How to use options for hedging and speculation

Options trading has transformed the way investors manage risk, seek income, and pursue profit in today’s markets. In 2025, with volatility elevated in both directions, options have become go-to tools for everyone from conservative retirees to high-octane day traders. Are options right for you? Whether you’re interested in shielding your portfolio from losses or hoping to leverage bets on the market’s next big swing, understanding the basics—and pitfalls—of options is more important than ever.

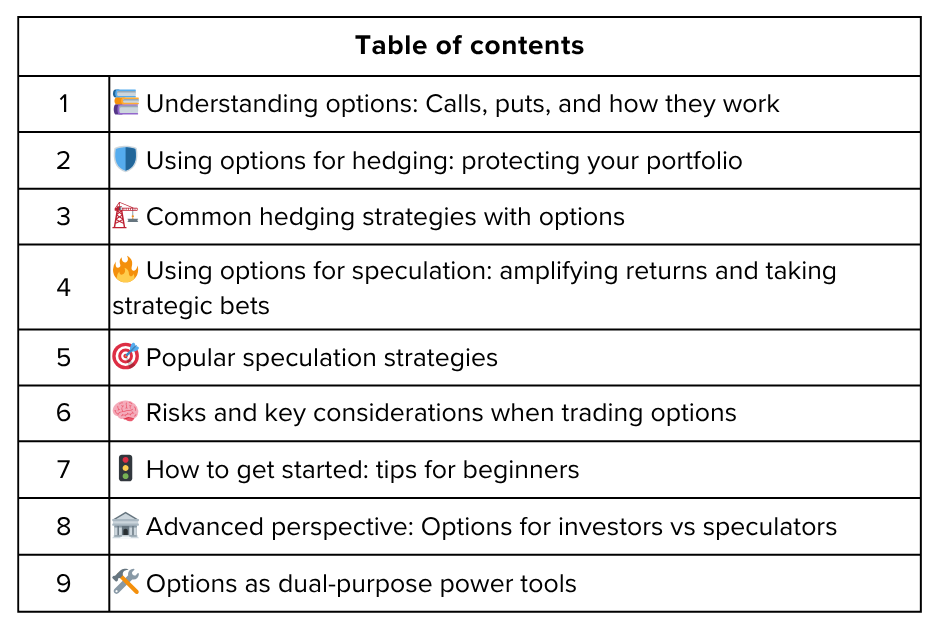

This comprehensive guide breaks down the language of options, explores how to use them for hedging and speculation, outlines real-world strategies, discusses risks, and explains how to get started safely and smartly.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Understanding options: Calls, puts, and how they work 📚

At their heart, options are contracts that grant the holder the right—but not the obligation—to buy or sell a certain number of shares (typically 100) of an underlying asset (usually a stock or index) at a specified price (the strike price) by a certain expiration date.

There are two main types of options:

Call options: Give the holder the right to buy the underlying asset at the strike price. Buyers of calls are typically bullish—they want the price to rise.

Put options: Give the holder the right to sell the underlying asset at the strike price. Buyers of puts are bearish—they want the price to fall.

For both types, the option writer (or seller) takes on the obligation to fulfill the trade if the buyer exercises the option. In exchange, the writer collects a premium (the price of the option).

Basic terms to know:

Premium: The price paid for the option contract.

Expiration date: The day the option contract expires.

Strike price: The price at which the option can be exercised.

In the money (ITM): When exercising the option would result in a profit.

Out of the money (OTM): When exercising would not be profitable.

Using options for hedging: protecting your portfolio 🛡️

Hedging is the process of reducing exposure to risk—essentially buying financial “insurance” against adverse price moves in your portfolio. Options, with their asymmetric payoff profiles, are excellent hedging tools.

Why hedge with options?

Limit downside risk: A small upfront cost (the option premium) can cap your losses if the market collapses.

Stay invested: You don’t have to sell your stocks to reduce risk—you can overlay protection using options.

Flexibility: Choose your downside floor or how much premium you want to pay, tailoring the hedge to your needs.

Who uses hedging?

Long-term investors who want to protect gains.

Fund managers who need to stick with core assets but must limit risk for their clients.

Anyone uneasy about volatility or uncertain events (earnings, elections, rate hikes).

Common hedging strategies with options 🏗️

Let’s look at some of the most popular strategies investors use to hedge with options:

1. Protective put

This is the classic hedge. Buy a put option on a stock (or ETF) you own. If the price drops below the strike, your losses stop there (minus the premium paid). If the stock rises, you still participate in the upside—just less the option cost. Think of it like portfolio insurance.

Example:

You own 100 shares of ABC at $100. You buy a $95 put for a $3 premium. If shares drop to $80, your maximum loss is $8 per share ($100 initial - $95 strike + $3 premium). Your downside is capped, but your upside is not.

2. Covered call

This strategy is for mild bulls or range-bound markets. You own the underlying stock and sell a call option against it. You collect the premium, which can cushion minor losses or add to gains. If the stock surges above your call strike, it may be called away, but you profit from the movement and the premium income.

Downside: If the stock soars, your upside is capped at the strike price plus premium.

3. Collar

A collar combines a protective put and a covered call: you own the stock, buy a put below current price, and sell a call above current price—sometimes making the hedge almost premium-free. This structure secures a price floor for your shares and, in exchange for selling the call, limits your upside.

4. Index hedges

If your holdings resemble a broad index (like the S&P 500), buying puts on the index or ETFs (like SPY) can hedge against large, systemic declines.

5. Married put and synthetic long stock

A married put is simply buying a stock and a put at the same time—locking in risk from the outset. Synthetic long stock, meanwhile, uses options to replicate the stock’s performance, potentially with less capital at risk.

Using options for speculation: amplifying returns and taking strategic bets 🔥

Unlike hedging, speculation with options is all about making directional or volatility bets in the search for outsized returns. The unique combination of leverage, limited risk (for buyers), and flexibility makes options a popular speculative vehicle for traders of all levels.

Why speculate with options?

Leverage: A small premium can control a much larger position.

Directional bets: Take advantage of anticipated moves up (long call) or down (long put).

Volatility plays: Profit from expected increases or decreases in volatility, regardless of direction.

Defined risk: Option buyers cannot lose more than the premium, even if the trade goes horribly wrong.

Income generation: Selling options (writing) can generate income for those confident a stock will remain in a range.

Popular speculation strategies 🎯

Here are some tried-and-true ways to use options when looking to boost profits or play market movements:

1. Long calls and long puts

Long call: Buy a call if you expect a stock to surge. If it rises above the strike plus the premium, gains can be substantial.

Long put: Buy a put if you expect a sharp drop. Pays off if the stock falls well below strike minus the premium.

2. Short puts and short calls

Short put: Sell a put if you think a stock will stay above a price. You collect premium. If wrong, you may have to buy the stock at the strike—risk can be large if stock crashes.

Short call: Sell a call, betting the stock won’t rise above the strike. Unlimited risk if the stock soars, so this is best reserved for professionals.

3. Vertical (bull and bear) spreads

Buy one option and sell another at a different strike but same expiry—limiting risk, capping gain, and reducing premium outlay.

Bull call spread: Buy a call at a lower strike, sell a call at a higher strike.

Bear put spread: Buy a put at a higher strike, sell one at a lower strike.

4. Straddles and strangles

Profit from big movement in either direction.

Straddle: Buy a call and put at the same strike. Make money if the stock moves up or down by more than your premium outlay.

Strangle: Buy a call above and a put below current price—cheaper than a straddle, but needs a bigger move.

5. Iron condors and butterflies

Iron condor: Sell an out-of-the-money call and put, buy further out options as protection. Collect premium if the stock stays in a narrow range.

Butterfly spread: Set up a three-leg trade (buy one lower-strike option, sell two at-the-money, buy one higher-strike option) to benefit if a stock stays close to a specific target.

Risks and key considerations when trading options 🧠

It’s easy to get excited about options’ flexibility—but they carry significant risk as well:

Total loss: Buyers risk losing the entire premium if the market doesn’t move as planned, or doesn’t move enough, before expiry.

Unlimited risk with writing calls: Selling “naked” (uncovered) calls exposes you to potentially unlimited losses if the underlying soars.

Assignment and liquidity: Writers of options (sellers) can be assigned anytime. Illiquid contracts can make entering and exiting difficult without big slippage.

Complexity: Multi-leg strategies (like condors and butterflies) increase complexity, require higher commissions/margin, and need careful monitoring.

Time decay (theta): Option values erode as expiration approaches, especially if the underlying does not move enough.

Volatility shifts: Sudden drops in volatility can reduce premium values even if the stock moves your way.

Wise traders always plan for the worst-case, not just best-case, outcome.

How to get started: tips for beginners 🚦

1. Learn the foundations

Study the mechanics: what each option and strategy actually does, how premiums are set, and how risks play out in real portfolios.

2. Practice before you play

Try simulated trading platforms (“paper trading”) to gain experience using real market prices without risking your capital.

3. Start simple and size conservatively

Use straightforward trades—covered calls on stocks you own or protective puts—to learn how options impact your portfolio. Don’t over-leverage.

4. Focus on risk management

Predetermine loss limits for every trade. For premium-selling strategies, never risk more than you can afford to lose if assigned.

5. Watch liquidity and commissions

Heavily traded options with tight bid-ask spreads are best. Be sure to account for the impact of fees, especially for multi-leg trades.

6. Keep learning and review your trades

Study both your wins and losses. Review why a strategy worked or failed so you can improve over time.

7. Upgrade as you grow

Once you’re comfortable, try more advanced strategies like spreads, condors, or butterflies. Always be clear about your thesis, risk, and exit plan.

Advanced perspective: Options for investors vs speculators 🏦

Not all options users are chasing fast money. Many investors use options to generate consistent income (via cash-secured puts or covered calls), manage taxes, reduce volatility, or build positions patiently over time.

Income investors: Sell cash-secured puts on stocks they want to own. If assigned at a good price—great; if not, they keep the premium.

Tax management: Use options to delay taxable gains or harvest losses, especially near year-end.

Portfolio insurance: Long-term put options (“LEAPS”) protect against black swan events without requiring daily attention.

Speculators may take short-term bets on earnings, Fed meetings, or even volatility itself, aiming for quick outsized wins. The key difference is discipline and purpose.

Options as dual-purpose power tools 🛠️

Options are neither just for gamblers nor only a hedge for the risk-averse. When used thoughtfully, they can shield portfolios, generate income, or create high-reward setups tailored to your market view.

The most successful options users in 2025 are those who treat them as tools, not tickets to fast riches—combining careful study, proper sizing, and disciplined management. Respect risk, understand your strategy inside and out, and keep your goals in focus. Options can be a force multiplier in your investment journey—just be sure to trade wisely and thoughtfully.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.