Mastering the debt-to-equity ratio: Essential insights for investors 🔍💸

Hey there, savvy investors!

Ready to unravel the mystery of the debt-to-equity ratio?

This financial metric might sound like a mouthful, but it's a crucial tool in your investment toolkit. So let's dive into its significance, how it varies across industries, and why it matters for your investment decisions.

🤔 What is the debt-to-equity ratio?

The debt-to-equity (D/E) ratio is a financial metric that compares a company's total liabilities to its shareholder equity. In simpler terms, it shows how much of a company's operations are financed through debt versus its own funds. To calculate it, you divide the total debt by the shareholder equity:

This ratio helps investors and creditors assess the financial leverage and risk profile of a company.

📊 Calculating the debt-to-equity ratio

Let's take an example to make this clearer. Suppose company XYZ has total liabilities of $200,000 and shareholder equity of $500,000. The D/E ratio would be:

This means for every dollar of equity, the company owes 40 cents to creditors. A D/E ratio of 0.4 suggests that Company XYZ relies more on equity than debt, indicating lower financial risk.

📈 Why is the debt-to-equity ratio important?

Understanding the D/E ratio is like having a financial compass. Here's why it's essential:

Risk assessment: A high D/E ratio indicates that a company relies heavily on borrowed money, which can be risky if profits decline. Conversely, a low ratio suggests less reliance on debt and potentially lower risk.

Financial health: Monitoring changes in the D/E ratio over time provides insights into a company's financial health and stability. An increasing ratio might signal rising financial risk if not used for productive purposes.

Creditworthiness: Lenders often use this ratio to evaluate creditworthiness. A higher D/E ratio might lead to higher interest rates or difficulties in obtaining credit.

🏢 Industry variations: Not all D/E ratios are created equal

The ideal D/E ratio varies significantly across industries due to different capital requirements and business models. Let's compare two real-life examples:

Tech industry: Companies like Apple often have higher D/E ratios due to substantial investments in innovation and technology infrastructure. For instance, Apple's D/E ratio was around 3.77 in early 2024, indicating significant leverage but also reflecting its robust cash flow capabilities.

Utility sector: Utility companies typically have lower D/E ratios because they rely more on stable cash flows and less on aggressive expansion strategies. This sector often requires substantial capital investments but benefits from predictable revenue streams.

Understanding these industry norms helps investors make informed comparisons and assessments.

💡 Real-world example: Apple Inc. vs. Tecnoglass Inc.

Apple Inc. (AAPL)

Debt: $279 billion

Equity: $74 billion

D/E Ratio calculation:

Apple's D/E ratio of approximately 3.77 indicates that for every dollar of equity, it has about $3.77 in debt. This high ratio reflects Apple's aggressive growth strategy financed through significant borrowing, which is typical for tech companies investing heavily in innovation and infrastructure.

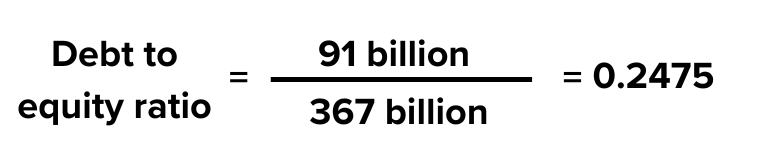

Tecnoglass Inc. (TGLS)

Debt: Approximately $91 million

Equity: Approximately $367 million

D/E Ratio Calculation:

Tecnoglass's D/E ratio is much lower, at about 0.25, indicating that it relies more on equity than debt to finance its operations. This conservative financial strategy reflects a focus on stability and lower risk, which is common in companies with less aggressive growth ambitions.

These examples illustrate the significant differences in financial strategies and risk profiles between companies in the tech industry and those in other sectors, such as manufacturing or utilities.

📊 How to interpret the debt-to-equity ratio

Interpreting the D/E ratio requires context:

High D/E ratio: Indicates potential for higher returns due to leverage but also increased risk of financial distress if earnings falter.

Low D/E ratio: Suggests financial stability and lower risk but may indicate missed opportunities for growth through leverage.

📊 Understanding and interpreting the debt-to-equity (D/E) ratio

The debt-to-equity (D/E) ratio is a critical measure of a company's financial structure, showing how much debt a company uses relative to its equity to finance operations and growth. While the ratio itself is straightforward, its interpretation depends on the context, such as the industry, economic conditions, and the company’s overall strategy.

What does a high D/E ratio mean?

A high D/E ratio indicates that a company relies heavily on debt to fund its operations. While this can lead to higher returns during periods of strong growth, it also increases the risk of financial distress if earnings decline. The company must meet its debt obligations regardless of performance, which could strain cash flow.

A technology startup might have a high D/E ratio because it borrows extensively to invest in research and development. If its products succeed, the returns could far exceed the cost of debt, making this strategy worthwhile. However, if the products fail, the company may struggle to repay its loans, potentially leading to bankruptcy.

What does a low D/E ratio mean?

A low D/E ratio suggests that a company relies more on equity than debt, which often signals financial stability and lower risk. However, it may also indicate that the company is missing growth opportunities by not leveraging debt to scale operations or invest in new projects.

A well-established consumer goods company may maintain a low D/E ratio, prioritizing stability over rapid expansion. While this reduces financial risk, it might mean the company is not capitalizing on potential growth opportunities, such as entering new markets or launching innovative products.

Comparing two companies:

Company A has a D/E ratio of 2.5, indicating it uses $2.50 of debt for every $1 of equity. It operates in a growth-driven industry like renewable energy, where debt finances expansion projects that promise high returns.

Company B has a D/E ratio of 0.3, showing it uses only $0.30 of debt for every $1 of equity. It operates in the pharmaceutical industry, focusing on stability and long-term sustainability.

Interpreting the D/E ratio requires balancing the benefits of leveraging debt for growth against the risks of over-leverage and financial instability. By understanding this metric within the right context, investors and businesses can make informed decisions that align with their financial goals and risk tolerance.

🧿 The investor's perspective: Balancing risk and reward

Investors use the D/E ratio to balance risk and reward:

Conservative investors: Prefer companies with lower ratios, valuing stability over aggressive growth.

Aggressive investors: Might seek higher ratios for potentially greater returns, accepting increased risk.

⚖️ The debt-to-equity balancing act

When building an investment portfolio, understanding how companies use debt is crucial. The debt-to-equity (D/E) ratio offers valuable insights, but the real challenge is to balance the potential risks and rewards associated with different levels of debt. Here's how you can approach it:

Know your risk appetite: Your willingness to take risks will determine how much you should invest in companies with high or low D/E ratios. Companies with higher debt levels (and higher D/E ratios) often have the potential for bigger rewards because debt can amplify returns. However, this also comes with greater risk if the company's earnings falter. On the other hand, companies with lower debt levels tend to be more stable, offering steady but less dramatic returns.

If you’re a risk-tolerant investor, you might invest in a company like Tesla, which historically used significant debt to fund its rapid expansion in the electric vehicle market. The high D/E ratio signals potential for high returns if Tesla continues to grow.

If you prefer stability, a company like Procter & Gamble, with a lower D/E ratio, might suit you better. It focuses on steady growth and dividends, making it a safer bet in volatile markets.

Diversify: Diversification is key to managing risk. By including companies with varying levels of debt in your portfolio, you reduce the impact of any single company’s financial performance on your overall returns. For instance, pairing high-D/E companies with low-D/E ones ensures that if one sector struggles, others can stabilize your portfolio.

You could invest in Apple (a company with relatively low debt compared to equity, known for its cash-rich operations) and pair it with Delta Air Lines, a capital-intensive business with a higher D/E ratio. This mix balances growth opportunities with stability.

Monitor changes: Companies’ debt levels don’t remain static. Changes in their D/E ratios can signal shifts in financial health, growth strategies, or potential risks. A rising D/E ratio might indicate the company is taking on more debt for expansion, while a declining ratio could mean the company is paying off debt, potentially becoming more stable.

If a company like Netflix significantly increases its D/E ratio, it might be borrowing to fund original content production. This could be an opportunity if the content attracts more subscribers. However, if subscriber growth stalls, the increased debt could strain the company’s finances.

🔍 Cautions and considerations

While useful, the D/E ratio has limitations:

Industry specificity: Compare companies only within the same industry. Different industries have different normal debt levels, so comparing across industries can be misleading.

Not all debt is equal: Short-term and long-term debts have different impacts on a company. Short-term debt might be more urgent, while long-term debt could be part of a growth strategy.

Context matters: A high debt level isn't always bad if the company is growing and making good money. Look at the bigger picture of the company's performance and plans.

🤝 Putting it all together: Your action plan

Ready to master the debt-to-equity dance? Here's your game plan:

Assess current investments: Calculate the D/E ratios of your portfolio companies.

Define your goals: Are you seeking stability or growth?

Adjust your mix: Use industry norms to guide portfolio adjustments.

Stay informed: Keep learning about financial metrics and market trends.

Review regularly: Adapt your strategy as market conditions change.

🤑 The bottom line: Debt-to-equity and you

Understanding the debt-to-equity ratio empowers you to make informed investment decisions. Whether you're cautious or adventurous in your approach, this metric offers valuable insights into a company's financial health and risk profile.

So go ahead, dive into those balance sheets with confidence! May your investments be wise, your risks calculated, and your returns rewarding.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.