Dollar-cost averaging: A simple strategy to beat market volatility

Ever felt like investing in the stock market is like riding a rollercoaster blindfolded? You're not alone! The constant ups and downs can make even seasoned investors queasy. But what if there was a way to smooth out those stomach-churning drops and nail-biting climbs? Enter Dollar-Cost Averaging (DCA) – the financial world's answer to motion sickness pills for your investment journey.

Let's dive into this simple yet powerful strategy that could be your ticket to beating market volatility and building wealth over time. Buckle up, because we're about to turn that rollercoaster ride into a smooth sailing adventure!

What is dollar-cost averaging? 🤔

Imagine you're at an all-you-can-eat buffet, but instead of piling your plate high in one go, you make multiple trips, sampling a bit of everything over time. That's essentially what Dollar-Cost Averaging is in the world of investing.

Dollar-Cost Averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of what the market is doing. It's like setting your investments on autopilot – you decide how much you want to invest, how often, and in what, then let the magic of consistency do its work.

Key Features of DCA:

Regular investments: You invest the same amount at fixed intervals (e.g., monthly).

Fixed dollar amount: The amount you invest stays the same each time.

Regardless of price: You buy whether the market is up, down, or sideways.

Long-term strategy: It's designed for patient investors with a long-term outlook.

DCA in action: A simple example

Let's say you decide to invest $100 every month in your favorite stock. Here's how it might play out over six months:

Total invested: $600

Total shares: 29.8

Average share price: $20.13

By consistently investing the same amount, you've bought more shares when prices were low and fewer when they were high, smoothing out the impact of price fluctuations.

Why use dollar-cost averaging? The upside of consistency 🚀

Dollar-Cost Averaging isn't just a fancy term to impress your friends at dinner parties (though it might do that too). It's a powerful strategy that offers several compelling benefits:

1. Emotional detachment from market swings

DCA helps you avoid the emotional rollercoaster of trying to time the market. It's like having a steady hand on the wheel while everyone else is swerving to avoid imaginary potholes.

2. Reduced impact of volatility

By spreading your investments over time, you're less likely to invest a large sum right before a market dip. It's the investment equivalent of not putting all your eggs in one basket – or rather, not putting all your eggs in the basket on the same day.

3. Lower average cost per share

Over time, DCA can lead to a lower average cost per share compared to trying to time the market. It's like being a savvy shopper who buys a little bit during every sale, rather than splurging on full-price items.

4. Discipline and consistency

DCA enforces a disciplined approach to investing. It's like having a gym buddy who never lets you skip leg day – except this buddy is helping you build your financial muscles.

5. Accessibility for all investors

Whether you have $50 or $5,000 to invest each month, DCA makes consistent investing accessible to everyone. It's the democratization of investing strategy!

The psychology behind dollar-cost averaging 🧠

Let's face it – humans are emotional creatures, especially when it comes to money. DCA taps into some powerful psychological principles that make it an effective strategy:

Overcoming loss aversion

We tend to feel the pain of losses more acutely than the pleasure of gains. DCA helps mitigate this by spreading out your entry points, reducing the impact of any single "bad" investment timing.

Avoiding analysis paralysis

With DCA, you don't need to obsess over finding the "perfect" time to invest. It's like choosing a restaurant – sometimes it's better to pick a place and enjoy your meal rather than endlessly debating where to go.

Building positive habits

Regular investing becomes a habit, much like brushing your teeth or checking your phone (though hopefully more financially rewarding than the latter).

Dollar-cost averaging vs. Lump sum investing: The showdown 🥊

"But wait," you might say, "wouldn't it be better to invest all my money at once if I have it?" Let's pit DCA against its main rival: Lump Sum Investing.

Scenario: $12,000 to invest over a year

Let's compare two investors, both with $12,000 to invest over a year:

DCA Daphne: Invests $1,000 monthly.

Lump Sum Larry: Invests all $12,000 on day one.

Here's how it might play out in different market conditions:

In a rising market:

In this scenario, Lump Sum Larry comes out ahead because he's fully invested from the start, capturing all the gains.

In a volatile market:

Here, DCA Daphne's strategy shines, as she's able to buy more shares when prices dip, potentially outperforming Lump Sum Larry.

In a declining market:

In a down market, DCA Daphne's approach helps mitigate losses compared to Lump Sum Larry's all-in strategy.

The takeaway? DCA isn't always the highest-returning strategy, but it's often the most psychologically comforting and can outperform in certain market conditions.

How to implement dollar-cost averaging like a pro 🏆

Ready to put DCA into action? Here's your game plan:

Choose your investment: Pick a diversified index fund, ETF, or a mix of individual stocks.

Set your amount: Decide how much you can consistently invest each period.

Determine your frequency: Monthly is common, but you could do bi-weekly or even weekly.

Automate: Set up automatic transfers from your bank account to your investment account.

Stay the course: Resist the urge to change your strategy based on short-term market movements.

Review periodically: While DCA is a set-it-and-forget-it strategy, it's wise to review your investments annually to ensure they still align with your goals.

Real-world examples: DCA in action 🌍

Let's look at how DCA might have played out in some real-world scenarios:

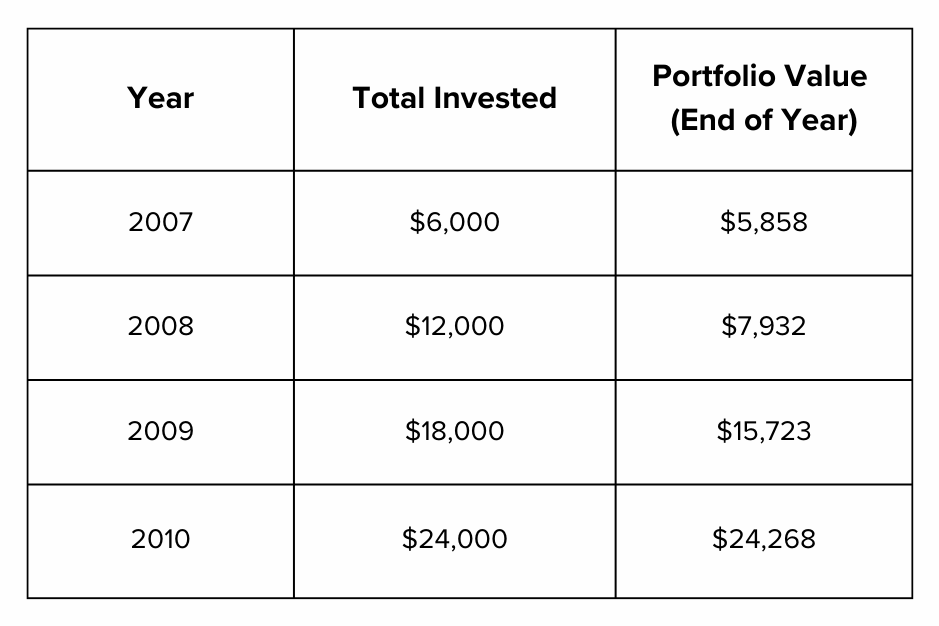

Example 1: Investing through the 2008 financial crisis

Imagine you started investing $500 monthly in an S&P 500 index fund in January 2007, right before the financial crisis hit:

Despite the market crash, by consistently investing through the downturn, you would have broken even by 2010 and been well-positioned for the bull market that followed.

Example 2: DCA vs. Lump Sum in a tech giant

Let's compare DCA to a lump sum investment in a popular tech stock like Amazon (AMZN) over a 5-year period from 2015 to 2020:

In this case, the DCA approach outperformed the lump sum strategy, demonstrating its potential in volatile, high-growth stocks.

Common mistakes to avoid with dollar-cost averaging ⚠️

Even a simple strategy like DCA has its pitfalls. Here are some common mistakes to watch out for:

Inconsistency: Skipping investments when the market is down (that's often the best time to buy!).

Overcomplicating: Trying to time your regular investments based on market news.

Ignoring fees: Not considering transaction costs, especially if investing very frequently.

Lack of diversification: Applying DCA to a single stock instead of a diversified portfolio.

Forgetting to rebalance: Not adjusting your portfolio periodically to maintain your desired asset allocation.

The bottom line: Harnessing the power of consistency 🏁

Dollar-Cost Averaging isn't a get-rich-quick scheme or a crystal ball that predicts market movements. Instead, it's a practical, accessible strategy that harnesses the power of consistency and long-term thinking.

By smoothing out the impact of market volatility, DCA can help you build wealth over time without the stress of trying to time the market perfectly. It's particularly well-suited for investors who:

Have a regular income and can invest consistently

Are looking to build long-term wealth

Want to reduce the impact of market volatility on their investments

Prefer a hands-off, disciplined approach to investing

Remember, the key to success with DCA is consistency and patience. It's not about making a killing in the market; it's about steadily building wealth over time, regardless of market conditions.

So, are you ready to turn your investing journey from a wild rollercoaster ride into a smooth sailing adventure? With Dollar-Cost Averaging, you might just find that beating market volatility is simpler than you ever imagined. Happy investing!

Disclaimer: All content provided is for informational purposes only and should not be considered as financial advice. Remember, investing involves risk, and past performance is not indicative of future results. Always do your own research or consult with a financial advisor before making investment decisions.

Share this article with your fellow investors and help them navigate the choppy waters of market volatility!

Poll 📊

Disclaimer: All content provided is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.