The 1,000+ new ETFs problem: How to filter gimmicky thematics from durable products

The ETF industry has hit a strange kind of abundance. Investors now face not a shortage of choice, but too much of it: more than a thousand new ETFs launched over a few short years, many of them with clever tickers, narrow narratives, and heavy marketing. The result is a real problem for serious investors—how to separate fleeting, gimmicky thematics from products that can actually serve a portfolio for a decade or more.

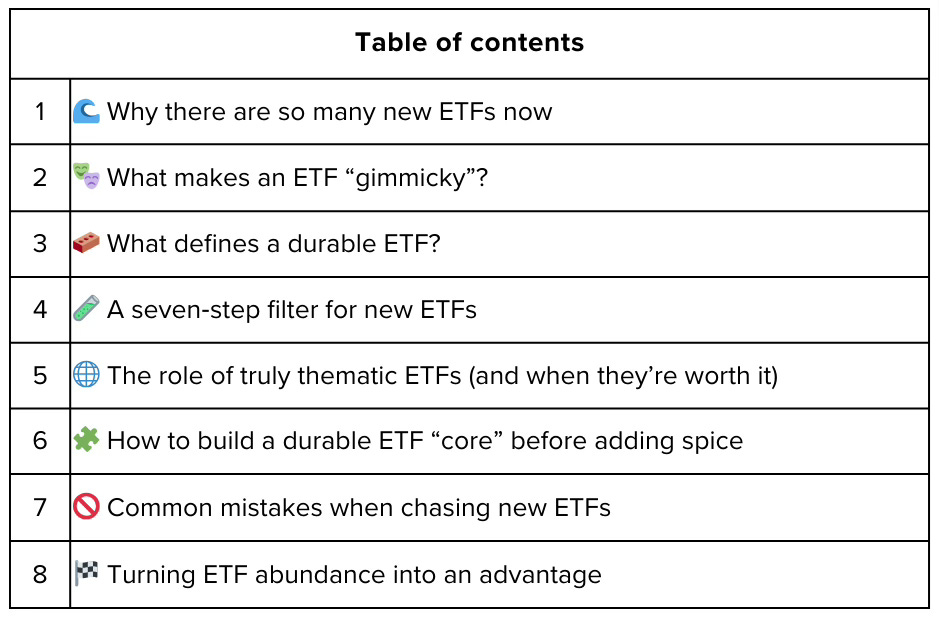

This article walks through why so many new ETFs exist, the tell‑tale signs of “product for product’s sake,” the characteristics of genuinely durable funds, and a practical framework for filtering the noise before you allocate a single rupee or dollar.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.