How do economic indicators like CPI and PMI affect your portfolio?

For investors and anyone managing their money in 2025, the constant headlines about the latest CPI, PMI, jobs report, or GDP release can be confusing. These numbers move markets, stir up anxiety, and sometimes cause seemingly irrational swings in stock, bond, and even crypto prices. But what are these economic indicators, how do they actually work, and, most importantly—how do they affect your portfolio? In this article, we’ll break down what matters and why, and give you a practical guide for making sense of economic data in today’s world.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

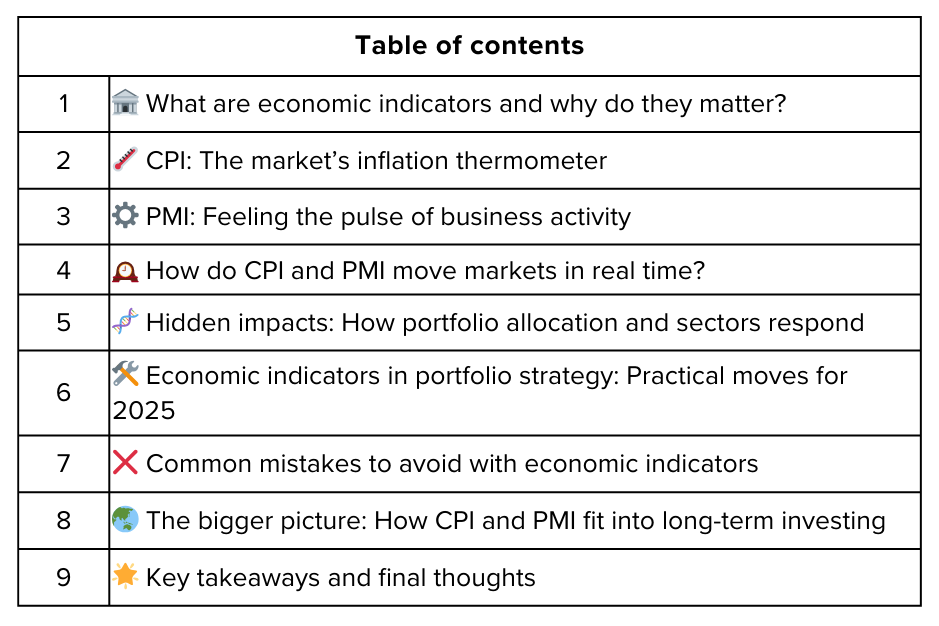

What are economic indicators and why do they matter? 🏦

Economic indicators are statistics that measure aspects of a country’s economy, giving a snapshot of its health and future outlook. Think of them as vital signs for the market.

Why do investors care so much?

They signal growth, inflation, or recession risk.

Central banks (like the U.S. Fed or RBI) watch them to set interest rates and other policies.

Traders use them as cues for when to buy, sell, or protect their positions.

Sudden changes or surprises can trigger big moves in stock, bond, currency, and commodity markets.

Some indicators—like the Consumer Price Index (CPI) or Purchasing Managers’ Index (PMI)—are so widely watched that their release times are circled on every Wall Street calendar.

CPI: The market’s inflation thermometer 🌡️

What is the CPI?

The Consumer Price Index measures the average change over time in the prices paid by consumers for a standardized “basket” of goods and services—food, rent, clothing, fuel, healthcare, and more.

It’s the benchmark for U.S. inflation, and similar indices guide policy in other countries.

Why does CPI matter to portfolios?

High inflation (rising CPI) can eat away at your purchasing power and investment returns.

Central banks may hike interest rates to fight high inflation, which generally pressures stocks and especially hurts “growth” sectors. Bonds fall as rates rise.

Low or falling CPI may signal slow growth or even deflation, affecting company profits.

Recent example (2025):

As of August 2025, U.S. CPI rose about 2.7% year-over-year. This is moderate but trending up, and the Fed is considering its next rate move.

Core CPI, excluding food and energy, was a bit higher at 3.1%, suggesting some sticky inflation.

PMI: Feeling the pulse of business activity ⚙️

What is the PMI?

The Purchasing Managers’ Index surveys business leaders in manufacturing and services about new orders, employment, inventory, and production. It ranges from 0 to 100.

A PMI above 50 indicates expansion; below 50 signals contraction.

Why does PMI matter to markets?

It’s a leading indicator—changes in PMI often show up in company earnings and market moves before GDP data is released.

Strong PMIs boost confidence in corporate profits and stocks, while weak PMIs warn of potential downturns or sector-specific stress.

It helps differentiate which sectors are heating up or cooling down (e.g., manufacturing vs. services).

2025 snapshot:

In August 2025, the U.S. services PMI stayed strong at 54, but manufacturing PMI dipped to 48, spooking industrial stocks and favoring tech and healthcare.

How do CPI and PMI move markets in real time? 🕰️

Stocks:

Hot CPI readings typically hit tech, consumer discretionary, and other rate-sensitive stocks the hardest.

Strong PMI lifts cyclical sectors like industrials, materials, and financials.

Negative surprises (inflation unexpectedly high, PMI drops below 50) often spark sharp sell-offs.

Bonds:

Higher CPI = falling bond prices/yields up (investors fear rate hikes).

Weak PMI (recession worries) usually pushes yields down as bonds gain “safe haven” appeal.

Currencies:

Hot inflation or strong PMIs can strengthen a country’s currency as traders anticipate higher interest rates.

Gold and commodities:

CPI spikes often boost gold (an inflation hedge) but can pressure industrial metals if growth slows.

Crypto:

CPI and PMI can trigger short-term volatility in bitcoin and altcoins, which are increasingly traded as both risk assets and inflation hedges.

Hidden impacts: How portfolio allocation and sectors respond 🧬

Growth vs. Value stocks: “Growth” companies (tech, startups) are more sensitive to rate hikes from inflation news. “Value” stocks (banks, industrials, utilities) sometimes outperform during recoveries or when PMI is rising.

Dividends and REITs: Higher inflation and rate fears hurt income-generating assets as yields elsewhere become more attractive.

Small caps vs. large caps: Small-cap stocks are often more sensitive to economic slowdowns (falling PMI) and benefit more in rebounds.

Bonds: Short-term bonds are safer in rising rate environments. Long-term bond values can drop quickly if CPI stays hot.

Economic indicators in portfolio strategy: Practical moves for 2025 🛠️

Don’t react blindly: Markets sometimes overreact to individual data releases. It’s better to watch trends—a single high CPI print does not guarantee a rate hike, nor does a weak PMI instantly trigger a crash.

Diversify assets: Balance between stocks, bonds, commodities, and cash helps insulate against CPI or PMI-driven drawdowns.

Tweak your equity mix: Favor sectors or geographies that benefit from current economic trends. Manufacturing slowdown? Lean into tech or healthcare. Inflation up? Consider more gold or commodity exposure.

Mind your duration: In bonds, keep maturities relatively short when inflation or rates are climbing. Add risk as CPI trends stabilize or fall.

Hedge: Use options, inverse ETFs, or “real assets” like gold and real estate to cushion against surprises.

Think global: PMIs and inflation data in other economies (China, EU, India) also move global portfolios, especially for international investors.

Common mistakes to avoid with economic indicators ❌

Chasing headline numbers: Market sentiment and expectations matter as much as the data itself. Sometimes “bad news” is already priced in.

Ignoring the details: Look beyond the headline: Is inflation driven by food/energy, or broader price pressures? Are new orders in PMI still growing even if the headline falls?

Over-trading on each report: Jumping in and out with every release racks up costs and risks missing the big picture.

Confirmation bias: Only paying attention to data supporting your viewpoint can leave portfolios badly exposed.

The bigger picture: How CPI and PMI fit into long-term investing 🌏

Over time, markets rise and fall with broad economic cycles shaped by these indicators.

Trend changes in CPI or PMI often precede bull or bear markets—but not always at the same speed or intensity.

Being informed lets you interpret macro risks and calibrate your strategy, but sticking to your plan is usually smarter than chasing every piece of news.

Use economic data as a guide, not a gospel. Let it help you ask better questions about your investments rather than dictate every move.

Key takeaways and final thoughts 🌟

CPI and PMI are essential economic indicators that influence investor sentiment, policy moves, and portfolio performance in real, tangible ways.

Don’t panic over every jump or dip in these numbers, but don’t ignore them either—trends, surprises, and how the market reacts all provide clues for skilled investors.

Diversification, flexibility, and a focus on fundamentals will always outlast whipsaw reactions to economic headlines.

In 2025’s fast-moving markets, understanding the link between economic data and your investments is a superpower—use it wisely.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.

Poll 📊

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.