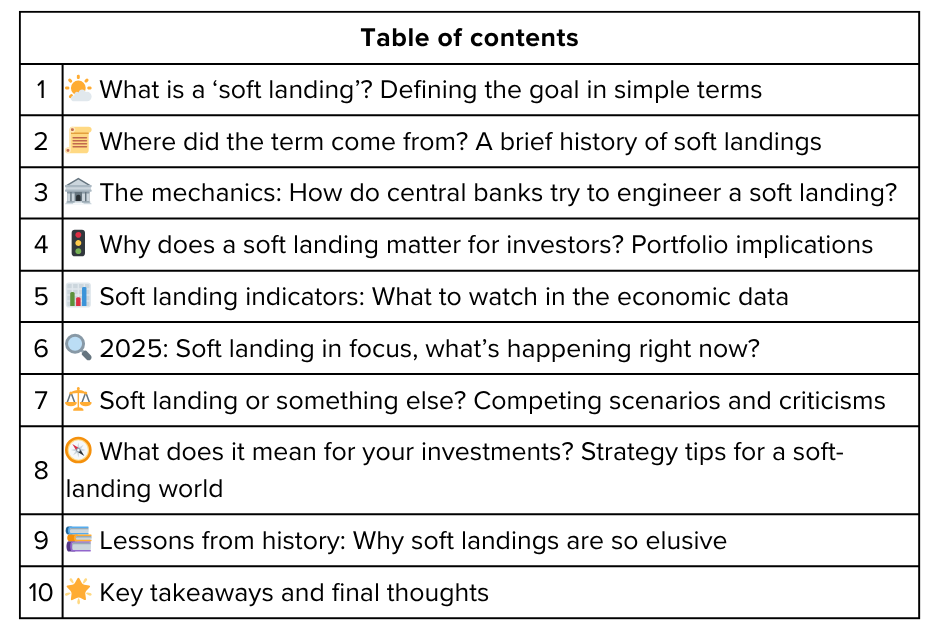

What investors mean by ‘soft landing’, and why it matters now

The phrase “soft landing” is being tossed around more than ever in financial news, central bank briefings, and investor conversations this year. As the global economy cools after intense post-pandemic stimulus and inflation spikes, everyone from Wall Street strategists to individual savers is wondering: Can the world’s central banks truly slow things down without causing a crash? What does a soft landing actually mean, and what does it signal for your portfolio decisions in 2025? This article breaks down the history, mechanics, and real-world importance of a soft landing, and how you can navigate this environment with confidence.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

What is a ‘soft landing’? Defining the goal in simple terms 🌤️

A soft landing is an economic scenario where policy makers—usually central banks—manage to bring an overheating economy back to a sustainable pace without tipping it into recession. Imagine a pilot slowing a plane for a gentle touchdown, rather than a jarring crash. In the world of finance, a soft landing means raising rates and cooling demand enough to curb inflation, but not so much that it sparks layoffs, negative growth, or financial crises.

Key points:

Slowdown in economic growth

Falling inflation

No severe recession or mass unemployment

Central banks (like the Fed or ECB) are the “pilots” aiming for the perfect descent

In contrast, a hard landing is an economic bust, where aggressive policies (like rapid rate hikes) trigger an outright recession.

Where did the term come from? A brief history of soft landings 📜

Borrowed from aviation, where a soft landing is a smooth, safe touchdown, economists popularized the metaphor during Federal Reserve tightening cycles in the U.S. In the 1990s, Chair Alan Greenspan was applauded for supposedly engineering a soft landing after an inflation scare. Since then, the term has become Wall Street’s gold standard anytime central banks try to slow inflation without causing pain. It reflects the challenge of ‘fine-tuning’ the economy, a task easier in theory than in reality.

Some famous soft landings in the U.S. cited by economists include:

1965 (Fed slowed growth without recession)

1984 (taming inflation, no downturn)

1994-95 (aggressive rate hikes, but the economy kept growing steadily)

But it’s rare. More often, rate-tightening campaigns lead to recessions—think of 2000, 2008, or 2020.

The mechanics: How do central banks try to engineer a soft landing? 🏦

Achieving a soft landing is the economic equivalent of threading a needle. The recipe typically involves:

Raising interest rates to slow borrowing and spending, curbing inflation.

Pausing hikes before growth collapses, then monitoring economic “vital signs”—unemployment, GDP, corporate profits, consumer sentiment.

Signaling carefully: Forward guidance manages market expectations about future policy moves.

Balancing tradeoffs: Policymakers want to squeeze out excess inflation, but not to the point businesses slash jobs or investment.

If done with luck and skill, inflation returns to target (around 2% for most developed economies), growth moderates, and job markets remain resilient.

Why does a soft landing matter for investors? Portfolio implications 🚦

Soft landings are rare but powerful events for markets. When investors believe the economy can slow gracefully:

Stocks often rally: Risk assets rebound as fears of recession fade and earnings outlooks stabilize.

Interest rates may peak, then fall: Bonds start pricing in a pause or even a cut, boosting prices (lower yields).

Volatility drops: Investors grow more confident in the policy path.

Sector rotation: Defensive stocks may lag, while cyclicals (industrials, consumer discretionary, small caps) gain.

Commodities stabilize: Fears of a major drop in global demand fade.

But if confidence slips—or policymakers “overcook” their medicine—expect sharp reversals and new volatility.

Soft landing indicators: What to watch in the economic data 📊

Investors and analysts pore over some key indicators in search of soft landing signals, such as:

Inflation readings (like CPI, PCE): Is inflation trending toward the central bank’s target?

Labor market strength: Is unemployment low but not falling so fast it risks wage spirals?

GDP growth: Is output moderating to a manageable pace without turning negative?

Corporate earnings: Are profits stable and outlooks positive?

Consumer confidence: Still robust, or are households bracing for job layoffs?

In the U.S. and Europe in 2025, most of these metrics show cooling but not collapsing, suggesting a soft landing is still plausible—but far from guaranteed.

2025: Soft landing in focus, what’s happening right now? 🔍

Across the developed world, central banks have spent the last two years hiking rates to tame inflation. Progress has been made: U.S. inflation is close to the Fed’s 2% goal, with the labor market still robust and GDP’s not in freefall.

Wall Street analysts in late 2024 and 2025:

See a higher probability of soft landing than recession based on growth, jobs, and moderating prices.

Warn of remaining risks: trade wars, energy shocks, and fiscal policy blunders could tip the economy into a hard landing.

Watch for “stagflation”—a painful scenario where inflation stays high but growth stalls—as the biggest threat to a soft landing narrative.

Despite these risks, many are cautiously optimistic the U.S. and possibly Europe could achieve a true soft landing—a relative rarity in economic history.

Soft landing or something else? Competing scenarios and criticisms ⚖️

Not everyone believes in Goldilocks outcomes:

No landing: Some believe a still-hot job market means inflation will not fall further, forcing central banks to keep hiking rates.

Hard landing: Critics argue soft landings are largely luck, and early warning signs (like yield curve inversion or weak manufacturing PMIs) still suggest a recession is building.

Rolling recessions: Some sectors (like housing or tech) may slow sharply even as the broader economy avoids outright contraction.

Stagflation: A return to 1970s-style “inflation-without-growth” if commodity prices surge or monetary/fiscal policy stumbles.

As of Q4 2025, the consensus leans toward successful soft landing—but the picture remains clouded by policy risk and global macro uncertainty.

What does it mean for your investments? Strategy tips for a soft-landing world 🧭

Maintain balance: Don’t abandon safe assets entirely—uncertainty always lingers.

Lean into quality and cyclicals: Financials, small caps, and cyclical sectors historically do well when growth stabilizes.

Prepare for rotation: As recession fears fade, investors may shift from defensives and bonds toward stocks tied to economic growth.

Stay global: Even if the U.S. scores a soft landing, global supply chains and emerging markets can swing on policy surprises.

Be nimble: Respond, don’t overreact, as new data comes in.

Watch inflation and policy signals: Rate cuts, policy changes, or renewed inflation could bring new risks or opportunities.

Lessons from history: Why soft landings are so elusive 📚

Despite many attempts, true soft landings have often slipped away, replaced by surprise recessions or renewed inflation. Their rarity is a warning that even the best policymakers can’t control every variable, pandemics, energy shocks, or trade disruptions can upend the best-laid plans.

That’s why the current moment is so fascinating and why investors need to remain open to all scenarios, not just “soft landing” optimism.

Key takeaways and final thoughts 🌟

A soft landing describes the economic sweet spot where growth slows, inflation falls, and recession is avoided.

Investors care deeply because it can mean higher returns with lower risk, as panic selling and deep drawdowns are avoided.

As of late 2025, hopes are high but caution is warranted—history shows how rare perfect outcomes are.

Stay diversified, follow the data, and be ready for rapid portfolio shifts if the economy’s “soft” landing turns bumpy.

Navigating a potential soft landing is about staying disciplined—being optimistic, but not blind to the risks that can suddenly spoil the party. As policymakers pilot the global economy through turbulence, investors who remain alert and adaptable will be positioned to land on their financial feet, no matter what comes next.

Poll 📊

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.