Gold vs. Bitcoin: Which is a better inflation hedge in 2025?

In today’s unpredictable market climate, with global inflation still a worry and central banks printing money, investors everywhere are searching for reliable tools to preserve their wealth. Two assets command the spotlight: gold, the age-old symbol of value, and bitcoin, the digital challenger making headlines and fortunes. But with the world changing fast, which one truly stands up as the better inflation hedge in 2025? This guide breaks down history, mechanics, pros and cons, and expert arguments so you can decide where your hard-earned money can best resist inflation’s bite.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

What does it mean to hedge against inflation? 🌡️

Inflation erodes your purchasing power. When prices rise, your savings buy less—unless those savings are tucked into assets that keep their value or, even better, grow faster than inflation. An inflation hedge is just that: an investment that protects or increases your wealth when currencies lose value.

Traditionally, gold has been the go-to for this task. But bitcoin, with its fixed supply and digital nature, promises a new kind of scarcity. As investors wrestle with the strengths and shakiness of both, understanding how each works is essential.

Gold: Centuries of safe-haven credibility 🏅

History:

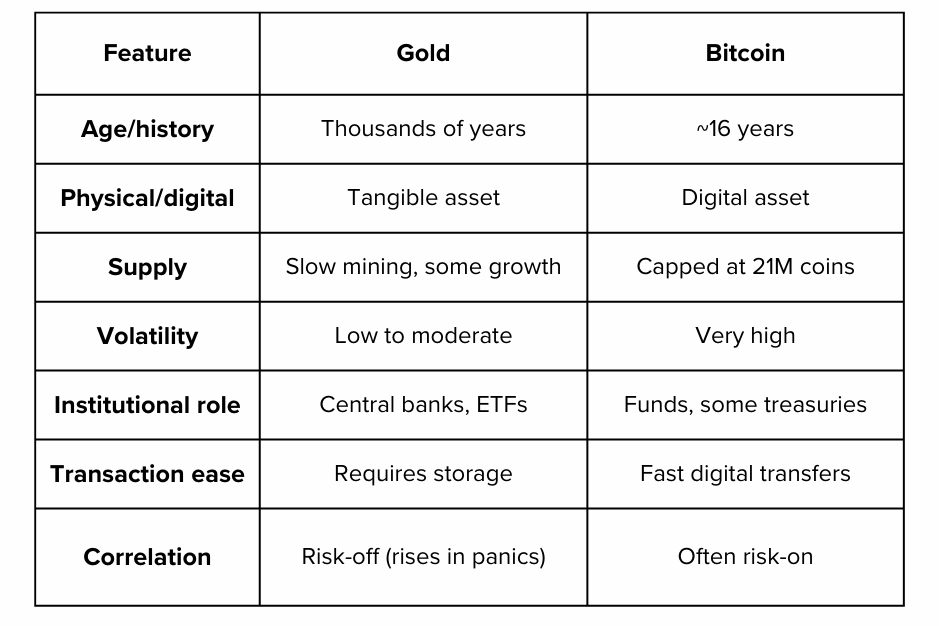

Gold’s reputation as “hard money” spans thousands of years. Ancient civilizations, banks, nations, and modern investors alike have trusted gold to store wealth across recessions, wars, and political swings.

How gold works as a hedge:

It’s rare and physically enduring.

Supply grows slowly and predictably through mining.

It holds its own in times of crisis, especially when faith in government or fiat currencies falters.

Gold often rises in value when stock markets plunge or currencies depreciate.

2025 performance:

Despite momentary volatility, gold remains a global favorite. In early 2025, gold climbed over 8% for the year, and in some accounts, as much as 30% due to renewed demand from both institutions and central banks.

Strengths as an inflation hedge:

Decoupled from fiat money supply, can’t be printed at will.

Trusted by central banks and financial institutions.

Negative correlation with stocks during equity crashes, meaning when shares fall, gold often rises.

Limitations:

Storage and insurance costs.

Can be taxed at higher rates than other investments.

Doesn't pay income or dividends—return depends on price appreciation alone.

Can have long periods of stagnation.

Bitcoin: The digital upstart’s inflation case 💻

History and mechanics:

Launched in 2009, bitcoin introduced the idea of a digital, decentralized currency with a mathematically capped supply—only 21 million coins will ever exist. New bitcoins are produced at a known declining rate (“halving” events), making its inflation rate even lower than gold’s long-term average.

Why bitcoin might hedge inflation:

Supply is absolutely limited, regardless of central bank actions.

Immune to government debasement and policy manipulation.

Can be transferred and stored globally, instantly, and securely.

In countries with runaway inflation (like Argentina), bitcoin demand has exploded as trust in government currencies collapses.

2025 performance:

Bitcoin surged to a record high in May 2025, passing $110,000, and finished up over 35% year-to-date, outperforming gold in some stretches. Still, bitcoin’s year has seen its share of wild swings, dropping double digits in short spans.

Strengths as an inflation hedge:

Absolute scarcity and transparency of issuance.

Growing acceptance among institutions and even some governments.

Attracts younger, tech-savvy, and internationally-minded investors.

Limitations:

Extreme volatility (double-digit price swings are routine).

Still considered a “risk-on” asset—often drops with tech stocks during panics.

Regulatory uncertainty in many countries.

Only 16 years of real-world history.

Key differences: Scarcity, trust, volatility, and use cases ⚔️

Gold’s safe-haven status is reinforced over centuries, and it’s typically uncorrelated (sometimes negatively) with stock markets. Bitcoin is growing in this role but still tends to tumble along with stocks during sharp market retreats.

Expert perspectives and the 2025 evidence 📝

Gold as crisis insurance:

Studies and market history consistently show gold performing well when markets crash or inflation spikes, like in 2008, 2020, and even during the 2022 bear market. Its negative correlation with equities makes it a genuine “parachute” for traditional portfolios.

Bitcoin as digital disruptor:

Proponents argue that bitcoin’s supply math, decentralization, and resistance to government tampering position it for the digital age. Some evidence, especially in unstable economies, shows bitcoin use surging when fiat money fails. For instance, bitcoin trading volumes exploded by 1,000% in inflation-hit Argentina.

Mixed performance:

Bitcoin sometimes outpaces inflation spectacularly (like in 2021), but has also plunged alongside risk assets when financial stress hits. Gold, by contrast, often holds or gains modestly during shocks.

2025 snapshot:

Gold is up about 8–30%, reflecting steady safe-haven flows.

Bitcoin has climbed over 35% at points but with much higher short-term drops.

Investors split: older and institutional buyers still lean gold; growth and digital adoption push bitcoin.

Institutional adoption and global trends 🌏

Central banks are increasing gold reserves amid mounting geopolitical and currency fears.

More public companies and funds are allocating small percentages to bitcoin as a growth or “dollar debasement” hedge.

Regulatory acceptance of bitcoin (and the recent U.S. pro-crypto policies) have helped boost its profile, but governments can still clamp down, adding risk.

Pros and cons: Is one really better? 🤔

Gold’s biggest advantages:

Centuries of trust, proven performance in inflation and crisis.

Lower overall volatility makes it easier to hold for “sleep-at-night” insurance.

Recognized and accepted everywhere.

Bitcoin’s unique appeal:

Extreme scarcity and predictable issuance.

Huge potential upside if digital assets become a mainstream store of value.

Portability and ease of transfer, especially for cross-border needs.

Gold’s drawbacks:

Cumbersome to transport and store (especially in large amounts).

Can lag inflation for stretches, especially in strong equity bull markets.

Can be seen as “old world” and slow-moving.

Bitcoin’s risks:

Volatility makes it a nerve-racking hold for many.

Less proven in extended, sustained inflationary environments or deep equity declines.

Security and regulatory crackdowns remain concerns.

Best strategies: Combining, not choosing? 🌀

Many modern wealth managers and institutions suggest the answer may not be “either/or,” but rather a blend:

Gold can anchor a portfolio, providing solid, lower-volatility protection.

Bitcoin can “turbocharge” portfolios if digital scarcity and adoption trends continue.

As a rule of thumb: Gold for sleep-at-night stability, Bitcoin for calculated risk and potential outperformance.

A diversified inflation-hedge basket might look like:

80–90% gold for traditional safety and steady inflation protection.

10–20% bitcoin for high-growth, high-volatility upside and digital currency defense.

Key takeaways and practical advice for 2025 🌟

Gold remains the #1 trusted inflation hedge for slow and steady protection, especially in system-wide crises and equity market crashes.

Bitcoin is a fast-emerging challenger, with massive upside potential and the pitfalls of youth, big booms and busts are still normal.

In 2025, both assets look more attractive than holding cash as inflation chips away at fiat.

Your allocation should reflect your risk tolerance, timeline, and conviction, consider a blend for broad protection.

Stay updated: Regulatory changes, institutional moves, and technological developments will keep shifting the landscape.

Final thought: In today’s inflation-prone world, both gold and bitcoin offer compelling but different armor. Tradition and trust vs. innovation and disruption. Savvy investors need not choose just one. Instead, understand their strengths, prepare for their weaknesses, and build a balanced portfolio that can weather tomorrow’s storms.

Poll 📊

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.