Real Estate and energy: Where the value screens flash green in December

Every market cycle eventually comes back to the same question: where is real value hiding? As 2025 moves into its final stretch, many screens are starting to point in the same direction—toward two of the most cyclical and often overlooked corners of the market: real estate and energy. After a bruising period of rate volatility, policy uncertainty, and style rotations, December is shaping up as a moment when these sectors start to look interesting again for value‑oriented investors and asset allocators.

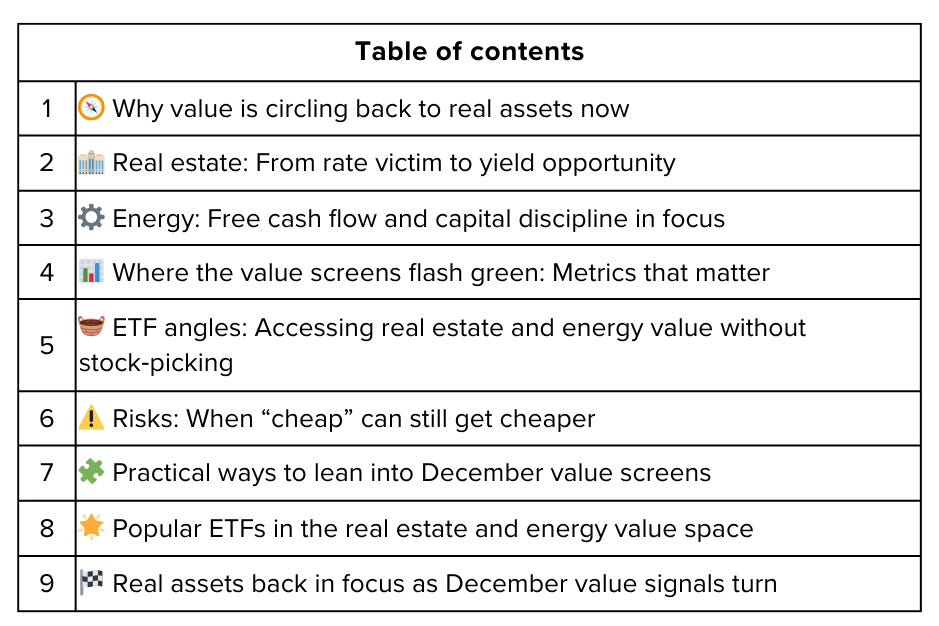

This article walks through why real estate and energy are back on value radars, what’s changed in the macro backdrop, how to think about fundamentals vs. sentiment, and how ETFs and factor screens can be used to separate genuine opportunity from value traps.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.