Gold vs. treasuries: Comparing defensive assets in uncertain times

As economic uncertainty reigns in 2025, with inflation fears, central bank policy shifts, and global political frictions in play, investors everywhere are asking a classic question: Where should I park my money to keep it truly safe? For decades, gold and U.S. Treasuries were both considered “risk-off” assets—a refuge in market storms. But this year, the lines have blurred, roles have shifted, and both the math and psychology of defensive investing look different than before. Which asset now offers the best shield? Let’s unpack what’s changed, how each asset works, and what matters most for your portfolio.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

What makes an asset “defensive”? Understanding the basics ⚙️

Defensive assets are designed not for maximum returns, but for capital preservation when markets get rough. They serve three main purposes:

Wealth preservation: Prevent large losses when risk assets (like stocks) tumble.

Liquidity: Allow investors to access cash quickly as needed.

Hedge against shocks: Provide protection against inflation, currency devaluation, or geopolitical risk.

Gold and Treasuries historically fit these roles but do so in fundamentally different ways. Gold is tangible, finite, and uncorrelated with financial assets. Treasuries—especially U.S. government bonds—are backed by the “full faith and credit” of the U.S. government and pay regular interest.

How gold and treasuries work: Structure, benefits, and limitations 🏦

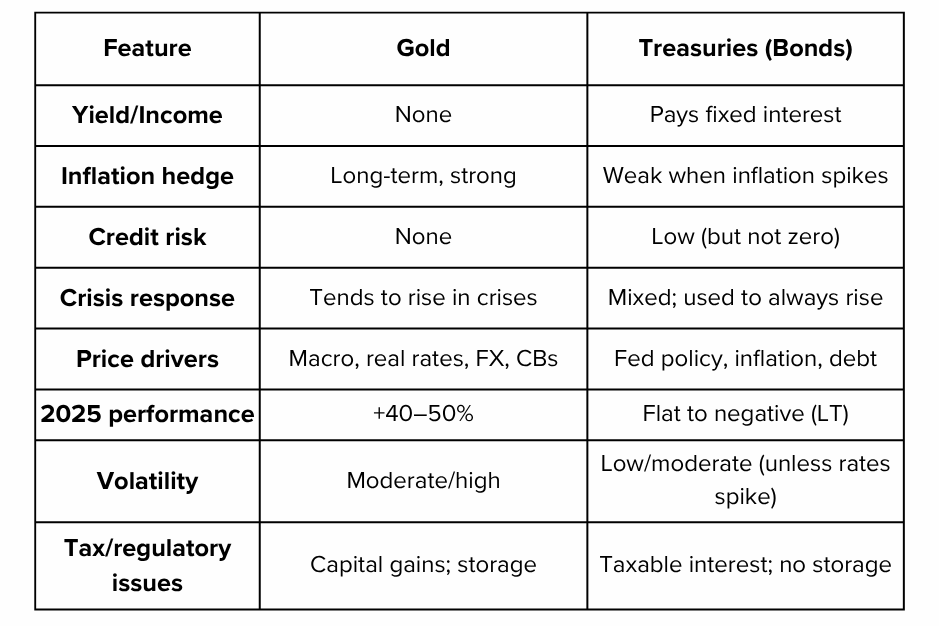

Gold

Nature: Physical, limited-supply asset, no income yield.

Value drivers: Geopolitical tension, currency debasement, real interest rates, inflation expectations, and central bank demand.

Liquidity: Globally recognized, instantly tradable in most markets, easy to buy and sell via ETFs, coins, or bars.

Costs: Storage, insurance, and sometimes taxing for physical gold; modest management fees for ETFs.

Treasuries

Nature: U.S. government debt obligations (bills, notes, and bonds), paying a fixed rate of interest.

Value drivers: Central bank policy, inflation, global demand for safe yield, U.S. fiscal policy, and macroeconomic trends.

Liquidity: The world’s most liquid financial market; easily bought or sold in minutes; central to portfolios and reserve management.

Income: Pay regular interest. If held to maturity, principal is guaranteed (barring default).

Historical safe haven behavior: What the last two decades have taught us 📚

2008–2020: During past crises (Global Financial Crisis, pandemic flash crash), both gold and Treasuries soared as investors fled to safety. Treasuries provided income and stability; gold, a non-yielding but crisis-proof hedge.

Inflation environment (2022–2024): When inflation rocketed, gold’s historic role as an inflation hedge kicked in, but initially Treasuries suffered steep losses as yields adjusted higher.

2025’s new twist: Gold prices have surged to record highs (up over 50% YTD), while many long-term Treasuries lag or outright lose value as investors worry about debt loads, fiscal policy, and bond market volatility.

Gold in 2025: A shining star as “safe haven” metrics shift ✨

Gold’s ascent has been dramatic this year. Prices cleared $4,000/oz, outperforming nearly every other asset class. What’s fueling this?

Central bank demand: Global central banks have bought record tons of gold, often shifting reserves away from Treasuries amid U.S. deficits and policy doubts.

Inflation and real rates: Real interest rates remain negative in many regions, keeping gold attractive versus cash or bonds.

Dollar weakness: The U.S. dollar has weakened, making gold more appealing globally.

Geopolitical instability: Ongoing conflicts, trade tariffs, and uncertain elections have driven more investors toward the tangible safety of gold.

Risks/downsides:

No yield or compounding.

Can be volatile and go long periods with little appreciation.

Needs secure storage/insurance for physical holdings; ETF fees, potential capital gains tax.

Treasuries in 2025: Still “safe,” but shaken by new realities 🏛️

U.S. Treasuries, while still foundational for institutions and individuals, have faced four unusual pressures this year:

Debt and deficit jitters: Record refinancing needs ($9+ trillion of maturing debt in 2025), massive deficits, and political gridlock have eroded absolute trust in Treasuries as “risk-free.”

Weak foreign demand: Central banks are buying less U.S. government debt (and more gold), reflecting evolving global reserve strategies.

Interest-rate-driven losses: Recent rate hikes have halved the value of many long-duration bonds; those holding from prior years face sizeable declines.

Rising term premium: Investors demand more yield to compensate for fiscal and inflation risk—pushing bond prices down even as yields remain high.

Benefits/risks:

Still pay guaranteed interest and principal if held to maturity.

Remain highly liquid and central to risk management.

Prices can fall sharply if rates rise or “risk-free” status is questioned.

Gold vs. treasuries: Key differences and the new correlations table ⚖️

Central banks, institutions, and the world’s shift in defensive strategy 🌏

For the first time since the 1990s, global central banks now hold more gold as reserves than they do in U.S. Treasuries, a historic shift reflecting both price moves and active buying.

India, China, and many other countries have increased gold reserves while cutting U.S. T-bill holdings, citing the need to diversify away from dollar-denominated risk.

The move underscores how modern “safe haven” strategies now demand more than just government debt; gold is increasingly viewed as a core defensive store of value alongside cash and bonds.

When should you prefer gold, treasuries or both? Investor profiles and practical moves 🗺️

If your main fear is inflation or currency crisis: Historically, gold performs better. It is a store of value that governments can’t print.

If you need current income and minimal drawdown risk: Treasuries (especially short-term) still count, especially if held to maturity.

During market or geopolitical panics: Both typically outperform stocks, but gold’s response may be more reliable in today’s environment.

For large, institutional portfolios: A blend remains common; use Treasuries for liquidity and yield, gold for diversification and tail-risk protection.

Most experts now favor a “barbell” approach—don’t abandon bonds, but rethink allocations. Instead of the old 60/40 (stocks/bonds), consider 55/30/15 (stocks/bonds/gold and hard assets) for higher resilience.

Building a resilient portfolio in 2025: Combining both for maximum safety 🏗️

Stay diversified: Neither bonds nor gold alone is a cure-all. Each adds unique protection.

Go global: Also diversify geographically with gold, global bonds, and cash.

Monitor duration: In Treasuries, favor shorter maturities if worried about rising rates.

Own physical and paper: Some gold in physical form (coins, bars) for disaster insurance, some in ETFs for liquidity.

Rebalance regularly: Let portfolio weights adjust with market realities, not fixed rules from 20th-century playbooks.

The future: What will tomorrow’s “safe haven” look like? 🚀

Traditional models are evolving: With debt, deficits, and geopolitics in flux, what “defensive” means continues to change.

Gold’s digital cousins (ETFs, tokenized gold, sovereign gold bonds) will play a growing role, providing new blends of safety and access.

U.S. Treasuries will remain critical, but their risks and competitiveness must be weighed more actively than in the past.

Key takeaways 🌟

Gold and Treasuries both remain essential defensive tools—but roles have changed.

Gold’s outperformance in 2025, and the global shift by central banks, highlight new skepticism toward government debt as the sole “risk-off” asset.

The best defense is still broad diversification, not betting everything on a single asset class.

In today’s world, gold and Treasuries are no longer perfect substitutes. Each has a place depending on your risk, income needs, views on inflation, and sensitivity to currency/fiscal policy shifts.

Ultimately, defense—like offense—is about staying flexible and forward-looking. In uncertain times, understanding the strengths and limits of each “safe haven” is the key to peace of mind and long-term wealth preservation.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.