What is a bear market? Quick explanation

Hey there, market watchers!

Ready for a quick dive into the world of finance? Let's explore the growling beast known as a bear market. Don't worry, no actual bears involved!

🐻 What exactly is a bear market?

A bear market occurs when stock prices fall 20% or more from recent highs. This significant drop reflects widespread investor pessimism and can signal economic downturns. Think of it like when your favourite snacks go on a major scale, but with stocks losing value instead!

📉 Key features of a bear market

Prolonged price declines: Stock prices consistently fall over weeks or months, not just a single bad day.

Widespread pessimism: Investors lose confidence, leading to more selling and further price drops.

Negative investor sentiment: Fear and uncertainty dominate, causing many to sell off investments.

Economic slowdown: Often linked with recessions, bear markets can reflect broader economic struggles.

🕰️ How long do bear markets last?

Bear markets typically last about 9.6 months on average. This duration is shorter than a school year but can feel much longer to investors watching their portfolios shrink.

🔍 Types of bear markets

Cyclical Bear Markets:

Short-term downturns lasting several months to a few years

Part of regular business cycles

Often triggered by economic slowdowns or temporary market corrections

Example: The 2018 bear market caused by trade tensions and interest rate concerns

Secular Bear Markets:

Long-term downturns that can last decades

Characterized by below-average returns and prolonged periods of price stagnation

Often punctuated by shorter bull market rallies

Example: The period from 1966 to 1982, marked by high inflation and low economic growth

Event-Driven Bear Markets:

Caused by specific, often unexpected events

Can be sharp but relatively short-lived

Example: The COVID-19 pandemic-induced bear market of 2020

🌪️ What causes a bear market?

Economic recessions: When economies contract, companies earn less, leading to falling stock prices.

Pandemics (e.g., COVID-19): Global health crises can disrupt economies and lead to sharp declines in stock markets.

Wars or geopolitical crises: Conflicts create uncertainty and can negatively impact global trade and investment.

Bursting of market bubbles: When overvalued assets correct sharply, it can trigger widespread selling.

💡 How to spot a bear market

Declining stock indexes: Major indices like the S&P 500 or Dow Jones Industrial Average consistently drop.

Negative economic indicators: Rising unemployment or declining GDP growth signal trouble.

Falling corporate profits: Companies report lower earnings, leading to reduced stock valuations.

Rising unemployment: Job losses often accompany economic downturns and contribute to negative sentiment.

🛡️ Surviving a bear market

Don't panic! Bear markets are temporary phases in the economic cycle.

Diversify your portfolio: Spreading investments across various sectors can reduce risk.

Consider defensive stocks: Companies in essential industries like utilities or healthcare often perform better during downturns.

Look for bargain investments: Lower prices might offer opportunities to buy quality stocks at a discount.

🎢 Famous bear markets in history

The Great Depression (1929-1932):

Triggered by the stock market crash of 1929

Dow Jones Industrial Average fell 89% from its peak

Lasted 34 months

Caused widespread bank failures and massive unemployment

Led to significant financial reforms and the creation of the SEC

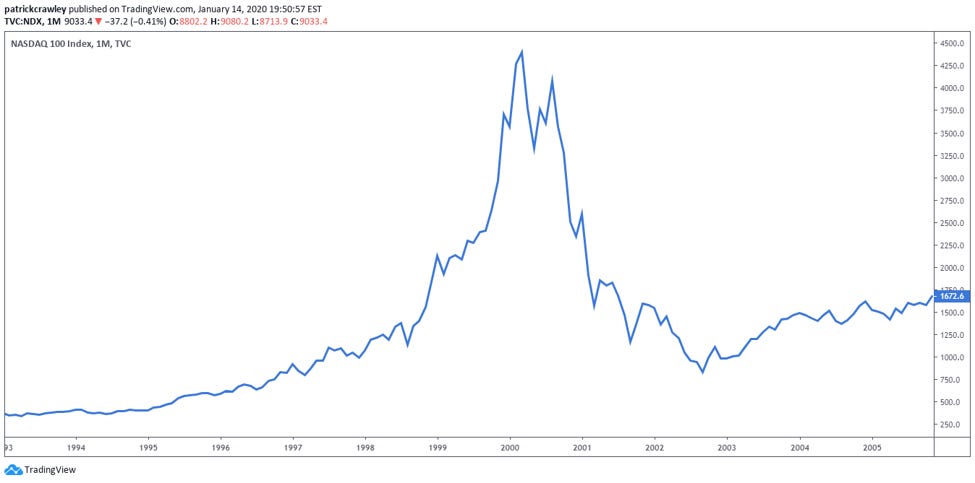

The Dot-com Bubble (2000-2002):

Fueled by excessive speculation in internet-based companies

NASDAQ Composite index fell 76.8% from its peak

Lasted 31 months

Many tech startups went bankrupt

Highlighted the importance of fundamental business models over hype

Photo source: Dot com bubble...

The Global Financial Crisis (2007-2009):

Triggered by the subprime mortgage crisis and collapse of Lehman Brothers

S&P 500 fell 57% from its peak

Lasted 17 months

Led to a global recession and massive government bailouts

Resulted in stricter financial regulations and changes in risk management practices

🧠 Bear market psychology

Investors often act like a herd during bear markets. Fear drives selling, which causes more fear among others, creating a self-reinforcing cycle of decline. It's similar to "follow the leader" but with financial consequences.

🚀 The silver lining

Every bear market in history has eventually turned into a bull market—a period when stock prices rise significantly, often in response to economic growth.

Here's why there's a silver lining to bear markets:

Historical resilience: Despite significant drops, markets have always recovered and reached new highs over time.

Buying opportunities: Lower stock prices can offer chances to invest in quality companies at discounted rates.

Market reset: Bear markets can correct overvalued assets, leading to healthier, more sustainable growth in the long run.

Learning experience: These periods provide valuable lessons in risk management and the importance of diversification.

Innovation catalyst: Economic challenges often spur companies to innovate and improve efficiency.

Remember, patience is key! While challenging, these periods can also present opportunities for those willing to invest wisely during downturns.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.