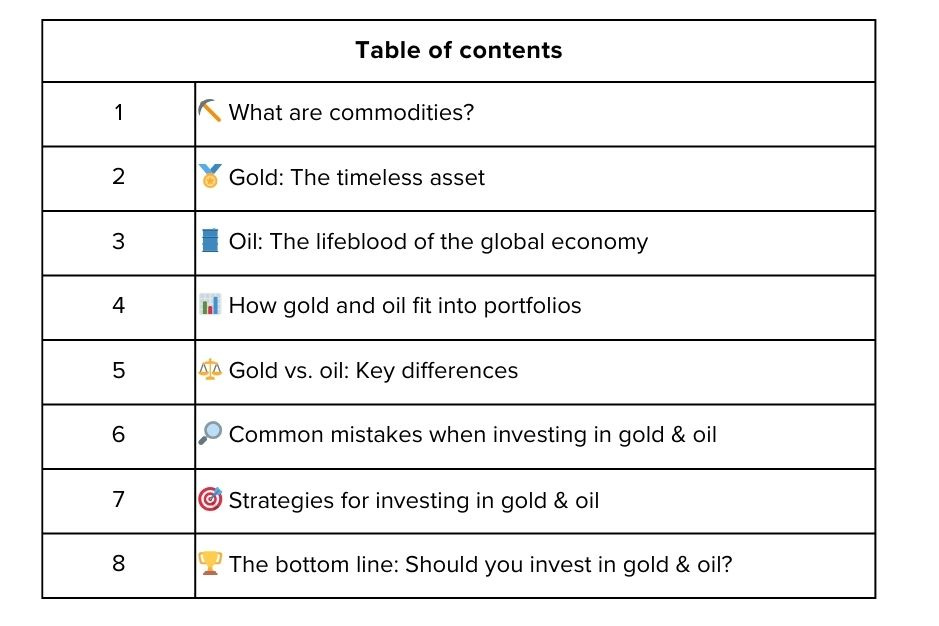

Commodities 101: How gold and oil fit into portfolios

When market volatility strikes, investors often turn to commodities—especially gold and oil—as part of their portfolio strategy. But how exactly do these assets fit into an investment mix? Are they just crisis hedges, or can they offer long-term value?

In this guide, we’ll break down how gold and oil function in financial markets, why investors love them, and how to use them to strengthen your portfolio.

What are commodities? ⛏️

Commodities are raw materials or primary agricultural products that can be bought and sold. They fall into two broad categories:

Hard commodities: These are natural resources extracted from the earth, such as metals (gold, silver, platinum) and energy sources (oil, natural gas, coal).

Soft commodities: These are primarily agricultural products, including crops (wheat, corn, soybeans) and livestock (cattle, pork, poultry).

Why do investors care about commodities?

Hedge against inflation – Commodities tend to hold or increase their value when inflation rises, making them useful protection against currency devaluation.

Diversification – Since commodities often move independently of stocks and bonds, they can add resilience to an investment portfolio.

Global demand drivers – Economic growth, geopolitical events, and supply chain disruptions all impact commodity prices, making them a dynamic investment option.

Tangible assets – Unlike stocks, commodities are physical assets with intrinsic value, reducing reliance on corporate performance or market sentiment.

Gold and oil, in particular, are two of the most widely traded commodities, each playing a unique role in financial markets. Let's explore why.

Gold: The timeless asset 🏅

Gold has been used as a store of value for thousands of years. But in modern investing, it serves specific purposes:

1. A safe-haven asset

When stock markets crash, gold often rises. Investors flock to gold during economic uncertainty because it retains its value when paper currencies and equities decline.

2. Inflation hedge

Gold is seen as a hedge against inflation. When the value of fiat currency falls due to rising prices, gold often appreciates.

3. Portfolio diversification

Gold has a low correlation with stocks and bonds, meaning it moves independently of traditional asset classes. This makes it a valuable tool for reducing portfolio risk.

4. Central bank holdings

Many central banks hold gold reserves, reinforcing its long-term importance. Countries like the U.S., China, and India stockpile gold to stabilize their economies.

5. Gold’s performance over time

Historically, gold has outperformed stocks during crises but lagged behind in booming equity markets. It shines the most when financial instability is high.

Oil: The lifeblood of the global economy 🛢️

Oil is the most traded commodity in the world, influencing everything from transportation costs to global economic growth. Its importance in portfolios stems from its widespread use and price volatility.

Economic indicator

Oil prices reflect global economic activity. Rising oil prices indicate higher demand and economic expansion, while falling prices often signal slowing growth.

Inflation driver

Unlike gold, which hedges inflation, oil contributes to inflation. Higher oil prices lead to rising costs for businesses and consumers, pushing inflation upward.

Geopolitical sensitivity

Oil prices are highly influenced by geopolitical events—wars, sanctions, and supply chain disruptions can cause massive price swings.

Energy sector investment

Investors use oil exposure through energy stocks, ETFs, and futures to capitalize on price fluctuations and sector growth.

How gold and oil fit into portfolios 📊

Now that we understand their characteristics, let’s see how they fit into investment portfolios.

1. Hedging against market uncertainty

Gold protects against stock market downturns and economic instability.

Oil hedges against inflation and geopolitical instability, as rising oil prices often accompany high inflationary periods.

2. Diversification benefits

Since gold has a low correlation with equities and bonds, it helps reduce portfolio volatility.

Oil is tied to industrial production and consumer demand, offering cyclical investment opportunities.

3. Speculation & trading opportunities

Gold attracts traders who speculate on inflation trends and currency movements.

Oil offers high liquidity for active traders who capitalize on short-term price swings due to economic data and geopolitical events.

4. Long-term wealth preservation

Gold is often held as a store of value for decades.

Oil investments are more cyclical and require market timing for maximum returns.

Gold vs. oil: Key differences ⚖️

Common mistakes when investing in gold & oil 🔎

While gold and oil can strengthen portfolios, investors should be aware of potential pitfalls:

Ignoring market cycles

Gold often performs well during economic crises but can stagnate during periods of growth when investors favor higher-yielding assets. Oil prices, on the other hand, follow a cyclical pattern driven by supply-demand dynamics, geopolitical events, and production levels. Understanding these cycles is crucial to avoiding mistimed investments.

Overexposure

Holding too much gold or oil in a portfolio can lead to excessive volatility and concentration risk. Gold does not generate income like stocks or bonds, and oil prices can be unpredictable due to global economic shifts. Diversifying across asset classes helps balance risk and returns.

Neglecting storage & costs

Physical gold requires secure storage, which comes with additional costs. Oil investments, typically done through futures contracts, involve rollover costs and expiration risks that can reduce profits. Investors should factor in these logistical and financial considerations before investing.

Misunderstanding geopolitical risks

Oil prices are highly sensitive to events like sanctions, trade disputes, and production cuts, which can cause sudden price swings. Gold, meanwhile, reacts to currency movements and interest rates, often rising when the US dollar weakens. Keeping track of global developments is key to making informed investment decisions.

Strategies for investing in gold & oil 🎯

Passive investors

Gold ETFs & mutual funds: Best for diversification without dealing with physical gold.

Energy sector ETFs: Exposure to major oil companies without direct commodity investment.

Commodity index funds: Track broad commodity markets, including gold and oil.

Active traders

Gold futures & options: High-risk, high-reward trading opportunities based on market speculation.

Crude oil futures: Suitable for those willing to navigate oil’s price volatility.

Leveraged ETFs: Used for short-term trading on gold or oil price movements.

Long-term investors

Physical gold holdings: Useful as a long-term wealth preservation tool, often stored in vaults or allocated accounts.

Oil Stocks & dividends: Blue-chip oil companies like ExxonMobil and Shell provide steady income through dividends.

Gold mining stocks: Invest in companies that extract and refine gold, offering leveraged exposure to gold price movements.

The bottom line: Should you invest in gold & oil? 🏆

Both gold and oil play unique roles in an investment strategy. Gold serves as a safe haven and inflation hedge, while oil provides exposure to global economic trends and price cycles.

The key is understanding your investment goals:

If you seek stability and crisis protection, gold is your best bet.

If you want economic exposure and trading opportunities, oil offers strong cyclical potential.

A balanced portfolio often includes both, ensuring diversification and risk management.

By strategically allocating these commodities, investors can better navigate market fluctuations and enhance their long-term returns.

Poll 📊

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.