💻 Nvidia: Riding the AI Wave or Overvalued?

Nvidia Corporation (NVDA) has become the poster child for the AI revolution. However, recent market fluctuations have ignited debates about its stock's true value. Is Nvidia riding a genuine wave of innovation, or is it simply overvalued?

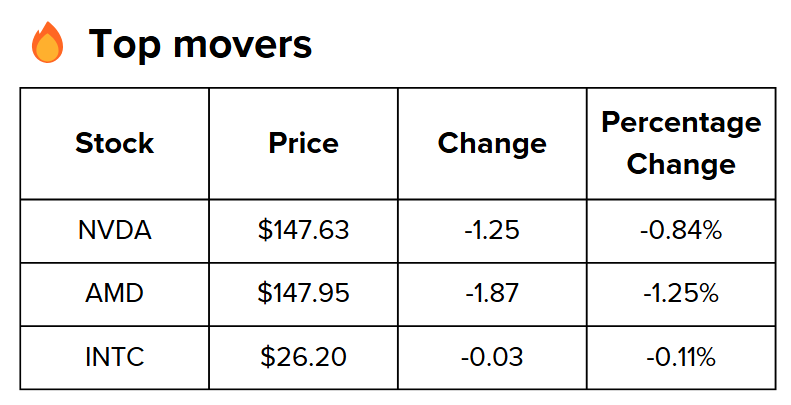

📈 Market snapshot

NVDA: $147.63, -1.25 (-0.84%

🍏 Current landscape

Nvidia's market capitalization has soar, reaching a staggering $3.43 trillion. This makes it the world's largest company by market cap, surpassing even Apple. This milestone comes amid both excitement and scepticism surrounding the sustainability of its growth.

Recently, Nvidia has been experiencing some volatility, with its stock price fluctuating. This is due to investors grappling with the company's valuation and the broader economic landscape.

Despite occasional setbacks, Nvidia's stock has shown remarkable resilience. The company's shares have surged by 910% since January 2023. This impressive rise is driven by the rapid growth of AI and Nvidia's vital role in advancing the technology. Nvidia dominates the AI chip market, enabling it to meet the rising demand for high-performance computing solutions.

Analysts warn that the high price-to-earnings (P/E) ratio of 69.31 suggests the stock could be overvalued. This concern is heightened by uncertainty around future demand for AI technologies. This high valuation has led to increased scrutiny and debate among investors and market watchers.

🌀 Turning the tables

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.