How tax‑loss selling and the Santa rally interact in the final full week of 2025

Every December, two powerful forces tug at stock prices at the same time: investors harvesting losses to cut their tax bill, and the so‑called Santa rally that often lifts markets into year‑end. In the final full week of 2025, these flows can collide in ways that matter a lot more than usual, especially after a year of big dispersion between winners (AI, mega‑cap, quality) and laggards (many small caps, cyclicals, and “old economy” names). Understanding how tax‑loss selling and seasonal strength interact can help you avoid getting whipsawed—and position smarter for early 2026.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

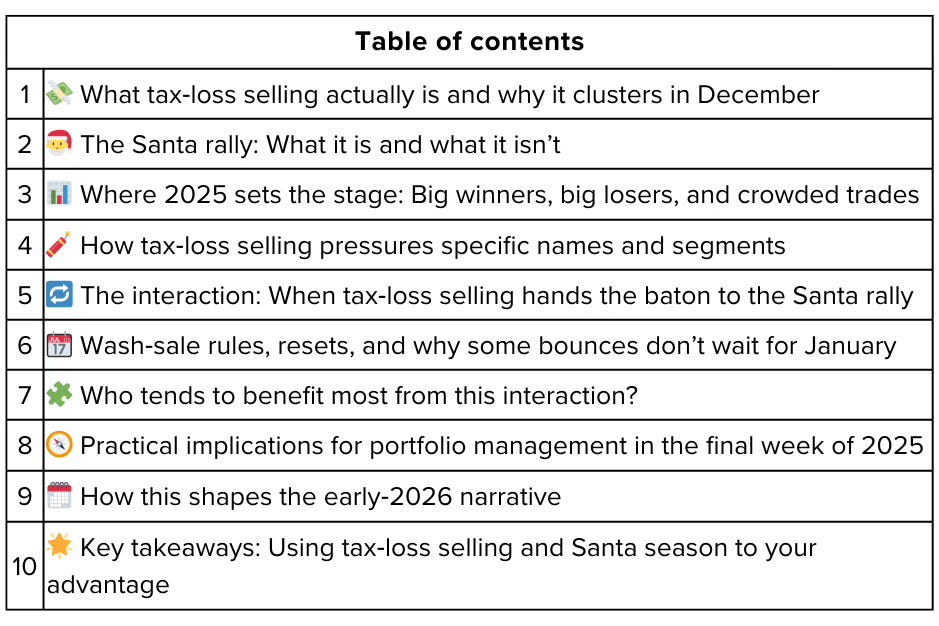

What tax‑loss selling actually is and why it clusters in December 💸

Tax‑loss selling is simple in concept: investors sell positions at a loss near year‑end to realize those losses and use them to offset realized capital gains elsewhere in the portfolio. The mechanics:

Realized capital losses can:

Directly offset realized capital gains in the same tax year.

Sometimes offset a limited amount of ordinary income.

Be carried forward to future years if they exceed gains (jurisdiction‑specific).

Why it bunches into December:

Investors and advisors typically “look through the books” in Q4 to:

Lock in gains they want to keep.

Identify losers unlikely to recover soon.

Professional managers care about calendar‑year reporting:

Window‑dressing (removing ugly positions from year‑end holdings lists).

Cleaning up portfolios ahead of new‑year inflows.

The result is intensified selling pressure in underperforming names, sectors, and themes into the final weeks of the year—often beyond what fundamentals alone would justify.

The Santa rally: What it is and what it isn’t 🎅

The Santa rally refers to a well‑documented seasonal pattern in which stocks tend to perform better than average in the final days of December and the first couple of trading days in January. Drivers include:

Lighter volumes and fewer “macro” headlines.

Positive risk appetite as funds position for the new year.

New money flows (year‑end bonuses, contributions) and portfolio re‑risking.

Short covering in names that have been heavily bet against.

It’s important to keep it in perspective:

It’s a tendency, not a guarantee.

It often shows up most cleanly in:

Smaller caps.

Beaten‑up names.

Cyclical or higher‑beta areas, as investors re‑enter risk after de‑risking into October/November.

The interesting part is the timing. In practice, the heavy tax‑loss selling and the early phase of the Santa rally overlap in the final full week of December—exactly where we are now.

Where 2025 sets the stage: Big winners, big losers, and crowded trades 📊

2025 has been another year of very uneven performance:

Leaders:

Mega‑cap AI and tech.

Quality growth with strong balance sheets.

Select defensives that investors crowded into earlier in the “soft landing” story.

Laggards:

Many small and mid caps.

Deep cyclicals and certain value pockets.

“Old theme” names left behind by AI and high‑growth narratives.

That dispersion creates:

Plenty of realized gains in the winners to offset.

A long list of underwater positions in portfolios that are candidates for tax‑loss harvesting.

So the setup into the final full week of 2025 is textbook:

Ongoing selling pressure in underperformers for tax reasons.

Mounting potential energy for a rebound once the forced selling exhausts and holiday liquidity kicks in.

How tax‑loss selling pressures specific names and segments 🧨

Tax‑loss selling is not evenly spread. It hits three types of stocks hardest:

Year‑to‑date and 12‑month losers

Names down meaningfully on the year, especially those that:

Were popular earlier (crowded trades that went wrong).

Sit in taxable accounts (funds, HNW portfolios).

These can see:

Persistent selling into the close every day.

“Air pockets” where there are more motivated sellers than buyers.

Illiquid or smaller‑cap names

A few days of larger sell orders can push prices down sharply.

Prices may detach from fundamentals temporarily as “price insensitive” tax sellers dominate.

Broken stories

Companies that missed earnings, cut guidance, or lost a key narrative during the year.

Even long‑term believers sometimes throw in the towel in December just to reset the clock.

Characteristics of tax‑loss pressure:

You often see:

Persistent weakness on little or no news.

Selling that accelerates late in the session.

Bid‑ask spreads can widen.

Short‑term technicals look bad—until the calendar flips.

The interaction: When tax‑loss selling hands the baton to the Santa rally 🔁

The final full week of the year is typically where the tug‑of‑war becomes most interesting:

Early‑to‑mid December:

Tax‑loss selling dominates.

Laggards drift lower, winners may grind higher or pause.

Managers clean up portfolios and lock in the year’s story.

Final full week:

Tax‑loss selling begins to exhaust as:

Most investors who plan to harvest have already done so.

There are fewer motivated sellers left in laggard names.

Liquidity thins out.

Any incremental buying interest in beaten‑up names starts to have an outsized effect on price.

Last few sessions and into early January:

Santa‑type flows (re‑risking, fresh capital, short covering) start to dominate the marginal price.

The same names pressure‑sold for tax reasons now:

Look optically cheap on charts and screens.

Face fewer natural sellers.

Attract contrarians and quant flows looking for mean reversion.

That’s why you often see:

Sharp bounces in some of the year’s worst performers right around the last week of December and first days of January.

A “January effect” particularly in:

Small caps.

Distressed but not broken stories.

Value and cyclical names that were tax‑loss targets.

Tax‑loss selling supplies the coil; the Santa rally and new‑year flows release it.

Wash‑sale rules, resets, and why some bounces don’t wait for January 📆

In many tax systems, investors must respect “wash sale” rules: if you sell a stock at a loss and buy back the same or a substantially identical security within a defined period (often 30 days), the loss may be disallowed for tax purposes.

That creates a few dynamics:

Some investors:

Harvest losses earlier in December to be able to re‑enter before or right after year‑endwithout violating wash‑sale rules.

Use substitutes (similar sector/ETF exposure) during the waiting period.

Others:

Choose to wait until the final days of December, planning to be out of the name through much of January.

What it means for price action:

For names harvested early:

You may see selling pressure ease already in the final full week.

Re‑entry or rotation into similar exposures can begin even before the year actually ends.

For names harvested late:

Pressure can persist almost to the last trading day.

The bounce may be more pronounced if and when buying returns in January.

In both cases, the marginal impact of each new buy order in the last week of December is amplified because:

Many sellers have already acted.

Many discretionary traders have stepped back for the holidays.

Who tends to benefit most from this interaction? 🧩

Not every stock gets a Santa bounce off tax‑loss selling. The sweet spot usually looks like this:

Structurally sound but cyclical laggards

Companies with decent balance sheets and viable business models that suffered from:

Rate sensitivity.

Temporary earnings pressure.

Sector‑level headwinds rather than existential issues.

Once macro fear moderates, they’re natural candidates for re‑rating.

Smaller caps with visibility, not hype

Off‑the‑radar businesses that:

Were de‑rated heavily in 2025.

Don’t have constant sell‑side promotion.

Screen cheap on simple metrics (P/E, EV/EBITDA, FCF yields).

“Old themes” overshadowed by AI and mega‑caps

Solid compounders in:

Industrials

Financials

Materials

Real‑economy tech

These can see renewed interest if investors want to:

Diversify away from concentrated mega‑cap exposure.

Add cyclical or value tilts for 2026.

Conversely, true “value traps” or structurally impaired names might still bounce, but those rallies tend to be:

Short‑lived.

More driven by technical flows than fundamental shifts.

Practical implications for portfolio management in the final full week of 2025 🧭

If you’re managing a book into this week, there are three distinct decisions:

Harvesting losses: if you haven’t already

Identify:

Positions deeply in the red with limited near‑term catalysts.

Names where you can replace exposure with a similar asset (e.g., sector ETF, peer) to maintain your macro/intended tilt.

Be mindful of:

Your specific tax rules and wash‑sale constraints.

Liquidity and price impact—avoid dumping size into the weakest days if possible.

Not over‑reacting to late‑December price action

Recognize that:

Sharp drops in laggards now may say more about tax flows than about fundamentals.

A name you like fundamentally might be cheaper for non‑economic reasons.

Use:

Limit orders.

Patience.

A clear separation in your notes between “flow‑driven” and “fundamental‑driven” moves.

Positioning for a possible bounce and 2026

If your thesis for 2026 includes:

Better breadth.

A pivot toward cyclicals/small caps/value.

A broader earnings recovery beyond mega‑cap tech.

Then:

Start building or adding to positions you like fundamentally but know have been hammered by tax selling.

Use scaled entries rather than all‑in trades.

Accept that you might not nail the exact day of the turn; you care about the next 12–24 months, not one week.

How this shapes the early‑2026 narrative 🗓️

The way tax‑loss selling and the Santa rally resolve can set the tone for the first quarter of 2026:

If laggards and cyclicals bounce hard into early January:

You’ll see renewed talk of:

“Broadening leadership”

“Small‑cap/value rotation”

Flows into diversified and equal‑weight indices may pick up.

If only large defensives and mega‑caps rally while losers stay pinned:

It signals:

Ongoing skepticism about the macro backdrop.

Continued crowding in perceived safety and AI narratives.

The market remains more fragile and narrow.

Either way, the calendar turn often acts like a psychological reset:

Fresh risk budgets.

New performance year.

Space for investors to admit:

“We overdid the tax‑loss selling.”

“We’re too concentrated in a few themes; let’s diversify.”

That’s why the final full week of December is not just noise—it’s the inflection zone between the “old year’s positioning” and the “new year’s thesis.”

Key takeaways: Using tax‑loss selling and Santa season to your advantage 🌟

Tax‑loss selling and the Santa rally are two sides of the same December coin:

One pushes laggards down, the other often helps them snap back.

2025’s big dispersion and concentrated winners mean:

There’s a larger‑than‑usual pool of candidates for tax‑driven dumping—and potential early‑2026 rebounds.

The final full week of the year is where:

Tax‑loss pressure begins to exhaust.

Seasonal and new‑year flows start to matter more.

For investors and traders, the playbook is:

Harvest thoughtfully, not mechanically.

Respect that some late‑December moves are flow‑driven, not fundamental.

Use dislocations to add to high‑conviction names and themes you want to own into 2026, particularly in:

Quality cyclicals.

Select small/mid caps.

Under‑owned value pockets that fit your macro view.

Handled well, this last week isn’t just about “cleaning up the year.” It’s one of the best times to reposition for the next one.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.