Why conferences matter more than headlines in January

Every January, investors obsess over macro headlines, Fed speeches, job reports, inflation tracks, while missing a quieter but often more critical driver of early-year market tone: corporate and industry conferences. These gatherings, held by investment banks, research houses, and global industry associations, kick off the year with direct, on‑the‑ground updates from company executives.

They may not grab front‑page attention, but for analysts and funds mapping the year’s direction, January conferences reveal something headlines can’t: how businesses actually see demand, margins, supply chains, and the next six months.

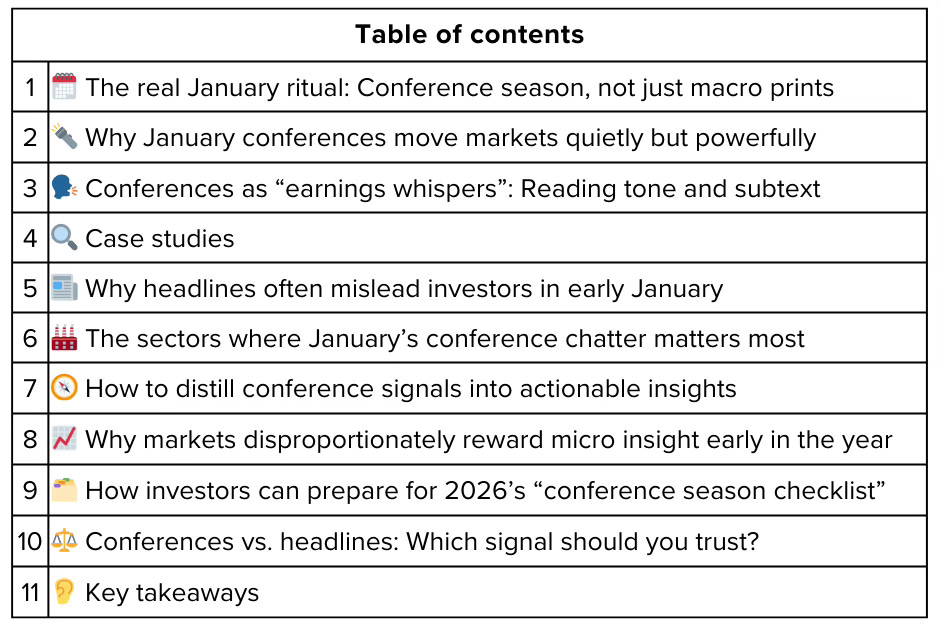

Let’s unpack why these events have become a key market compass, what kinds of data they surface, and how to use their signals to navigate the opening stretch of 2026 effectively.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.