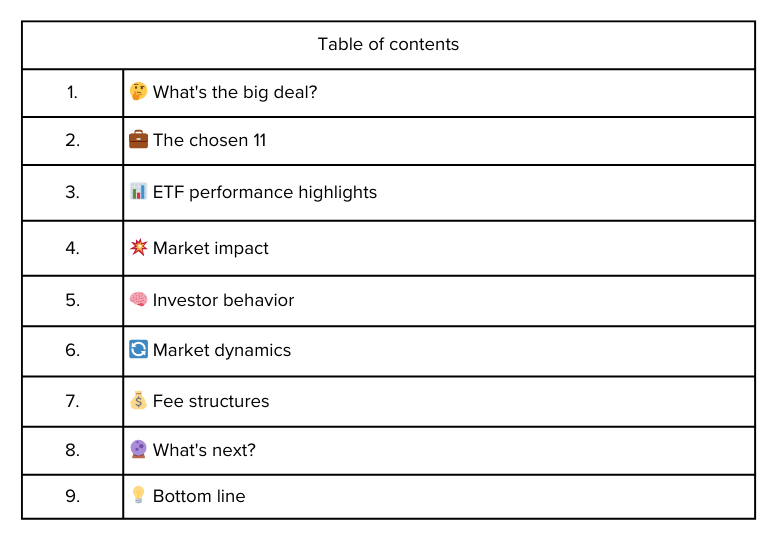

No more 'what ifs': Spot ETFs turn Bitcoin dreams into reality

January 2024 will go down as a landmark moment in crypto history. Why? The U.S. Securities and Exchange Commission (SEC) finally gave the long-awaited nod to spot Bitcoin ETFs. Many believe this move could change the future of Bitcoin investment forever.

Until now, investing in Bitcoin meant dealing with crypto wallets, private keys, and a rollercoaster of uncertainty on unregulated exchanges. But spot ETFs? They’re like the "easy mode" for Bitcoin investing. No wallets. No wild exchange fees. With just a few clicks on your brokerage account, you’re in the game.

If you've been on the fence about Bitcoin, this is your chance to get in without the usual crypto chaos. It's big news for seasoned investors, crypto newcomers, and traditional finance alike. So, what does this mean for you and the future of crypto? Let’s break it all down.

What's the big deal? 🤔

On January 10, 2024, the SEC approved 11 spot Bitcoin ETFs, marking a historic moment for cryptocurrency and traditional finance. These ETFs allow you to invest in Bitcoin through familiar brokerage accounts without the hassle of digital wallets or crypto exchanges.

The chosen 11 💼

ARK 21Shares Bitcoin ETF (ARKB)

Bitwise Bitcoin ETF (BITB)

iShares Bitcoin Trust (IBIT)

Fidelity Wise Origin Bitcoin Trust (FBTC)

Grayscale Bitcoin Trust (GBTC)

Invesco Galaxy Bitcoin ETF (BTCO)

VanEck Bitcoin Trust (HODL)

WisdomTree Bitcoin Fund (BTCW)

Franklin Bitcoin ETF (EZBC)

ProShares Bitcoin Strategy ETF (BITO)

Hashdex Bitcoin ETF (DEFI)

ETF performance highlights 📊

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.