The Buffett indicator: Is the market about to crash?

Ever heard of a financial crystal ball that could predict market crashes? Well, the Buffett Indicator might just be the closest thing we've got. Named after the legendary investor Warren Buffett, this metric has been making waves in the investment world. But what exactly is it, and why are some investors sweating bullets over its current readings? Let's dive in and demystify this powerful tool!

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

What is the Buffett indicator? 🤔

Imagine you're trying to figure out if that fancy restaurant in town is overcharging for its food. You might compare the prices to the quality of ingredients they use. The Buffett Indicator does something similar for the entire stock market!

The Buffett Indicator, also known as the Market Cap-to-GDP ratio, compares the total value of all publicly traded stocks in a country (market capitalization) to its Gross Domestic Product (GDP). It's like asking, "Is the stock market's price tag too high compared to what the economy is actually producing?"

The formula

Here's how you calculate it:

Buffett Indicator = (Total Market Cap / GDP) x 100

For example, if the total market cap is $30 trillion and the GDP is $20 trillion, the Buffett Indicator would be:

(30 / 20) x 100 = 150%

Interpreting the results

Warren Buffett himself gave us some guidelines:

Below 90%: The market is undervalued. Time to go shopping for stocks!

90% - 115%: The market is fairly valued. Proceed with caution.

Above 115%: The market might be overvalued. Watch out for turbulence ahead!

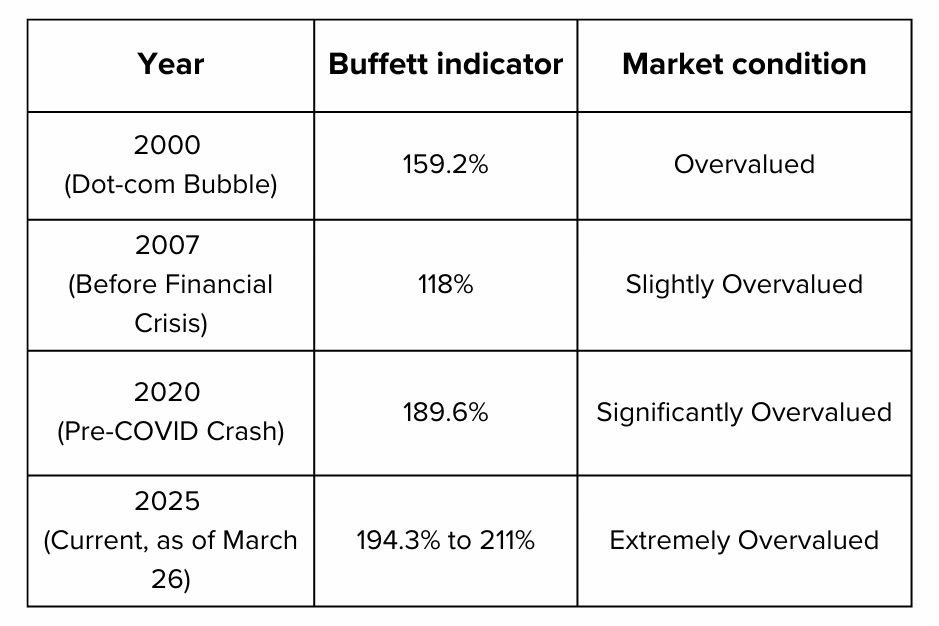

The current state of the Buffett indicator 😱

As of March 26, 2025, the Buffett Indicator, stands at a remarkable 194.3% to 211%. This surpasses previous highs, including those during the dot-com bubble and pre-financial crisis periods. Let's explore what this means for market valuations and potential future corrections.

This high ratio suggests that the US stock market is significantly overvalued relative to the GDP, which could indicate potential market risks or corrections in the future. However, it's important to consider other economic factors and not rely solely on this indicator for investment decisions.

Why is the Buffett indicator so high? 🚀

Several factors have contributed to this sky-high valuation:

Tech boom: The dominance of tech giants like Apple, Amazon, and Google has inflated market caps without necessarily boosting GDP at the same rate.

Low interest rates: Years of near-zero interest rates have pushed investors into stocks, driving up valuations.

Global revenue: Many US companies earn significant revenue overseas, which isn't reflected in US GDP.

Pandemic recovery: The stock market rebounded much faster from the COVID-19 crash than the overall economy.

Increased retail investing: The rise of commission-free trading apps has brought more retail investors into the market.

Is a crash inevitable? 🎢

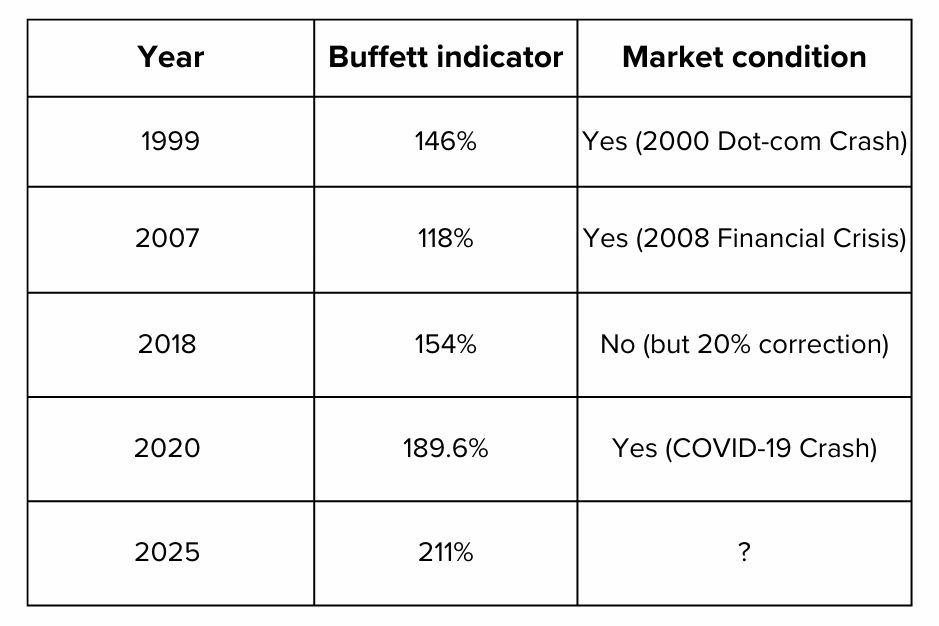

Here's where things get tricky. While the Buffett Indicator is flashing red, it's not a perfect predictor. Let's look at its track record:

As you can see, while high readings often precede significant market downturns, it's not a guarantee. The indicator has given false alarms before, and timing the market based on this metric alone could mean missing out on potential gains.

The case for caution: Why the bears might be right 🐻

Despite its limitations, there are compelling reasons to take the Buffett Indicator seriously:

Historical precedent: Every time the indicator has exceeded 100%, a market correction or crash has followed within a few years.

Reversion to the mean: Financial markets tend to return to their long-term averages over time. The current extreme deviation suggests a correction might be due.

Other warning signs: High inflation, geopolitical tensions, and potential interest rate hikes could all contribute to market instability.

Buffett's own actions: Warren Buffett's company, Berkshire Hathaway, has been holding record levels of cash, suggesting caution.

The bull's rebuttal: Why this time might be different 🐂

Before you panic-sell, consider these counterarguments:

Changed economic landscape: The digital economy might justify higher valuations as companies can scale rapidly with less capital.

Global markets: US companies are more global than ever, potentially justifying higher market caps relative to US GDP.

Low interest rates: If rates remain low, stocks might continue to be attractive compared to bonds.

Technological advancements: AI, blockchain, and other innovations could drive unprecedented economic growth, potentially "growing into" current valuations.

How to invest in a potentially overvalued market 🎯

So, what's an investor to do? Here are some strategies to consider:

Diversify globally: Look for opportunities in markets with lower Buffett Indicator readings.

Focus on value: Seek out companies trading below their intrinsic value, even in an overvalued market.

Dollar-cost averaging: Continue investing regularly to smooth out market volatility.

Defensive sectors: Consider shifting some investments to traditionally defensive sectors like utilities and consumer staples.

Build a cash reserve: Having some dry powder can help you capitalize on opportunities if a correction does occur.

Long-term perspective: Remember, timing the market is notoriously difficult. If you have a long investment horizon, short-term volatility matters less.

The bottom line: Caution, not panic 🏁

The Buffett Indicator is flashing warning signs, and it's certainly worth paying attention to. However, it's not a crystal ball, and basing your entire investment strategy on this single metric would be unwise.

Instead, use the Buffett Indicator as one tool in your investment toolkit. Combine it with other valuation metrics, economic indicators, and your own financial goals to make informed decisions. Remember, even Warren Buffett himself doesn't rely solely on this indicator!

Whether you're bullish or bearish, one thing's for sure: the financial markets are never boring. Stay informed, stay diversified, and most importantly, stay calm. After all, as another famous investor once said, "The stock market is a device for transferring money from the impatient to the patient.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: All content provided is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.