Sizing up success: The small-cap vs large-cap showdown

Ever wondered why some investors chase the next big thing while others stick to tried-and-true giants? It's not just about personal preference—it's a strategic decision that can make or break your investment portfolio. Welcome to the thrilling world of small-cap vs large-cap stocks, where David and Goliath battle it out in the financial arena. Buckle up, because we're about to embark on a journey through the risk-reward dynamics that shape these two distinct investment strategies.

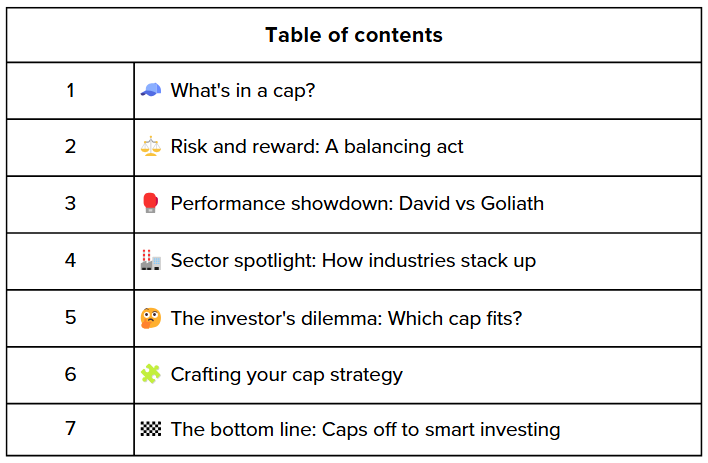

What's in a cap? 🧢

Before we dive into the nitty-gritty, let's clear up what we mean by 'cap'. No, we're not talking about headwear—we're referring to market capitalisation, the total value of a company's outstanding shares. It's like measuring the size of a fish in the vast ocean of the stock market.

Small-cap stocks: The minnows with bite

Small-cap stocks are typically companies with a market capitalisation between £300 million and £2 billion. These are the underdogs, the up-and-comers, the potential Davids ready to take on the Goliaths of the market. Think of them as the indie bands of the stock world—not yet mainstream, but with the potential to hit the big time.

Large-cap stocks: The whales of Wall Street

On the other end of the spectrum, we have large-cap stocks. These behemoths boast market caps of £10 billion or more. They're the household names, the industry leaders, the companies that probably made the device you're reading this on. Large-caps are like the headliners at a music festival—everyone knows their name, and they've got a massive following.

Risk and reward: A balancing act ⚖️

Investing is all about balancing risk and reward, like a tightrope walker at a circus. Small-cap and large-cap stocks each offer a unique risk-reward profile that can make your portfolio soar—or stumble.

Small-cap stocks: High risk, high reward

Investing in small-cap stocks is like backing a promising startup. The potential for growth is enormous, but so is the risk of failure. Here's why small-caps can be both thrilling and terrifying:

Growth potential: Small companies have more room to grow. A £1 billion company doubling in size is more feasible than a £100 billion giant doing the same.

Agility: Smaller firms can pivot quickly, adapting to market changes faster than their larger counterparts. It's like comparing a speedboat to an oil tanker—one can change direction on a dime, while the other needs miles to turn.

Undiscovered gems: Many small-caps fly under the radar of big institutional investors, creating opportunities for savvy individual investors to discover hidden value.

Volatility: Small-cap stocks can be as unpredictable as British weather. Their prices can soar on good news or plummet on bad, leading to a rollercoaster ride for investors.

Liquidity risk: With fewer shares traded daily, it can be harder to buy or sell small-cap stocks without affecting their price. It's like trying to sell a rare collectible—you might not always find a buyer when you need one.

Large-cap stocks: Steady as she goes

Investing in large-cap stocks is more like buying into an established business empire. The growth might be slower, but the ride is generally smoother. Here's what makes large-caps the comfort food of the investment world:

Stability: Large-caps are often industry leaders with proven business models. They're like the oak trees of the forest—deeply rooted and able to weather most storms.

Dividends: Many large-cap companies pay regular dividends, providing a steady income stream for investors. It's like owning a rental property that pays you every month.

Liquidity: With millions of shares traded daily, large-cap stocks are easy to buy and sell without affecting their price. It's like shopping at a supermarket—there's always stock on the shelves.

Analyst coverage: Large-caps are extensively researched by analysts, making information readily available. It's like having a team of detectives working round the clock to keep you informed.

Lower volatility: While not immune to market swings, large-caps tend to be less volatile than their smaller counterparts. They're the steady Eddie of the stock market.

Performance showdown: David vs Goliath 🥊

Now, let's pit our contenders against each other in a performance face-off. Imagine you had £1,000 to invest back in 2014. Where would you be now if you'd put it all in small-caps versus large-caps?

The journey of £1,000 over a decade

If you'd invested in a small-cap index fund, your £1,000 might have grown to around £2,500 by 2024. That's a respectable 150% return. Not too shabby, right?

On the other hand, if you'd put your money in a large-cap index fund, you might be looking at about £2,200. That's a 120% return—still impressive, but not quite as high as the small-cap performance.

But here's the kicker: look at the journey each took to get there. The small-cap line looks like a heart monitor during a horror film—lots of dramatic ups and downs. The large-cap line? It's more like a gentle hill climb, with a few bumps along the way.

Sector spotlight: How industries stack up 🏭

Different sectors tend to favour different cap sizes. Let's break it down:

Tech sector: Where small-caps dream big

The tech industry is a breeding ground for innovative small-caps. These companies often start with a groundbreaking idea and minimal capital, making them perfect small-cap candidates. Think of early-stage AI startups or niche software developers.

However, the tech sector also houses some of the largest large-caps in the world. Giants like Apple, with its staggering market cap of over £2 trillion, dominate the tech landscape. These behemoths often started as small-caps themselves, showcasing the growth potential in this sector.

Utility sector: Large-cap comfort zone

Utilities, with their stable cash flows and heavy regulation, tend to be large-cap territory. These companies require massive infrastructure investments, creating high barriers to entry for smaller players.

For instance, National Grid, a key player in the UK's energy infrastructure, boasts a market cap of over £30 billion. Small-cap utilities are rare birds indeed in this sector.

Retail sector: A mixed bag

Retail offers a fascinating mix of both small and large-caps. On the small-cap side, you might find speciality retailers or emerging e-commerce platforms. These companies can grow rapidly if they hit the right market niche.

On the large-cap end, we have titans like Tesco, with a market cap around £20 billion. These retail giants benefit from economies of scale and extensive distribution networks, but they also face challenges from nimble small-cap disruptors.

The investor's dilemma: Which cap fits? 🤔

Choosing between small-cap and large-cap stocks isn't about picking a winner—it's about finding the right fit for your investment strategy. Here's how to approach this dilemma:

Why choose small-caps?

You're after high growth potential and are willing to stomach higher risk.

You believe in the power of innovation and want to invest in tomorrow's leaders.

You have a long investment horizon and can ride out short-term volatility.

You enjoy researching lesser-known companies and potentially finding hidden gems.

Why choose large-caps?

You value stability and steady growth over explosive potential.

You're looking for regular income through dividends.

You prefer investing in established brands and market leaders.

You want easier access to company information and extensive analyst coverage.

Crafting your cap strategy 🧩

The savvy investor knows that it's not about choosing one or the other—it's about finding the right balance. Here's how to craft a cap strategy that fits like a glove:

Know your risk tolerance: Are you the type who thrives on excitement, or do you prefer a good night's sleep? Your risk tolerance should guide your cap allocation.

Consider your investment timeline: Small-caps might be better suited for long-term goals, while large-caps could be ideal for shorter-term objectives.

Diversify across caps: Don't put all your eggs in one cap basket. A mix of small, mid, and large-caps can provide a well-rounded portfolio.

Stay informed: Keep an eye on market trends. Sometimes small-caps outperform, other times large-caps take the lead. Being informed helps you adjust your strategy accordingly.

Rebalance regularly: As your small-caps grow (or shrink), your portfolio allocation will change. Regular rebalancing keeps your risk level in check.

The bottom line: Caps off to smart investing 🏁

In the end, the small-cap vs large-cap debate isn't about crowning a champion—it's about understanding the unique strengths and weaknesses of each. Small-caps offer the thrill of potential high growth, while large-caps provide the comfort of stability and established success.

Your ideal strategy might involve a bit of both—perhaps a core of steady large-caps for stability, with a sprinkling of small-caps for that growth kick. It's like crafting the perfect meal—you need both your meat and potatoes (large-caps) and your spicy seasonings (small-caps) to create a satisfying investment feast.

Remember, in the world of investing, one size doesn't fit all. Whether you're team David or team Goliath, the key is to build a portfolio that aligns with your goals, risk tolerance, and investment style. So go ahead, put your thinking cap on, and start crafting your perfect cap strategy. Your future self will thank you for it!

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.