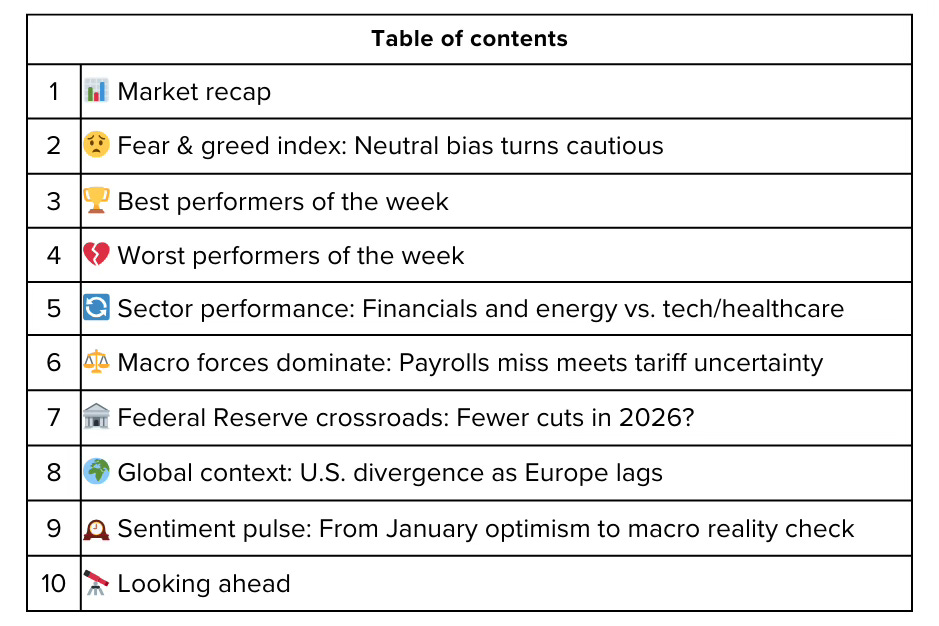

This week’s stock shocks as of 16th January, 2026.

Wall Street’s first full trading week of 2026 delivered the kind of reality check that often follows holiday optimism. What started as a continuation of December’s record-setting momentum ended in frustration as Friday’s disappointing jobs report, paired with hotter-than-expected wage growth, sparked a Treasury yield spike, dollar surge, and broad risk-off rotation. The S&P 500 [finance:S&P 500] posted a 0.3% weekly loss, the Nasdaq Composite [finance:Nasdaq Composite] fell 0.6%, and even the relatively resilient Dow Jones Industrial Average [finance:Dow Jones Industrial Average] slipped 0.1%.

The backdrop was messy: a Supreme Court ruling on President Trump’s tariff regime loomed over trade-exposed sectors, bank earnings showed pockets of strength but highlighted credit concerns, and the Fed’s path suddenly looked less certain. While indexes remain up modestly year-to-date and within striking distance of 2025 highs, the easy money from late last year is gone. Investors now face a market demanding proof that earnings growth, Fed easing, and policy tailwinds can overcome tightening financial conditions.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.