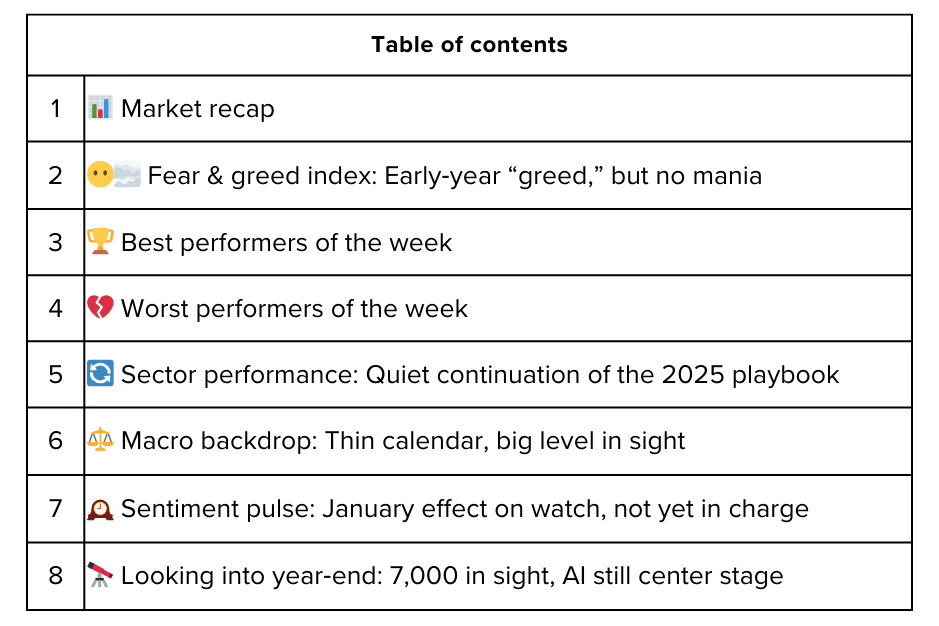

This week’s stock shocks as of 2nd January, 2026.

The first trading week of 2026 was more of a soft launch than a grand opening. With New Year’s Day falling mid‑week and volumes still thin, Wall Street eased into the year with modest gains, record‑adjacent index levels, and very little in the way of new macro information. The S&P 500 , Dow Jones Industrial Average , and Nasdaq Composite all drifted higher on Friday’s lone session, extending December’s strength without really testing the next psychological barrier at 7,000 on the S&P.

The story so far in 2026 is continuity rather than change: AI‑sensitive tech and large‑cap quality continue to anchor the tape, while defensives and bond‑proxies lag. Sentiment sits in cautious “greed,” macro data are sparse, and traders are watching to see whether the classic “January effect” in small caps and cyclicals finally shows up as the market returns to full strength next week.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.