Overvalued defensives vs Cheap cyclicals: What December’s valuation map says about 2026 returns

As 2025 winds down, one message keeps popping up in strategy decks and sector notes: defensives look expensive, cyclicals look cheap. After nearly two years of investors hiding in “safety” trades—staples, healthcare, utilities, big quality—valuations there have quietly drifted to the top end of their historical ranges. At the same time, economically sensitive sectors like industrials, financials, materials, energy, and small caps have been left behind by the narrow AI / mega‑cap rally, even though recession has kept refusing to show up.

The question for 2026 is straightforward but critical: is this justifiable “quality at any price,” or has the market overpaid for safety and underpriced cyclicals right as the growth and rate regime shifts? This article breaks down where valuations actually sit into year‑end, what past cycles say about forward returns from similar setups, and how to think about sector and style tilts going into 2026.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

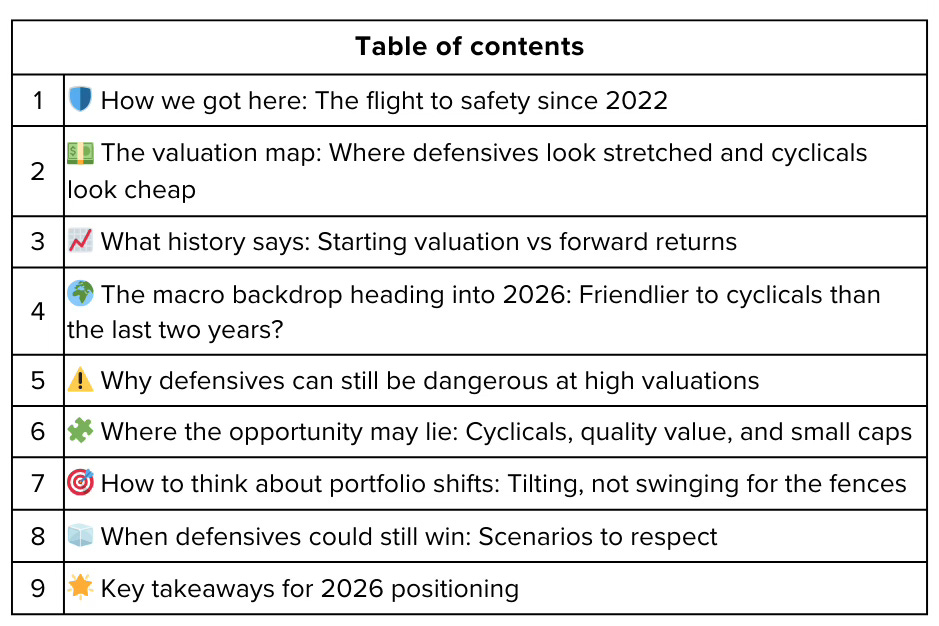

How we got here: The flight to safety since 2022 🛡️

The current valuation map is the product of three overlapping stories:

Inflation and rate shock (2022–2023): Higher yields crushed long‑duration growth and anything tied closely to credit, while investors rotated into stable cash flows and low‑vol names.

Recession scare that never quite landed (2023–2024): Every soft data wobble pushed more capital into perceived defensives, even as earnings for those sectors didn’t grow dramatically.

Narrow leadership (2023–2025): Mega‑cap tech and quasi‑defensives (staples, healthcare majors) dominated index returns while the median stock significantly lagged.

The result is a market where:

Classic defensives trade at rich multiples versus both their own history and the broader market.

Many cyclicals and small/mid‑caps trade at deep discounts despite balance sheets and earnings that look nothing like 2008.

This is exactly the kind of setup that often precedes multi‑year mean reversion in sector leadership.

The valuation map: Where defensives look stretched and cyclicals look cheap 💵

While exact numbers vary by index provider and methodology, the relative picture in December looks roughly like this (versus long‑term averages):

Staples and healthcare:

Forward P/E at or above long‑term averages, sometimes close to “growth” multiples despite slower expected EPS growth.

Price‑to‑cash‑flow multiples at the high end of their 10–15 year bands.

Utilities:

Still framed as “defensive income,” but competing with cash and short‑term bonds now paying real yields.

Valuations not obviously distressed despite regulatory and rate overhangs.

Quality / low‑vol factor baskets:

Trading at notable premia to the broad market; flows have piled in as “bond substitutes.”

On the cyclicals side:

Financials:

Many large banks on single‑digit or low‑teens forward P/Es, below long‑term averages.

Capital ratios and liquidity materially stronger than the pre‑GFC era.

Industrials and materials:

Valuations near or slightly below historical averages despite:

Ongoing reshoring / capex / infrastructure themes.

Solid balance sheets at many diversified industrials.

Energy:

Low earnings multiples and high free‑cash‑flow yields, even after a multi‑year run, reflecting skepticism about long‑term demand and policy risk.

Small caps:

Index‑level discounts vs large caps at or near extremes of the past few decades.

Hidden within are both genuine bargains and a lot of low‑quality names.

In simple terms: the market is paying up for stability and visibility, and demanding a large discount for anything that depends on the economic cycle, regulation, or capital markets.

What history says: Starting valuation vs forward returns 📈

Looking back across multiple cycles, two patterns are especially relevant when defensives are expensive and cyclicals are cheap:

Expensive defensives tend to underperform once:

Recession risk stabilizes or recedes.

The market begins to price in sustained (even if modest) real growth and easier policy.

Bond yields stop rising and the “bond proxy” narrative loses urgency.

In past episodes, starting from stretched multiples, forward 3–5 year returns for defensives have often been:

Lower than the market.

Driven mostly by dividends and modest EPS growth rather than multiple expansion.

Cheap cyclicals and small caps tend to outperform when:

The rate cycle turns from hiking to cutting or “on hold.”

Earnings revisions for cyclicals inflect from negative to positive.

The breadth of the market improves and leadership broadens beyond a handful of mega‑caps.

Historically, the best entry points into cyclicals have been when:

Valuations are depressed.

Macro data is weak but no longer deteriorating rapidly.

Policy shifts from “tightening” to “data‑dependent / easing bias.”

December 2025 checks many of those boxes: valuations diverged, macro soft but not collapsing, and central banks closer to the end of their tightening paths than the beginning.

The macro backdrop heading into 2026: Friendlier to cyclicals than the last two years? 🌍

Several macro pillars support an eventual rotation away from pricey defensives into cyclicals and smaller/value names:

Rates near peak:

Policy rates have likely peaked, with markets pricing a gradual easing path rather than further aggressive hikes.

This reduces pressure on balance sheets and boosts the relative appeal of cyclicals and smaller caps that rely more on credit.

Inflation down from the highs, but not back to “pre‑COVID zero”:

Moderate, positive nominal growth tends to favor real‑asset and cyclical exposures over pure bond proxies.

Manufacturing and global trade:

Data still weak but showing signs of bottoming rather than new free‑fall.

Ongoing themes in reshoring, infrastructure, energy transition, and digital/AI capex continue to support selected industrials and materials.

Consumer and services:

Labor markets have cooled from peak tightness but remain far from a deep recession profile.

Real incomes have improved as inflation moderated, supporting selective consumer cyclicals.

None of this guarantees a roaring cyclical bull market, but it does mean the environment is no longer obviously stacked in favor of hiding in defensives at any price.

Why defensives can still be dangerous at high valuations ⚠️

“Defensive” describes the business profile, not the stock behavior at any valuation. When you overpay for stability, two risks emerge:

Duration risk in disguise

Many defensives have long‑duration cash flow profiles.

When yields move higher or real rates stay positive, the valuation of those long‑duration streams can compress—just as with growth stocks.

If bond yields drift up again (for example, on better growth or renewed supply fears), expensive defensives can derate.

Crowding and positioning risk

After years of inflows, defensives are heavily owned by risk‑averse investors and multi‑asset funds.

If the narrative shifts to “growth is okay, cuts are coming,” those positions can become a source of funds:

People sell what they’re overweight and where they still have gains.

Money rotates into under‑owned cyclicals or smaller caps.

Earnings reality

EPS growth in staples, utilities, and mature healthcare is often mid‑single‑digit at best.

Paying growth‑like multiples for low‑growth businesses compresses future return potential unless something structural changes.

In short: defensives still have a role, especially if the macro picture worsens. But from current valuations, they are unlikely to deliver outsized returns unless we get a sharper‑than‑expected downturn.

Where the opportunity may lie: Cyclicals, quality value, and small caps 🧩

Given this setup, 2026’s return profile is more likely to favor:

Quality cyclicals

Industrials with:

Strong balance sheets

High return on invested capital

Exposure to structural themes (automation, infrastructure, energy transition, defense, reshoring)

Materials and energy with:

Disciplined capital allocation

Solid free‑cash‑flow yields

Ability to return cash via dividends and buybacks

Financials

Large, well‑capitalized banks and insurers that:

Benefit from a steeper yield curve once cuts begin at the front‑end.

Have already taken a lot of the valuation pain.

Avoiding the most rate‑sensitive or structurally challenged niches (e.g., weak regional lenders without deposit franchises) remains key.

Small and mid caps with quality screens

Rather than buying the entire small‑cap bucket:

Focus on profitability, free cash flow, and manageable leverage.

Use smart‑beta or active strategies that exclude “zombie” companies.

These names tend to respond strongly once:

The policy pivot is clear.

Earnings revisions turn positive.

Cyclical growth and “industrial tech”

Companies at the intersection of tech and the real economy:

Automation, robotics, industrial software, infrastructure‑adjacent semis.

These can offer growth at a discount to mega‑cap AI valuations, with direct exposure to capex cycles.

How to think about portfolio shifts: Tilting, not swinging for the fences 🎯

Given genuine macro uncertainty, the case is not for an all‑or‑nothing rotation, but for tilts:

Gradually relax extreme overweight in defensives:

Trim positions where multiples are clearly stretched relative to history and to their own growth outlook.

Keep a core exposure for downside protection, but don’t rely on them as return engines.

Add selective cyclical and value exposure:

Rotate into quality names within financials, industrials, materials, and energy rather than buying cyclical beta indiscriminately.

Consider balancing high‑multiple mega‑cap tech with reasonably priced “old economy” winners that benefit from the same structural themes.

Reintroduce small/mid caps:

Particularly domestically focused companies that gain more from easier credit and resilient local demand.

Use factors like quality, profitability, and low leverage to avoid value traps.

Risk management points:

Time horizon:

The 2026 story is more about 2–3 year mean reversion than a quick Q1 trade.

Correlation:

Balance cyclical bets across geographies and sectors to avoid concentrated macro risk (e.g., all in on one industry theme).

Liquidity:

Be mindful of liquidity when rotating into smaller names; use diversified vehicles where appropriate.

When defensives could still win: Scenarios to respect 🧊

There are plausible paths where expensive defensives keep outperforming:

Hard landing:

If growth rolls over sharply, earnings for cyclicals would get cut more aggressively.

Defensives could still outperform on a relative basis, even from high valuations.

Stagflation:

If inflation re‑accelerates while growth disappoints, both bonds and cyclicals could suffer.

Certain defensives with pricing power and stable demand could hold up better.

Policy error:

If central banks stay tight for too long or tightening in credit markets gets disorderly, markets might double down on safety and liquidity.

That’s why the answer is not “sell all defensives, buy only cyclicals.” It’s about probability‑weighting: from today’s valuation map, the balance of expected return over a 3‑year window increasingly favors adding risk to reasonably priced cyclicals and quality value, while being more selective about what “defensive” you are paying up for.

Key takeaways for 2026 positioning 🌟

The December valuation map is clear: many defensives are priced for perfection, while a broad swath of cyclicals and small/mid‑caps trade at meaningful discounts.

History suggests that starting from this kind of dispersion, forward 3–5 year returns tend to favor cheap cyclicals and quality value—provided the economy avoids a deep, prolonged recession.

The macro backdrop going into 2026 (rates near peak, moderating inflation, slow but positive growth) is more supportive for a gradual rotation than the last two years have been.

Defensives still matter as portfolio shock absorbers, but from current valuation levels they are unlikely to be the primary drivers of outperformance unless we get a much worse downturn than currently priced.

Smart implementation—quality screens, balance‑sheet discipline, avoiding value traps—is crucial. Cheap is not automatically good, and “defensive” is not automatically safe at any price.

If 2022–2024 was the era of “pay anything for safety and mega‑cap stories,” 2026 increasingly looks like the kind of environment where patient, selective exposure to under‑owned cyclicals and quality value can quietly compound while the crowd debates whether it’s “too early” to rotate.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.