Momentum factor ETFs: November performance and market breadth questions

Momentum has become one of the most closely watched factors in the world of quantitative investing, capturing the natural tendency of winning stocks to keep winning—until the music stops. As November 2025 unfolds, the spotlight is once again on Momentum Factor ETFs: these trackers are seeing shifting returns, raising questions about market breadth, leadership, and whether the momentum trade still delivers alpha under the surface. With market drivers in flux, global rotations, and factor cycles in motion, the story of momentum ETFs in November is as much about what’s working as about what’s not.

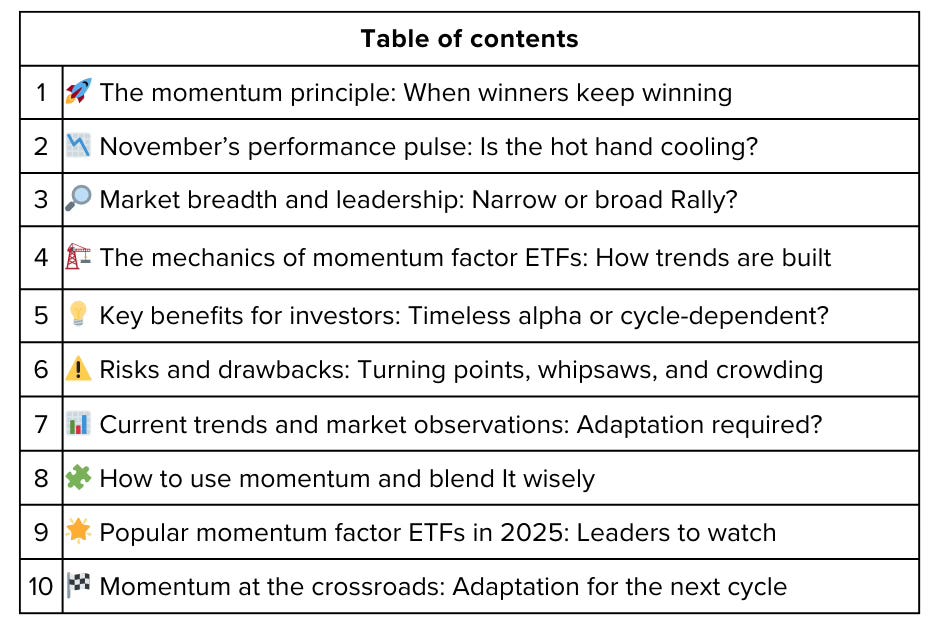

This article explores the heart of factor investing’s “hot hand,” why momentum is harder to pin down this year, the underlying mechanics of the top funds, broader market signals, risks, and the standout ETFs defining the game.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.