Tactical Asset Allocation (TAA): Balancing risk and reward in changing markets

In the ever-shifting world of investing, sticking to a single, unchanging strategy can leave your portfolio exposed to sudden market shocks and missed opportunities. Enter Tactical Asset Allocation (TAA)—a dynamic approach that empowers investors to adapt their portfolios in response to evolving market conditions. TAA isn’t about chasing fads or making wild bets; it’s about making informed, temporary shifts to balance risk and reward as the economic landscape changes. This comprehensive guide will demystify TAA, explain how it works, and show you how to use it to your advantage—whether you’re a seasoned investor or just starting out.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

What is Tactical Asset Allocation? 🔄

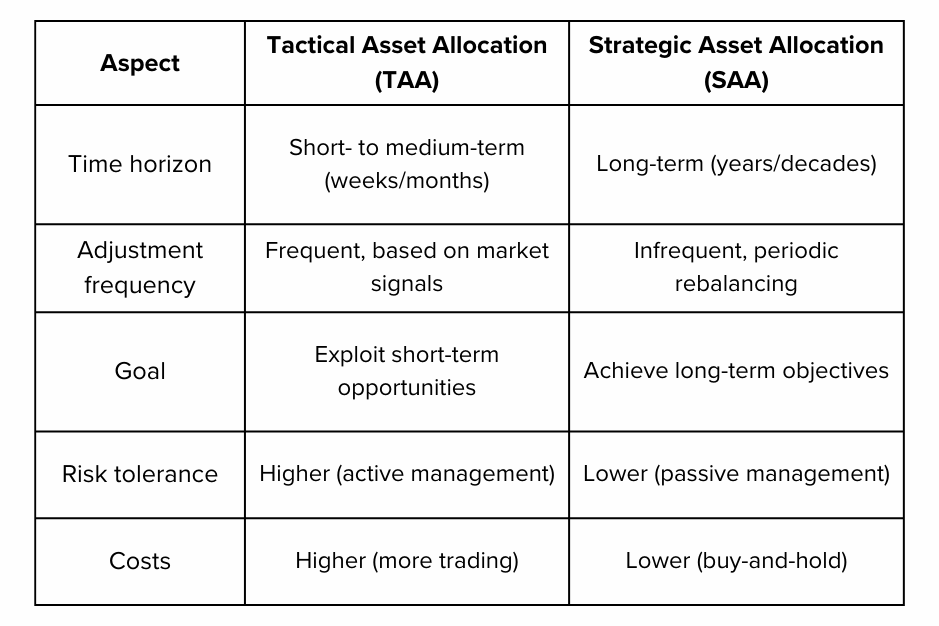

Tactical Asset Allocation is an active investment strategy that involves making short-term, deliberate changes to a portfolio’s asset mix to exploit market opportunities or manage risks. Unlike Strategic Asset Allocation (SAA), which sets a long-term target allocation and rarely deviates, TAA allows investors to temporarily “tilt” their portfolios toward or away from certain asset classes based on current market outlooks.

Key features of TAA:

Flexibility: Adjusts asset weights in response to economic, market, or geopolitical shifts.

Short- to medium-term focus: Changes typically last from a few weeks to several months.

Risk management: Aims to protect capital during downturns and seize opportunities during upswings.

For example, if economic data suggests a looming recession, a TAA strategy might reduce exposure to equities and increase holdings in bonds or cash to preserve capital.

TAA vs. Strategic Asset Allocation (SAA) ⚖️

Why combine both?

TAA can enhance returns and manage risk during volatile periods, while SAA keeps your portfolio anchored to your long-term financial goals. Many investors use a hybrid approach: SAA for the “core” and TAA for a “satellite” portion of their portfolio.

Why Tactical Asset Allocation matters in today’s markets 🌍

1. Adapting to economic shifts

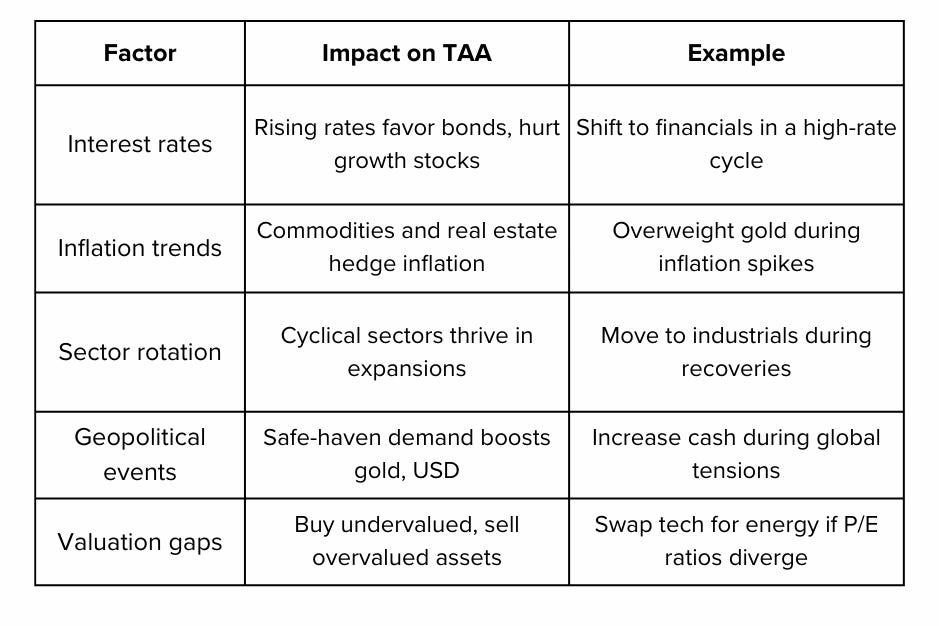

Markets are influenced by a constant stream of economic data—GDP, inflation, interest rates, and more. TAA lets you respond to these signals, reducing risk or boosting returns as conditions change. For instance, if inflation is rising, you might tilt toward commodities or inflation-protected bonds.

2. Mitigating downside risk

TAA can help shield your portfolio from sharp downturns. By reducing exposure to overvalued assets or sectors before a correction, you can limit losses and preserve capital.

3. Seizing short-term opportunities

Markets often overreact to news or events, creating temporary mispricings. TAA enables you to overweight undervalued assets and underweight overhyped ones, capturing gains that a static strategy would miss.

4. Responding to geopolitical and market events

Political crises, natural disasters, or regulatory changes can quickly alter market dynamics. TAA gives you the agility to pivot your allocations as needed, reducing exposure to riskier regions or sectors.

How Tactical Asset Allocation works: Step-by-step 🛠️

1. Analyze the market environment

Successful TAA starts with a thorough assessment of macroeconomic indicators, market valuations, and technical trends. Key data points include:

Economic growth (GDP)

Inflation and interest rates

Corporate earnings

Market sentiment and volatility (e.g., VIX)

Sector and regional trends

2. Identify tactical opportunities

Based on your analysis, determine which asset classes, sectors, or regions are likely to outperform or underperform in the near term. For example:

Overweight bonds if recession risk is rising.

Underweight tech stocks if valuations look stretched.

3. Adjust asset weights

Temporarily shift your allocations to reflect your outlook. This could mean:

Increasing cash holdings for safety.

Rotating into defensive sectors (like healthcare or utilities) during uncertainty.

Adding to commodities if inflation is heating up.

4. Execute trades efficiently

Use low-cost ETFs, index funds, or sector-specific funds to implement your changes. Minimize trading costs and taxes by making thoughtful, not impulsive, adjustments.

5. Monitor and rebalance

Regularly review your portfolio and market conditions. When the tactical opportunity fades or your thesis changes, revert to your strategic targets.

Key factors influencing TAA decisions 📉

Pro tip:

No single indicator should drive your decisions. Combine macro, fundamental, and technical analysis for a holistic view.

Implementing TAA: Practical strategies for investors 🎯

1. Core-satellite approach

Allocate most of your portfolio (e.g., 70–80%) to a diversified, long-term SAA “core.” Use the remaining 20–30% for tactical shifts based on market outlooks.

2. Quantitative models

Some investors use quantitative signals—momentum, moving averages, or valuation metrics—to guide tactical moves. For example, a momentum model might overweight sectors with recent strong performance.

3. Rule-based triggers

Set clear rules to avoid emotional decision-making. Examples:

Buy: When the S&P 500’s P/E falls below a set threshold.

Sell: When volatility spikes above a certain level.

4. Diversify tactical bets

Don’t put all your tactical eggs in one basket. Rotate between sectors, regions, or asset classes to spread risk.

5. Monitor costs and taxes

Frequent trading can erode returns through commissions, spreads, and taxes. Use tax-advantaged accounts or tax-loss harvesting to offset some of these costs.

Case studies: TAA in action 📚

Case 1: Navigating the 2025 tech rally

Scenario: AI breakthroughs send tech stocks soaring, pushing valuations 40% above historical averages.

TAA move: Reduce tech allocation from 25% to 15%, reallocating to undervalued industrials and cash.

Outcome: Avoided steep losses when the tech sector corrected, while industrials delivered steady gains.

Case 2: Hedging during the 2024 recession

Scenario: An inverted yield curve signals a looming recession.

TAA move: Shift from 50% equities to 30%, increase bonds to 60%, add 10% gold.

Outcome: Portfolio loss limited to 8% versus 22% for a static allocation, demonstrating TAA’s risk-mitigation power.

Case 3: Capitalizing on sector rotation

Scenario: Commodity prices surge as global demand rebounds.

TAA move: Overweight energy and materials, underweight consumer discretionary.

Outcome: Outperformed the market as energy and materials led gains.

Pros and cons of Tactical Asset Allocation 🎭

Advantages:

Potential for higher returns: Capture short-term opportunities missed by static strategies.

Risk reduction: Limit losses during downturns by shifting to safer assets.

Adaptability: Respond to new information, economic changes, or market shocks.

Challenges:

Higher costs: More trading means more fees and taxes.

Timing risk: Mistimed moves can hurt performance.

Complexity: Requires ongoing analysis and discipline.

Behavioral pitfalls: Emotional decisions or overconfidence can lead to poor outcomes.

Combining TAA with strategic allocation: The hybrid approach 🤝

Most investors benefit from blending SAA and TAA. Here’s how a hybrid portfolio might look:

Example:

During the 2025 energy crunch, the tactical portion shifted from tech to oil ETFs, boosting returns by 12% over the year while the core remained stable.

Best practices:

Limit tactical shifts to a manageable portion (e.g., 20% or less).

Rebalance regularly to avoid drifting too far from your long-term plan.

Document your TAA decisions and review outcomes to learn and improve.

Key takeaways and final thoughts 🚀

Tactical Asset Allocation is a powerful tool for navigating volatile markets, but it’s not a magic bullet.

Combine TAA with a solid strategic core for the best balance of stability and agility.

Stay disciplined: Use data, set rules, and avoid emotional decisions.

Monitor costs and rebalance regularly to keep your strategy on track.

Even small tactical shifts can make a difference—you don’t need to overhaul your entire portfolio to benefit.

“Tactical Asset Allocation is like adjusting your sails in a storm—you can’t control the wind, but you can set your course for smoother sailing.”

By mastering TAA, you’ll be better equipped to manage risk, seize opportunities, and keep your investment journey on track—no matter how choppy the markets get.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.