Earnings revision cycles: Why upgrades are fueling this year-end rally

As 2025 enters its final quarter, global equity markets are enjoying a surprising year-end rally. Inflation is easing, central banks appear to have paused rate hikes, and optimism about earnings has surged. One powerful but often overlooked driver behind this upswing is the earnings revision cycle—a wave of analyst upgrades that reflects improving profit expectations across sectors.

But what exactly is an earnings revision cycle, why does it matter so much to markets, and why are current upgrades proving so influential? Let’s unpack the concept, the psychology behind it, and its direct impact on investor sentiment, valuations, and this year’s rally.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

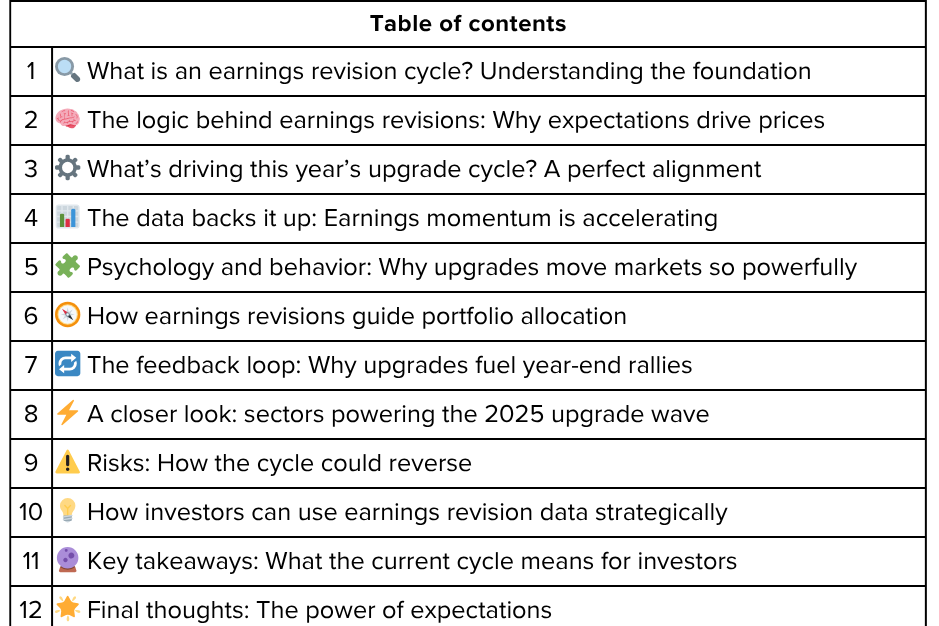

What is an earnings revision cycle? Understanding the foundation 🔍

Every listed company comes with an evolving set of expectations from Wall Street analysts, who estimate its future earnings based on business performance, macroeconomic trends, and management guidance. These are known as earnings estimates, typically expressed as earnings per share (EPS) forecasts for the coming quarters or year.

An earnings revision cycle occurs when analysts collectively start adjusting those earnings forecasts upward or downward. When revisions tilt positive—meaning more upgrades than downgrades—we see an earnings upgrade cycle. Conversely, when estimates fall and downgrades pile up, it signals an earnings downgrade cycle.

Economists and investors track these shifts using metrics like the Citi Earnings Revision Index (CERI), which measures the net difference between upward and downward EPS revisions across the market.

In essence, the earnings revision cycle tells us how analysts’ expectations are evolving, revealing the underlying direction of corporate health and investor optimism.

The logic behind earnings revisions: Why expectations drive prices 🧠

The link between earnings revisions and stock prices is firmly rooted in behavioral finance and market mechanics:

Stock prices discount future earnings. Investors don’t just price a company based on current profits—they value future earnings potential.

Analyst upgrades change expectations. When analysts revise earnings upward, they’re signaling stronger business performance ahead, encouraging investors to pay more for the stock.

Momentum builds. Positive revisions attract institutional attention, leading to more buying, rising prices, and further upward revisions.

Feedback loop forms. This self-reinforcing cycle—where improving fundamentals drive optimism, prices, and further upgrades—is what fuels powerful rallies.

On the flip side, negative revisions can quickly turn sentiment sour, as in 2022 when multiple sectors saw earnings downgrades amid fears of economic slowdown, triggering sharp market corrections.

What’s driving this year’s upgrade cycle? A perfect alignment ⚙️

Several key trends have come together in 2025 to flip analyst sentiment from cautious to constructive:

1. Resilient U.S. and global growth

Despite projections of a slowdown, economies have held up remarkably well. The U.S. economy continues to grow at a moderate pace, avoiding recession while maintaining strong employment. This resilience has led analysts to raise profit expectations, particularly in consumer sectors and industrials.

2. Stabilizing inflation, steady margins

Earlier fears of margin erosion due to rising input costs have faded. Inflation has cooled, supply chains have normalized, and many companies retained the price increases they pushed through during 2022–2023. As a result, earnings revisions have turned increasingly positive.

3. Technology’s second wind

After a tough year of layoffs and cost cutting, major tech companies have posted better-than-expected results throughout 2025. AI-driven productivity, efficiency gains, and increased enterprise spending have boosted profit projections, leading to widespread upgrades in the tech sector.

4. Industrial and materials revival

Global infrastructure spending, energy investments, and improved trade relations have lifted cyclical industries—traditionally among the first to benefit from positive revisions.

5. A weaker dollar

For multinational U.S. firms, a softening dollar has translated into better overseas earnings when converted back to dollars. Analysts quickly factored this into their upgraded forecasts for exporters.

Together, these dynamics created a fertile environment for an earnings upgrade cycle that’s directly underpinning the fourth-quarter stock rally.

The data backs it up: Earnings momentum is accelerating 📊

By late Q3 2025, major indicators confirmed the shift in corporate momentum:

The Citi Earnings Revision Index (CERI) turned decisively positive in June, its strongest level in nearly 18 months.

Global earnings growth forecasts were revised from 5% to over 9% for the full year, according to FactSet.

In the U.S., roughly 77% of S&P 500 companies beat earnings estimates in Q3—well above the 10-year average of 69%.

Analysts have raised 2026 earnings-per-share projections for the S&P 500 to $260, compared to $247 at midyear—a meaningful jump.

This upward trend reinforces investor confidence and invites fresh capital flows from both retail and institutional players eager to capture the gains.

Psychology and behavior: Why upgrades move markets so powerfully 🧩

Earnings revision cycles demonstrate one of the most powerful behavioral biases in markets — anchoring and delayed reaction.

Investors tend to “anchor” their expectations based on prior earnings environments, adjusting too slowly when conditions improve.

Analysts, too, are cautious at first to avoid being wrong early; upgrades often lag the initial recovery.

When revisions finally pick up, they validate what early investors already sensed—and that confirmation sparks broader buying.

This staggered recognition process means earnings upgrades can sustain rallies far longer than initial catalysts, as each new round of revisions attracts a fresh cohort of buyers.

How earnings revisions guide portfolio allocation 🧭

Seasoned investors don’t just watch the headlines—they monitor revisions as a leading indicator of sector rotation and style leadership.

1. Sector positioning

When revisions skew positive in certain industries, investors often shift portfolios toward those gaining sectors.

Current leaders: Industrials, tech, financials, and consumer discretionary sectors are experiencing the most upgrades.

Laggards: Energy and certain defensive sectors like utilities are seeing downward adjustments as money flows toward growth-sensitive areas.

2. Style shifts (growth vs. value)

A rising revision cycle often favors growth and cyclical stocks, which benefit from improving profit forecasts.

Defensive and value sectors typically lag during upgrade cycles.

3. Geography

Stronger earnings momentum in the U.S. and parts of Asia has driven capital inflows into those equity markets, even as Europe’s revisions remain mixed.

Monitoring revision ratios across markets provides an early glimpse into global capital rotation trends.

The feedback loop: Why upgrades fuel year-end rallies 🔁

Every major market rally rests on three pillars—liquidity, sentiment, and earnings expectations. This year, all three are working in harmony.

Upgrades improve sentiment.

Rising earnings forecasts convince investors that the macro outlook is healthier than feared.

Capital flows follow optimism.

Institutional funds and ETFs chase improved earnings momentum, driving prices higher.

Momentum feeds revisions.

As stock prices climb and economic data holds up, analysts raise forecasts again—setting up another leg of the rally.

This virtuous cycle can sustain bull runs longer than expected, particularly when investor positioning starts from a place of skepticism, as it did earlier this year.

A closer look: Sectors powering the 2025 upgrade wave ⚡

Technology and AI

Surging demand for AI infrastructure and cloud computing continues to lift earnings across big tech. Early cost optimization is now translating to record margins, spurring analysts to upgrade guidance repeatedly.

Financials

With the Fed pausing rate hikes, improved clarity on net interest margins and credit quality has driven multiple upgrades, especially for regional and large-cap banks.

Industrials and materials

Re-energized government infrastructure spending and strong global demand for renewable energy components have restored optimism here.

Consumer discretionary

With wage growth outpacing inflation, consumers are spending again on travel, leisure, and services—pushing earnings estimates upward.

Risks: How the cycle could reverse ⚠️

While positive revisions are bullish, markets must keep an eye on potential spoilers:

Profit compression: Companies may struggle to sustain margins if wage pressures rise or supply costs return.

Policy shifts: Renewed central bank tightening could dampen sentiment and slow spending.

Global shocks: Geopolitical risks, commodity volatility, or trade disruptions could abruptly reverse momentum.

Over-optimism: Analysts sometimes overshoot; after steep upgrades, markets can become vulnerable to disappointments.

In short, while revisions drive rallies, they can also set the stage for pullbacks when reality falls short.

How investors can use earnings revision data strategically 💡

Track revision ratios: Indicators like the Citigroup Earnings Revision Index or Bloomberg’s ERI provide valuable signals about market strength.

Focus on positive “breadth”: When upgrades outnumber downgrades across multiple sectors, it signals broad-based improvement.

Align with momentum: Pair earnings revision data with momentum indicators to identify stocks or ETFs riding the upgrade wave.

Avoid overbought zones: When revisions are overwhelmingly positive, be alert to mean reversion.

Blend with quality: Combining earnings momentum with balance-sheet strength yields better risk-adjusted results.

Key takeaways: What the current cycle means for investors 🔮

Upgrades are real fuel. Analyst revisions are boosting market confidence and valuations, powering the 2025 year-end rally.

Breadth matters. This cycle isn’t isolated—it’s spread across sectors, reinforcing durability.

Momentum will carry into early 2026, provided inflation stays tame and policy remains growth-friendly.

Stay disciplined. Don’t chase euphoric markets—use revisions as confirmation, not a starting point.

Final thoughts: The power of expectations 🌟

Earnings revision cycles underscore a timeless truth in markets: expectations drive prices more than reality itself. As long as profits keep surprising to the upside, equity markets can sustain rallies even amidst macro uncertainty.

This year’s late-2025 rally isn’t built on hope alone—it’s built on a steady drumbeat of upgrades that reflect a stronger economic base than most anticipated. For investors, keeping an eye on revisions isn’t just about riding rallies—it’s about understanding when optimism turns into complacency, and when momentum shifts into danger.

The numbers may change, but the story remains the same: when analysts and investors align on a brighter outlook, markets rarely stand still.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.

Hey, great read as always. I'm realy curious about how the psychology aspect precsiely connects with investor sentiment after these revisions.