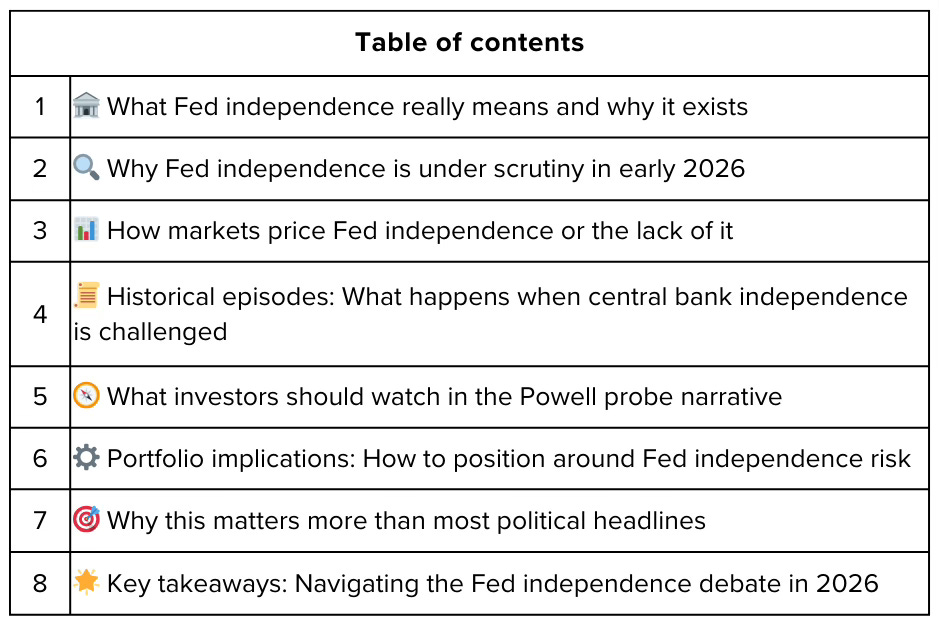

Powell probe 101: Why Fed independence suddenly matters for your portfolio

In early 2026, the phrase “Fed independence” has moved from academic papers and op-eds straight into portfolio strategy discussions. Political pressure on Federal Reserve Chair Jerome Powell and questions about the central bank’s autonomy are no longer abstract debates,they’re live risks that can swing bond yields, currency values, inflation expectations, and equity multiples in real time.

For investors, this isn’t just a civics lesson. The degree to which markets believe the Fed can set policy free from political interference directly affects how they price everything from Treasury bonds to tech stocks. This guide breaks down what Fed independence actually means, why it’s under scrutiny now, how past episodes played out, and what you should watch as this story unfolds through 2026.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

What Fed independence really means and why it exists 🏦

The Federal Reserve was designed as an independent central bank, meaning:

It sets monetary policy (interest rates, balance sheet operations) based on its dual mandate: maximum employment and stable prices.

It does not take direct orders from the President, Congress, or any political party.

Fed officials serve fixed terms; the Chair serves four-year terms and can only be removed “for cause,” not policy disagreement.

The logic behind independence:

Short-term political incentives often favor easy money (lower rates, more stimulus) to boost growth before elections.

But that can create inflation, bubbles, and long-term instability.

An independent Fed can make unpopular but necessary decisions,like raising rates to cool inflation,without fear of immediate political retaliation.

History shows that countries with truly independent central banks tend to have:

Lower and more stable inflation over time.

More credible monetary policy.

Better long-term economic outcomes.

When that independence is questioned or undermined, markets react,because credibility is the foundation of how central banks anchor expectations.

Why Fed independence is under scrutiny in early 2026 🔍

Several factors have brought Fed independence to the forefront:

Political commentary and pressure

Public statements from political figures questioning Powell’s decisions or suggesting policy should align more closely with executive priorities.

Debate over whether the Fed should cut rates faster to support growth, or hold firm to ensure inflation stays contained.

Reappointment and term politics

Powell’s current term as Chair runs through May 2026, with his Board term extending to 2028.

Speculation about whether he’ll be reappointed or replaced has created uncertainty.

Markets know that leadership transitions can shift policy tone, especially if a new Chair is perceived as more politically aligned.

Inflation vs. growth tension

With inflation still above target in some measures but growth moderating, the Fed faces difficult tradeoffs.

Political voices argue for different priorities: some want faster cuts to avoid recession; others want tighter policy to crush inflation fully.

When those voices get louder, markets start pricing in “policy uncertainty risk.”

Historical context

Previous episodes (Nixon pressuring Arthur Burns in the 1970s, Trump’s public criticism of Powell in 2018–2019) showed how political interference can distort policy and market expectations.

The current environment feels like a potential replay of those dynamics, raising alarms among institutional investors and policy watchers.

How markets price Fed independence or the lack of it 📊

Markets don’t have a “Fed independence meter,” but they express views through several channels:

1. Inflation expectations and breakevens

When the Fed is seen as independent and credible:

Long-term inflation expectations (measured by TIPS breakevens or surveys) remain anchored near the Fed’s 2% target.

Even if near-term inflation fluctuates, markets trust the Fed will act to bring it back down.

When independence is questioned:

Long-term expectations can drift higher.

Markets worry the Fed might cave to political pressure for easier policy, letting inflation run.

That can push nominal bond yields higher (more inflation risk premium) and steepen the curve in uncomfortable ways.

2. Bond yields and the term premium

Independent central banks enjoy lower “term premiums”,the extra yield investors demand for holding long-term bonds.

If markets doubt the Fed’s ability to act independently:

Term premium rises.

Long-term yields climb even if short-term rates are stable.

This can hurt long-duration assets: growth stocks, REITs, utilities.

3. Currency markets

The dollar’s reserve currency status relies partly on confidence in U.S. institutions, including the Fed.

Questions about Fed independence can:

Weaken the dollar as foreign investors price in higher political risk.

Or strengthen it if markets see independence as ensuring tighter policy and lower long-run inflation.

Direction depends on the specific narrative: is pressure toward easier or tighter policy?

4. Equity valuations and sector rotation

Growth stocks (tech, high-multiple compounders):

Benefit from low, stable real rates that depend on Fed credibility.

If credibility erodes and inflation expectations rise, real rates can jump, pressuring valuations.

Financials and cyclicals:

Can benefit from higher nominal rates in the near term but suffer if uncertainty about policy creates volatility and chokes credit.

Defensives and inflation hedges (staples, energy, materials, gold):

Often outperform when Fed credibility is in doubt and inflation expectations drift higher.

In short: Fed independence affects the discount rate, the inflation forecast, and the policy path,three of the most important inputs to every asset class.

Historical episodes: What happens when central bank independence is challenged 📜

1. The 1970s: Nixon, Burns, and runaway inflation

President Nixon famously pressured Fed Chair Arthur Burns to keep rates low ahead of the 1972 election. Burns complied, and inflation spiraled into double digits by the late 1970s. It took Paul Volcker’s painful rate hikes in the early 1980s,and a deep recession,to restore credibility.

Lesson: Political interference can delay necessary policy tightening, leading to worse outcomes later.

2. Trump vs. Powell (2018–2019)

President Trump publicly criticized Powell for raising rates, calling the Fed “crazy” and suggesting he might remove him. Markets initially wobbled, but Powell stayed the course. Eventually, the Fed did cut rates in 2019,but based on economic data, not political pressure.

Market impact:

Short-term volatility as markets priced in uncertainty.

Dollar and bond yields fluctuated with each new tweet.

Ultimately, Powell’s credibility held because he acted on data, not rhetoric.

3. Emerging market parallels

Countries like Turkey and Argentina have seen their central banks lose independence, leading to:

Currency collapses.

Inflation spirals.

Capital flight.

While the U.S. is far from that scenario, the direction of travel matters: even small erosions in perceived independence can reprice risk premiums.

What investors should watch in the Powell probe narrative 🧭

As the story evolves through 2026, here are the key variables to monitor:

1. Reappointment or replacement signals

If Powell is reappointed or clearly supported, markets likely price in continuity and credibility.

If a replacement is floated who is seen as more politically aligned, expect:

Volatility in rates and inflation expectations.

Possible dollar weakness.

Reassessment of the Fed’s policy path.

2. Public commentary from political figures

Frequency and intensity of statements pressuring the Fed.

Whether Powell or other Fed officials push back publicly (historically, they avoid direct confrontation but may make speeches emphasizing independence).

3. Policy decisions vs. political preferences

If the Fed cuts rates when inflation is still elevated and political pressure is high, markets may interpret it as capitulation.

If the Fed holds rates despite political pushback, credibility is reinforced.

4. Market-based credibility indicators

Watch:

Long-term TIPS breakevens (5-year and 10-year).

Term premium models (e.g., New York Fed’s ACM model).

Dollar index moves and FX risk reversals.

Volatility in bond and equity options (VIX, MOVE index).

5. International reaction

Foreign central banks and sovereign wealth funds hold large amounts of U.S. Treasuries.

If they express concern or adjust allocations, that’s a signal that global confidence in Fed independence is wavering.

Portfolio implications: How to position around Fed independence risk ⚙️

Depending on your view of how this plays out, here are strategic tilts:

If you believe Fed independence will hold:

Maintain exposure to long-duration growth equities.

Hold intermediate-to-long duration Treasuries; credibility keeps term premiums low.

Favor quality over inflation hedges; stable policy supports stable multiples.

If you’re worried independence is eroding:

Shorten duration in bonds; rising term premiums hurt long-end prices.

Add inflation hedges:

Gold, commodities, TIPS.

Energy and materials with pricing power.

Tilt toward value and cyclicals that can handle nominal growth even with higher inflation.

Consider hedging dollar exposure if you think credibility loss weakens the currency.

If uncertainty is high and you’re unsure:

Diversify across factors and geographies.

Use options or structured products to hedge tail risks (sharp moves in rates or inflation).

Keep liquidity to pivot as clarity emerges.

Why this matters more than most political headlines 🎯

Political noise is constant, but Fed independence is different because:

It directly affects the discount rate, inflation expectations, and risk premia across every asset class.

Loss of credibility can create self-fulfilling dynamics: if markets expect the Fed to cave to political pressure, inflation expectations rise, forcing the Fed to tighten more aggressively later,or lose control entirely.

It’s not just a U.S. story: global capital markets watch the Fed’s credibility as a benchmark for institutional quality worldwide.

In other words: this isn’t just a “political risk to monitor”,it’s a fundamental input to valuations and expected returns.

Key takeaways: Navigating the Fed independence debate in 2026 🌟

Fed independence is the bedrock of credible monetary policy. When it’s questioned, markets reprice inflation risk, term premiums, currency stability, and equity valuations.

Early 2026 has brought this issue to the forefront due to political commentary, Powell’s term dynamics, and the Fed’s difficult inflation-vs-growth tradeoffs.

Markets express views through inflation expectations, bond yields, the dollar, and sector rotations,not through editorials. Watch those signals, not just headlines.

History shows that erosion of independence leads to worse outcomes: higher inflation, more volatility, and eventually painful policy corrections.

Portfolio strategy should adapt based on your assessment of Fed credibility. Shortening duration, adding inflation hedges, and tilting toward value/cyclicals can make sense if you expect credibility to weaken.

This is a slow-moving but high-stakes story. Small changes in perceived independence can have outsized effects on long-term expected returns across all assets.

As this narrative unfolds through 2026, the smartest investors won’t just track political headlines,they’ll watch what markets do in response. Because at the end of the day, the price of Fed independence (or its erosion) is written in bond yields, breakevens, and equity multiples long before it shows up in the history books.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.