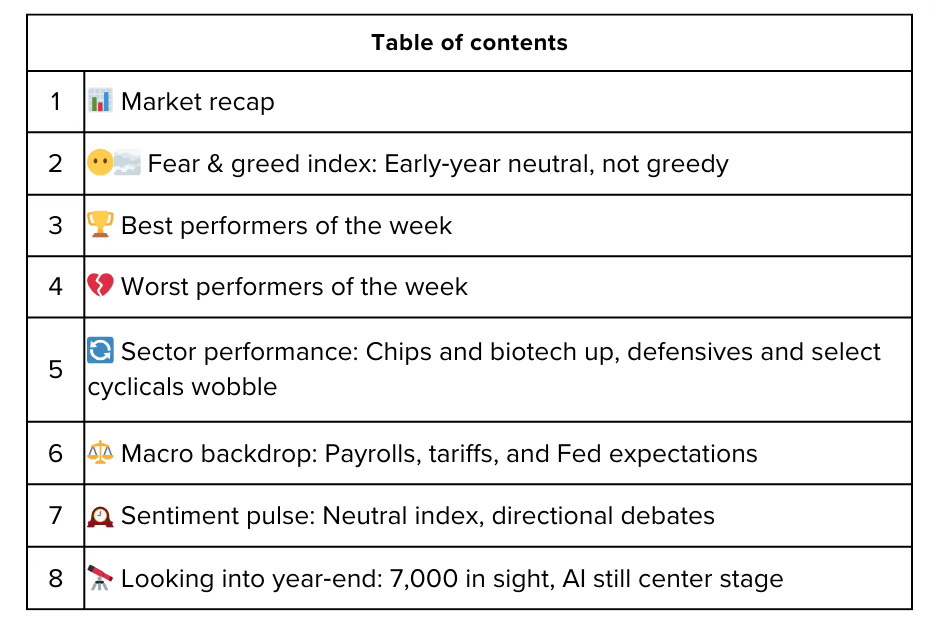

This week’s stock shocks as of 9th January, 2026.

The first full trading week of 2026 felt like a classic “macro overhang” market. Stocks managed to grind higher overall, but every uptick had to fight through headlines about Friday’s crucial payrolls report, a looming Supreme Court ruling on President Trump’s new tariff regime, and a dollar and yield spike that kept growth investors on edge. The S&P 500 [finance:S&P 500] is up roughly 0.9% week‑to‑date, while the Dow Jones Industrial Average [finance:Dow Jones Industrial Average] and Nasdaq Composite [finance:Nasdaq Composite] have jumped about 1.8% and 1.1% respectively, keeping all three benchmarks within reach of their late‑2025 record highs.

Under the surface, sector moves were anything but calm. Semiconductors, cybersecurity, and high‑quality pharma led the charge, while mega‑cap AI darling Nvidia [finance:NVIDIA Corporation] slid and a handful of defensives and bond‑like names continued to lag. As investors stared down both jobs data and tariff headlines into the weekend, the rally looked more tactical than euphoric—a market that wants to go up, but knows it still has plenty to prove.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.