International ETFs: Global rotation as US valuations appear stretched

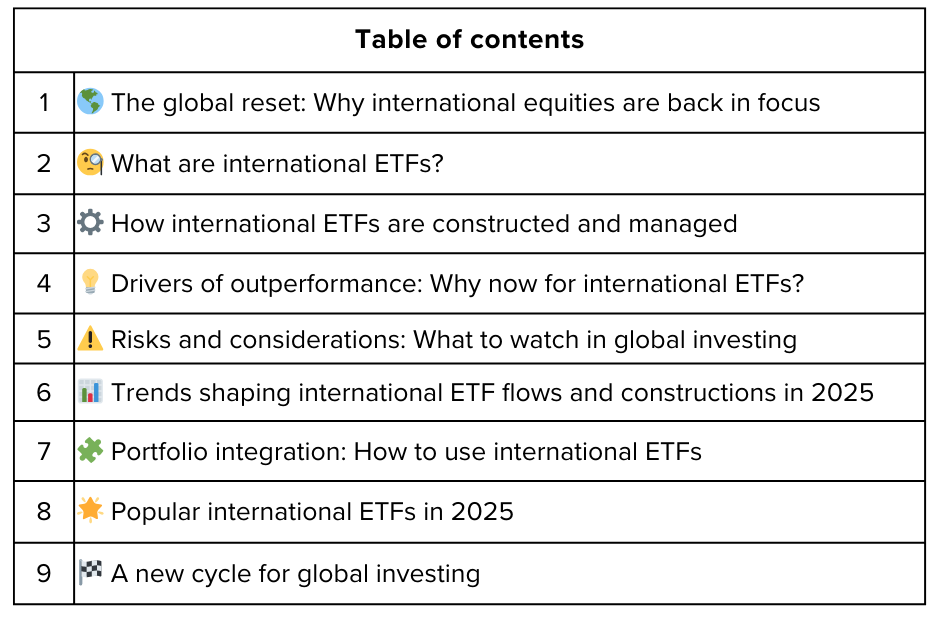

In 2025, a palpable shift in global investing is underway. After years of U.S. stock market dominance, international equities and the ETFs that track them are making a comeback. The catalyst? Stretched U.S. valuations, a reversal in performance leadership, currency dynamics, and renewed interest in global diversification. Investors are rediscovering the importance of international exposure, not just as a tactical play, but as a long-term reallocative move as market leadership rotates. In this article, we unpack why this trend is emerging now, the structure and strengths of international ETFs, key opportunities and risks, and the funds at the forefront in 2025.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.