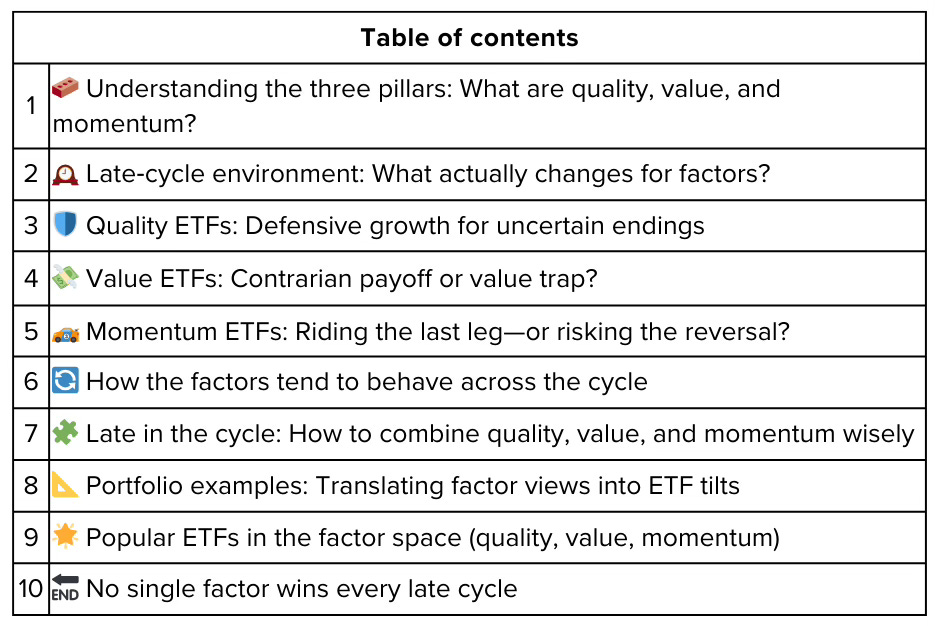

Quality, value, and momentum ETFs: Which factor makes sense late in the cycle?

Every cycle eventually reaches the same question: what should you own when the easy gains are behind you, earnings are decelerating, and macro uncertainty is high? Factor investing—tilting toward systematic styles like quality, value, and momentum via ETFs—offers a structured way to answer that question. But late in the cycle, not all factors behave the same way.

This article looks at how quality, value, and momentum typically behave late in an economic and market cycle, what that means for ETFs built around those factors, and how investors can think about combining them rather than betting on a single “winner.”

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.