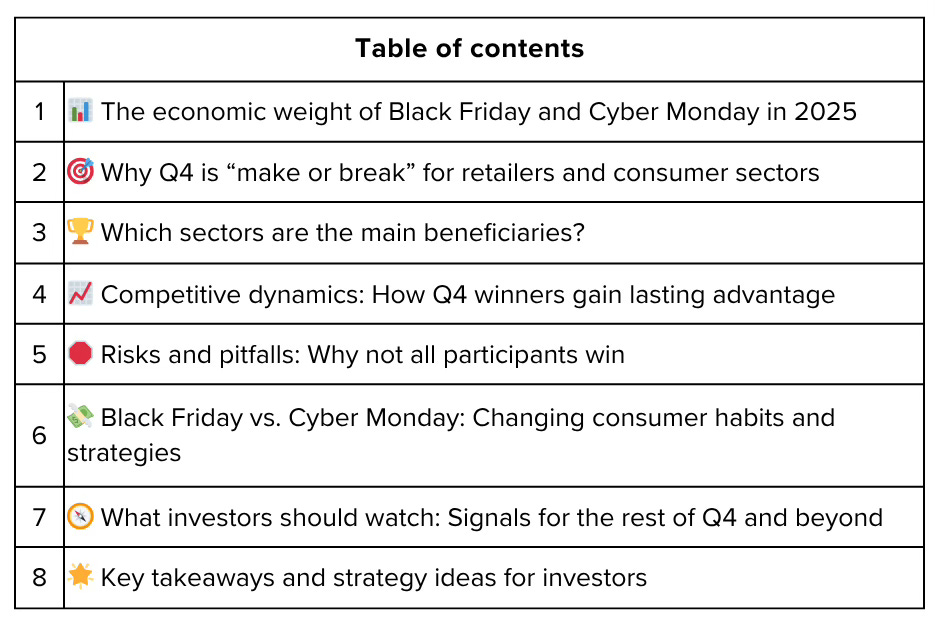

Why Black Friday and Cyber Monday Are Critical for Q4 Sector Leaders

When the calendar flips to November, Wall Street, Main Street, and every retailer from Amazon to your neighborhood boutique turn their eyes to two mega-shopping events: Black Friday and Cyber Monday. These aren’t just “big days” anymore—they’re the heartbeat of the crucial holiday quarter, often determining which sectors, companies, and stocks end the year as winners. In a landscape where one quarter’s results can make or break annual goals, understanding the real power behind Black Friday and Cyber Monday is essential for investors, executives, and consumers alike.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

The economic weight of Black Friday and Cyber Monday in 2025 📊

Black Friday and Cyber Monday have long been seen as bellwethers for retail and consumer health. In 2025, they are more influential than ever. Consider the numbers:

Black Friday 2025 U.S. online sales are projected to reach $11.7 billion—an 8.7% year-over-year increase, smashing previous records.

Cyber Monday 2025 is expected to hit $14.2 billion in U.S. online sales, making it the season’s single biggest shopping day.

The combined “Cyber Five” period (Thanksgiving through Cyber Monday) is forecast to constitute over 17% of total U.S. holiday season sales—a multi-billion-dollar inflection point for sector leaders.

Globally, Black Friday and Cyber Monday generate well over $20 billion in total sales, with 197 million shoppers participating in the U.S. alone during the long weekend.

These surges don’t just pad the bottom line—they reveal consumer priorities, tilt sector leadership, and point the way for Q4’s market narrative.

Why Q4 is “make or break” for retailers and consumer sectors 🎯

For many consumer-facing companies, the last quarter—notably November and December—can account for as much as 30-40% of annual revenue. Here’s why:

Gift buying and promotions make for bigger average basket sizes.

Retailers gain pricing power on select “must-have” items even as discounts dominate headlines.

Inventory turn is critical—companies that misjudge demand risk left-over stock and margin hits.

Investor expectations hinge on “holiday beats”: stocks can soar or tumble on sales results from these few days.

For digital-first, omnichannel, and traditional retail names alike, a successful Black Friday–Cyber Monday stretch often means outperformance versus peers for the whole year.

Which sectors are the main beneficiaries? 🏆

1. E-commerce and online marketplaces

Cyber Monday is the digital king, but Black Friday online shopping continues to surge. Sector leaders (think Amazon, Shopify, Flipkart, Alibaba) often report their highest conversion and revenue days of the year. Standout specialties include:

Consumer electronics: Historically, top category for discounts and sales spikes (+334% growth YoY in electronics).

Apparel and footwear: Promotions drive traffic both online and in brick-and-mortar stores.

Toys and games: Early deep discounts for “hot” gifts lead to exploded sales—622% growth on Black Friday over typical days.

Home goods/furnishings: Increasingly promoted for early holiday redecorations and gifting.

2. Omnichannel and physical retailers

While online reigns, 81.7 million Americans shopped in-store on Black Friday 2024, the highest since the pandemic. Retailers pairing digital convenience with physical store experiences (Target, Walmart, Best Buy) win big with curbside pickup, in-store exclusives, and hybrid marketing campaigns.

3. Logistics and payment platforms

Delivery firms, digital wallets, and “buy now, pay later” fintechs see transaction volumes spike. Shopify merchants tallied $11.5 billion in BFCM sales, while payment providers report record processing volumes and instant credit approvals.

4. Advertising and marketing tech

With ad spend peaking before and during these dates, digital marketing and performance analysis firms enjoy tailwinds as brands compete for every click and conversion.

Competitive dynamics: How Q4 winners gain lasting advantage 📈

Customer acquisition: Deep discounts and broad campaigns generate new customer registrations and emails—a springboard for long-term engagement and upselling.

Brand visibility: High-volume days and viral “doorbuster” deals put sector leaders at the center of media cycles and consumer consciousness.

Margin mix: Goods with fat margins (accessories, private label) are often paired with “loss leaders,” helping boost profits despite fierce promotional activity.

Inventory optimization: Real-time data from these mega-events allows successful companies to quickly restock winners, discount laggards, and manage supply chains more nimbly for the rest of Q4.

Companies that execute flawlessly often see their stock prices outperform both competitors and the broader market through year-end and beyond.

Risks and pitfalls: Why not all participants win 🛑

Missed forecasts: Overoptimistic sales, inventory shortages, or logistics hiccups can dent results and slam stocks.

Margin erosion: Excessive discounting to chase volume can cut deeply into Q4 profits, especially for brands over-reliant on BFCM-driven sales.

Logistics bottlenecks: Delivery delays or fulfillment mishaps risk backlash, negative reviews, or lost future business.

Ad spend waste: Intense competition can inflate ad costs, eating into returns from digital sales.

Consumer fatigue: Some segments report “deal fatigue” and more selective bargain-hunting, meaning companies must work smarter on personalization and loyalty.

Black Friday vs. Cyber Monday: Changing consumer habits and strategies 💸

Cyber Monday has now overtaken Black Friday as the largest single online sales day, but Black Friday wins for combining digital and physical reach.

Modern consumers research products online but may complete purchases in-store for immediacy, pickup, or post-sale support.

“Click & collect,” app-driven flash sales, and real-time social proof (e.g., live trends on TikTok and Instagram) differentiate sector leaders from also-rans.

Mobile commerce (m-commerce) is stronger than ever, with peak transactions hitting $11.3 million per minute on Black Friday 2025 and 79% of BNPL sales initiated on mobile devices.

What investors should watch: Signals for the rest of Q4 and beyond 🧭

Year-over-year growth rates: Acceleration or deceleration versus last year sets the investment tone for all consumer-related stocks.

Conversion rates: Higher checkout rates often mean effective digital channel strategy and pricing.

New customer adds: A surge now can create recurring value over 2026.

Profit margins: Watch for rising revenues but shrinking profits—a red flag.

Inventory commentary: What companies say about stock levels often matters more than the sales number itself.

These metrics determine not just holiday winners, but which sector leaders retain momentum into Q1.

Key takeaways and strategy ideas for investors 🌟

Black Friday and Cyber Monday are not just marketing bonanzas—they set the competitive pecking order for consumer-facing sectors for the entire year.

Strong Q4 performance drives outperformance for stocks in retail, e-commerce, logistics, fintech, and ad tech.

The smart money analyzes underlying data—traffic sources, conversion rates, fulfillment, loyalty trends—not just headline sales figures.

Companies executing omnichannel strategies, optimizing inventory, and blending physical and digital are best positioned for enduring leadership.

For investors and executives, focusing on end-to-end operational excellence during this five-day window could be the key to annual—and even multi-year—sector dominance.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.