Liquidity ratios simplified: Current, quick, and cash ratios explained.

Liquidity ratios are the unsung heroes of financial analysis. They might not grab headlines like earnings or revenue, but they quietly reveal whether a company can pay its bills, weather a cash crunch, or seize new opportunities. In this comprehensive guide, we’ll break down the three most important liquidity ratios—current, quick, and cash ratios—using real-world examples, practical insights, and a friendly, conversational tone. Whether you’re an investor, business owner, or just curious about financial health, this article will help you master these essential metrics.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam.

What are liquidity ratios? 🤔

Liquidity ratios are financial metrics that measure a company’s ability to meet its short-term obligations using its most liquid assets. In simple terms, they answer the question: If all the company’s bills came due tomorrow, could it pay them without scrambling for extra cash or selling off long-term assets?

These ratios are crucial for:

Investors: Assessing risk before buying shares.

Creditors and lenders: Deciding whether to extend credit or loans.

Management: Monitoring financial health and making operational decisions.

A higher liquidity ratio generally signals a stronger ability to pay short-term debts, while a lower ratio can be a red flag for potential cash flow problems.

The big three: Current, quick, and cash ratios 🏆

Let’s dive into the three most widely used liquidity ratios, each offering a different lens on a company’s short-term financial strength.

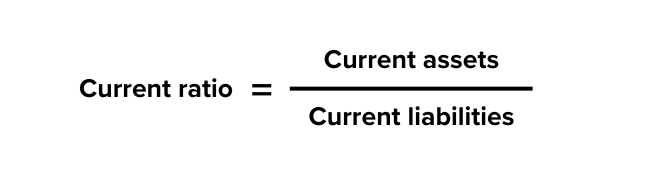

1. Current ratio

Formula:

Current assets include cash, accounts receivable, inventory, and other assets expected to be converted to cash within a year.

Current liabilities are obligations due within a year, such as accounts payable, short-term loans, and accrued expenses.

Interpretation:

A current ratio above 1 means the company has more current assets than current liabilities—a good sign. Ratios between 1.5 and 3 are generally considered healthy, but the ideal range varies by industry.

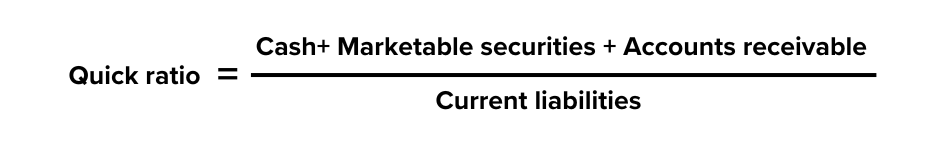

2. Quick ratio (Acid-test ratio)

Formula:

Excludes inventory and prepaid expenses, focusing only on assets that can be quickly converted to cash.

Interpretation:

A quick ratio of 1 or higher is usually seen as strong, indicating the company can meet its short-term obligations without relying on inventory sales. This is especially important in industries where inventory may be slow-moving or hard to liquidate.

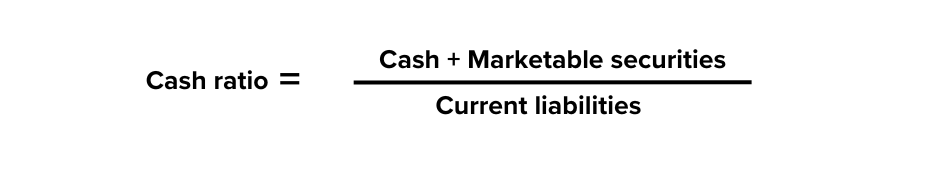

3. Cash ratio

Formula:

The most conservative measure, considering only cash and near-cash assets.

Interpretation:

A cash ratio close to 1 is rare and often unnecessary, but a very low cash ratio could signal trouble if the company faces an unexpected cash crunch.

Why liquidity ratios matter: The real-world impact 🌍

Liquidity ratios aren’t just academic—they have real consequences for businesses and investors:

Creditworthiness: Banks and suppliers use these ratios to decide whether to extend credit or set loan terms. Strong liquidity can mean better rates and more favorable terms.

Operational flexibility: Companies with high liquidity can invest in growth, weather downturns, and respond to opportunities or emergencies.

Risk assessment: Investors use liquidity ratios to gauge bankruptcy risk. A declining ratio can be an early warning sign of trouble.

Management decisions: Executives monitor liquidity to guide inventory management, capital expenditures, and cash flow planning.

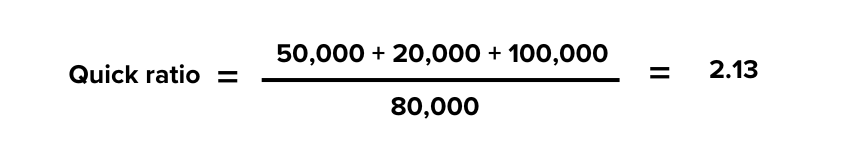

How to calculate liquidity ratios: Step-by-step examples🧮

Let’s bring these ratios to life with a practical example.

Sample balance sheet data

Calculations

Current Ratio:

Quick Ratio:

Cash Ratio:

Interpretation:

This company is in a strong liquidity position. It can cover its short-term debts more than twice over with its current assets, and even without inventory, it’s still well above the danger zone11.

What’s the difference? ⚖

️

Current ratio is broadest, including all current assets.

Quick ratio is stricter, excluding inventory.

Cash ratio is strictest, focusing only on cash and equivalents81013.

Industry differences: One size doesn’t fit all 🏭

Liquidity ratios must be interpreted in context:

Retailers

Retailers often have lower quick and cash ratios due to fast inventory turnover. A ratio below 1 is not a concern if inventory is managed well and sales are steady.

Manufacturers

Manufacturers need higher quick ratios to handle slower inventory turnover. A low quick ratio may signal liquidity risks, especially with unsold or obsolete inventory.

Tech firms and service companies

Tech and service companies usually have higher quick ratios since they have minimal inventory. A low ratio could indicate cash flow problems or excessive spending.

Liquidity ratios provide crucial insights, but their interpretation depends on the industry context. Comparing them across sectors without understanding these nuances can lead to inaccurate conclusions. Always benchmark against industry peers and historical performance for a more accurate assessment of financial health.

How stakeholders use liquidity ratios 👥

Creditors and Banks: Evaluate loan applications and set credit limits. Strong liquidity means lower risk and better borrowing terms.

Suppliers: Decide whether to offer trade credit or require upfront payment.

Investors: Assess risk before buying shares or bonds. Weak liquidity can signal potential distress or bankruptcy risk.

Management: Guide decisions on cash management, inventory, and short-term financing.

Limitations and pitfalls of liquidity ratios ⚠️

No financial metric is perfect. Here’s what to watch out for:

1. Snapshot in time:

Ratios are based on balance sheet data at a single point. Cash flows can change quickly.

2. Quality of assets

High receivables may not be collectible; inventory may be obsolete.

3. Industry variations

What’s “good” in one industry may be poor in another.

4. Window dressing

Companies may temporarily boost ratios before reporting periods.

Pro Tip: Always use liquidity ratios alongside other metrics (like cash flow statements and profitability ratios) for a complete picture.

Improving liquidity ratios: Practical strategies 🛠️

If a company’s liquidity ratios are weak, management can take action:

Speed Up receivables: Encourage faster customer payments.

Manage inventory: Reduce excess or obsolete stock.

Delay payables (Responsibly): Negotiate longer payment terms with suppliers.

Increase cash reserves: Build up cash through profits or financing.

Refinance short-term debt: Convert short-term obligations to longer-term loans.

Case studies: Liquidity ratios in action

Case 1: The retailer with low quick ratio

A supermarket chain has a current ratio of 0.72 and a quick ratio of 0.54. At first glance, these look low, but supermarkets turn inventory into cash rapidly. For them, a lower ratio is normal and not a cause for alarm7.

Case 2: The manufacturer facing a crunch

A manufacturing firm has a current ratio of 1.1 but a quick ratio of 0.6. Most of its assets are tied up in slow-moving inventory. If sales slow down, it may struggle to pay bills, signaling a need to improve liquidity management8.

Key takeaways and final thoughts 🚀

Liquidity ratios are essential tools for assessing a company’s ability to pay short-term debts.

Current, quick, and cash ratios each offer a different perspective—use them together for a full picture.

Interpret ratios in context: Compare to industry norms and historical trends.

Watch for red flags: Declining ratios, especially below 1, can signal trouble.

Use ratios as a starting point: Combine with other financial analysis for smart decision-making.

“Liquidity is like oxygen for a business: you barely notice it when it’s there, but it’s the only thing you think about when it’s gone.”

Stay curious, keep learning, and remember—understanding liquidity ratios can help you make smarter investment, lending, and business decisions.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.