Private market and alternative asset ETFs: Democratizing alternatives

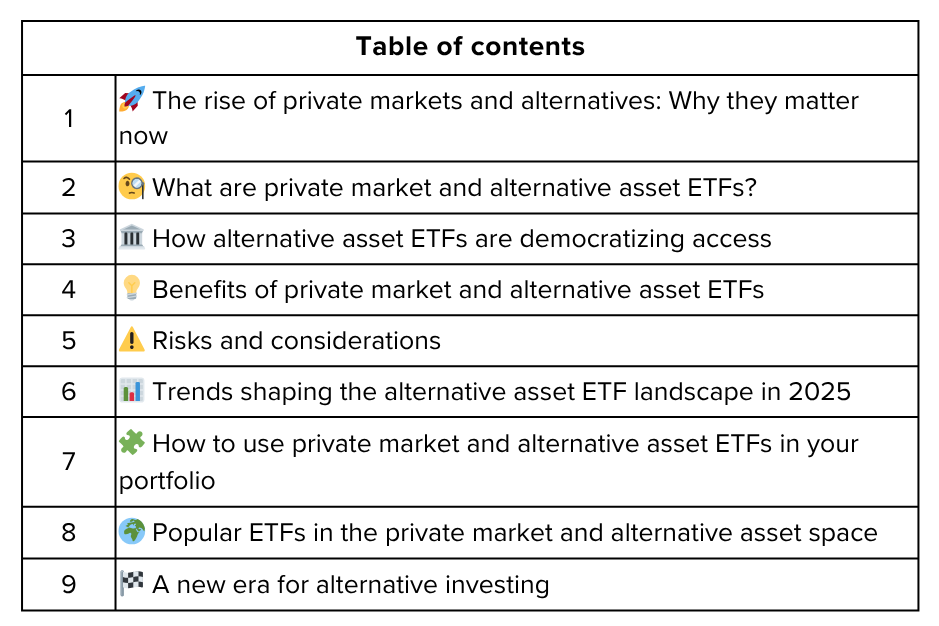

The financial world in 2025 is undergoing a remarkable transformation. Once reserved for institutional investors and the ultra-wealthy, private markets and alternative assets are now finding their way into the portfolios of everyday investors, thanks to innovative ETFs. Private Market and Alternative Asset ETFs are tearing down traditional barriers, offering a new avenue for diversification, growth, and risk management. In this article, we explore how these funds are democratizing access to a previously exclusive asset class, why interest is surging, how they work, and what investors need to know to make the most of the alternative revolution.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.