Operating margin vs. Net margin: Which metric matters most?

When you peek into a company’s financial health, profit margins are like the heartbeat—telling you how well the business is performing. Among the many metrics, Operating Margin and Net Margin often take center stage. But which one really matters? Should investors, business owners, and analysts focus more on operating margin or net margin? This article breaks down these two key profitability metrics, explains their differences, and guides you on when and why each matters most.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

Understanding profit margins: The basics 💡

Before diving into operating and net margins, it helps to understand what profit margins are. Simply put, a profit margin measures how much profit a company makes for every dollar of revenue. It’s expressed as a percentage and offers insight into efficiency, cost control, and overall profitability.

There are several types of profit margins, but the most relevant here are:

Operating margin: Profit from core business operations, before interest and taxes.

Net margin: The bottom-line profit after all expenses, including interest and taxes.

Both ratios are calculated by dividing a specific profit figure by total revenue:

What is operating margin? ⚙️

Operating margin measures the percentage of revenue left after covering all operating expenses but before paying interest and taxes. It focuses on the profitability of a company’s core business activities.

How to calculate operating margin:

Operating Income (EBIT) = Revenue – Cost of Goods Sold (COGS) – Operating Expenses (like salaries, rent, marketing)

Excludes interest and taxes.

What does operating margin tell you?

How efficiently a company runs its core business.

How well it controls production and operating costs.

The profitability of ongoing operations without the noise of financing and tax strategies.

Example:

If a company has $500,000 in operating income on $2,000,000 revenue, its operating margin is:

Meaning it keeps 25 cents from every dollar of sales after operating costs.

Why investors care about operating margin

It isolates operational efficiency.

Helps compare companies within the same industry.

Useful for spotting operational strengths or weaknesses.

What is net margin? 💰

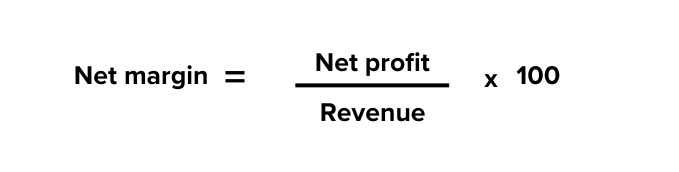

Net margin, often called net profit margin or “the bottom line,” measures the percentage of revenue left after all expenses—including operating costs, interest, taxes, and one-time items.

How to calculate net margin:

Net Profit = Operating Income – Interest Expenses – Taxes – Other non-operating expenses/income.

What does net margin tell you?

The company’s overall profitability.

How well it manages all costs, including financing and tax strategies.

The final profit available to shareholders.

Example:

If the same company has a net profit of $300,000 on $2,000,000 revenue, net margin is

It keeps 15 cents of every sales dollar after all expenses.

Why net margin matters

Reflects true profitability after all costs.

Helps investors understand the impact of debt and taxes.

Useful for comparing companies with different capital structures or tax situations.

Operating margin vs. Net margin: Key differences 🔍

When should you focus on operating margin? 🕵️♂️

Operating margin shines when you want to:

Evaluate core business efficiency: It shows how well a company turns sales into profit before financing and taxes.

Compare companies in the same industry: Since it excludes interest and taxes, it’s a cleaner comparison of operational performance.

Analyze management effectiveness: Operating margin reflects cost control and pricing strategies.

Ignore capital structure effects: If you want to see how the business itself is doing without the influence of debt or tax strategies.

Example:

A steel manufacturing company with heavy debt might have a lower net margin due to interest expenses, but a strong operating margin indicating efficient operations.

When does net margin take the spotlight? 🌟

Net margin is crucial when you want to:

Understand overall profitability: It factors in every cost, showing what shareholders actually earn.

Assess impact of financing: Companies with high debt will have lower net margins due to interest expenses.

Evaluate tax efficiency: Tax strategies and rates affect net margin.

Compare companies with different capital structures: Net margin reveals the true “bottom line” differences.

Example:

Two companies with similar operating margins but one with higher debt will have different net margins, reflecting financial risk and tax impact.

Real-world examples: Operating vs. Net margin in action 📈

Example 1: Tech company with low debt

Operating margin: 30%

Net margin: 28%

The small difference indicates low interest and tax expenses. The company is operationally efficient and financially stable.

Example 2: Retailer with high debt

Operating margin: 15%

Net margin: 5%

A big drop from operating to net margin shows heavy interest payments, reducing overall profitability despite decent operations.

Example 3: Manufacturing firm with tax benefits

Operating margin: 20%

Net margin: 18%

The small difference suggests effective tax planning, keeping more profit for shareholders.

How to use both metrics together for smarter decisions 🤝

Neither operating margin nor net margin alone tells the whole story. Together, they provide a fuller picture:

Operating margin reveals operational strengths and weaknesses.

Net margin shows the final profit after financing and tax effects.

By comparing the two, you can:

Identify if low net margin is due to operational inefficiency or financial structure.

Spot companies with strong operations but heavy debt risk.

Evaluate whether tax strategies are positively impacting profitability.

Industry differences: Margin benchmarks matter 🏭

Profit margins vary widely by industry:

Tech and software firms:

Tech companies enjoy high margins due to low COGS and scalable business models, allowing significant profitability with minimal cost increase.

Retailers:

Retailers face lower margins due to high operating costs and competition but can achieve large profits through high sales volumes.

Manufacturers:

Manufacturers have moderate margins influenced by fixed costs and input expenses, with efficiency and innovation improving profitability.

Financial firms:

Financial firms tend to have lower operating margins, with profitability driven by high asset turnover, fee income, and risk management.

The importance of industry comparison:

Comparing margins to industry peers and historical trends helps identify competitive advantages or potential issues.

Monitoring and benchmarking profit margins is crucial for assessing financial health, identifying opportunities, and ensuring long-term sustainability.

Common pitfalls when interpreting margins ⚠️

Ignoring industry context: A 15% operating margin might be excellent for retail but poor for software.

Overlooking non-operating items: Extraordinary gains or losses can distort net margin.

Comparing across industries: Margins differ widely; cross-industry comparisons can mislead.

Focusing only on one metric: Operating margin alone ignores financing costs; net margin alone hides operational issues.

Key takeaways and final thoughts 🚀

Operating margin measures profit from core business operations, excluding interest and taxes. It’s a great indicator of operational efficiency.

Net margin measures overall profitability after all expenses, reflecting the true bottom line.

Both metrics are important, but their relevance depends on your focus—whether operational performance or total profitability.

Use them together for a comprehensive view of financial health.

Always consider industry norms and company-specific factors when interpreting margins.

By mastering operating and net margins, you’ll be better equipped to analyze companies, make smarter investment decisions, and understand the story behind the numbers.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.