back at or below their issue price after a brief sizzle.

Long-term winners deliver solid fundamentals—not just publicity. Waiting and watching is often your best friend with IPOs.

Be alert to lock-up expiries, insider selling, and post-IPO volatility. These are the real moments when share prices sort reality from hype.

Next time an IPO headline grabs your attention, think beyond the buzz. Study the business, watch the market mechanics, and don’t let FOMO drive your decisions. As always, building wealth comes from persistent patience, not chasing the crowd.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.