ETF premium vs. discount: What investors should monitor

Exchange-Traded Funds (ETFs) are a favorite for modern investors, known for their transparency, real-time pricing, and flexibility. Yet, beneath their simplicity lies a subtle risk: sometimes, an ETF trades above or below the true value of its holdings. These differences, known as “premiums” and “discounts,” aren’t just technicalities—they can impact what you really pay, what you actually get, and the long-term returns on your investment. This guide breaks down what ETF premiums and discounts are, why they happen, how to monitor them, and how to avoid the pitfalls that can quietly erode your wealth.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

What is an ETF premium or discount? Know the basics 🎯

Every ETF represents a basket of underlying assets, whether stocks, bonds, commodities, or something more exotic. The Net Asset Value (NAV) reflects the current market value of all those holdings divided by the number of ETF shares outstanding. In a perfect world, the ETF’s market price and its NAV would always match.

Premium: The ETF trades at a market price higher than its NAV—investors pay more than the sum of its parts.

Discount: The ETF trades at a market price lower than its NAV—investors pay less than the underlying value.

Example:

If an ETF’s NAV is $100 and its market price is $102, it trades at a 2% premium. If it’s $98, it’s at a 2% discount.

Why do premiums and discounts happen? Market mechanics 🔄

Several factors can create (and close) these gaps:

Market supply and demand: When buyers flood into an ETF or sell en masse, ETF prices can temporarily move away from NAV.

Underlying securities liquidity: ETFs holding stocks or bonds that are hard to price or trade (think small caps, emerging markets, or high-yield bonds) are more susceptible.

Different trading hours: If you’re trading a U.S.-listed ETF that tracks a European or Asian index, NAV and market price can diverge while one market is closed.

Volatility and shocks: Fast-moving, stressed markets can create wider, more persistent discounts or premiums as it’s harder to arbitrage price differences.

Arbitrage lag: Normally, large institutional traders (authorized participants) exploit these gaps—by delivering ETF baskets to the fund for new shares or redeeming ETF shares for underlying securities—helping bring price and NAV together. But when markets move quickly, this “creation/redemption” mechanism can lag.

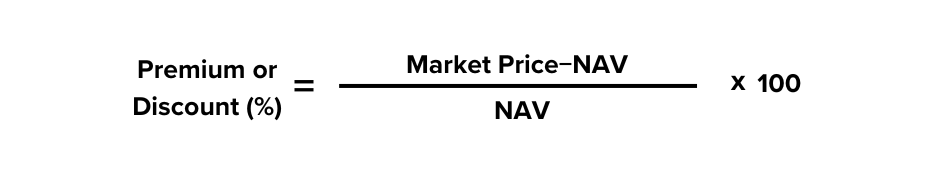

How are ETF premiums and discounts calculated? The simple math 🧮

The standard formula is:

A positive result is a premium; a negative result means a discount.

Most ETF providers publish daily (and sometimes intraday) snapshots so investors can see if they’re at risk of paying over or under fair value.

When are premiums and discounts problems, when are they normal? ⚠️

Normal: Small, temporary differences—cents or tenths of a percent—are routine for popular, liquid ETFs. These are quickly closed by arbitrage.

Worrisome: Big, persistent premiums or discounts suggest something is wrong—maybe the ETF’s underlying assets are frozen, closed, or illiquid, or there’s an imbalance in supply and demand.

Dangerous: Buying at a big premium and selling at a later discount can cause investors to “buy high, sell low” even if the underlying index does great.

Fixed income ETFs and international ETFs:

Bond funds or overseas equity ETFs often have larger, lasting pricing gaps due to time zone mismatches or the challenge of pricing thinly traded assets. In March 2020, for example, some U.S. bond ETFs traded at unusually steep discounts as market volatility soared.

Asset class differences: Why not all ETFs behave the same 🗺️

U.S. large-cap equity and index ETFs: Mostly trade at or close to NAV thanks to deep, liquid markets.

International ETFs: Gaps widen outside home market hours or amid global events.

Bond/commodity ETFs: Can show larger, persistent gaps due to pricing complexity and liquidity limits.

Niche, thematic, or small-fund ETFs: These are prone to wider gaps, especially during turmoil or outside optimal trading hours.

Investor lesson: The more complex or illiquid the ETF’s focus, the more attention you should pay to price vs NAV.

How to monitor and minimize ETF premium/discount risk 🕵️

1. Use real-time premium/discount data:

Most providers post this data on their site; some add charts showing the average deviation over time.

2. Check intraday NAV (iNAV) if available:

Helps spot gaps during the day, not just at the close.

3. Trade when the ETF’s underlying markets are open:

For international ETFs, this means trading during the overlap with the local market’s hours.

4. Use limit orders:

Never use market orders in thin or volatile ETFs—set your price near NAV.

5. Monitor big market events:

Be extra careful during central bank announcements, political shocks, or rebalancing events—these can widen spreads.

6. Compare similar ETFs:

If two funds track the same benchmark but one always trades at a wider premium/discount, consider the more tightly priced option.

Premiums, discounts, and the creation/redemption magic 🪄

ETF structures are designed to keep prices and NAV together via “arbitrage.” Here’s how it works:

If the ETF price is too high, institutional investors create new shares by delivering the underlying assets to the ETF sponsor and selling the new ETF shares at the higher price—bringing prices back to normal.

If the ETF price drops below NAV, institutions buy ETF shares on the cheap and redeem them for underlying assets, selling those assets for profit—again closing the gap.

In liquid, normal markets, this process is fast and efficient. During stress, delays and disruptions can make it less effective—causing wider premiums or discounts to persist.

What persistent or volatile premiums/discounts might signal 🚨

Occasional small gaps are normal, but frequent or large divergences should make you cautious:

Persistent premiums: Could indicate excess speculative demand, fund restrictions, or operational issues.

Persistent discounts: May signal liquidity problems, limited interest, or underlying asset pricing difficulties.

Volatility in the gap: High standard deviation in the premium/discount, even if the average is low, is a warning sign—a big gap the day you buy or sell can still hurt.

Bond and small-cap ETFs are especially prone.

Smart ETF trading practices for real-world investors 🛠️

Stick to liquid funds for core positions.

For broad asset class exposures, large funds tracking major indexes keep premium/discount risk low.

Be extra careful with international or complex funds.

Trade during global overlap and check NAV data.

Check premium/discount history.

Funds with big, rare gaps are better than those with lots of wild swings.

Avoid trading at the open or close.

Spreads and price gaps often widen at these moments.

Don’t buy on “sale” just because an ETF trades at a discount,

unless you’re sure the NAV is accurate and the gap will close—otherwise, you may have to sell at an even steeper discount.

Monitor creation/redemption halts or suspensions.

If an ETF announces a pause, be wary—arbitrage may be offline, and prices can drift.

What’s changing with ETF premium and discount behavior? 📈

The explosion in specialist and international ETFs has made gap monitoring more important than ever.

Big market events and geopolitical shifts are showing up faster and more dramatically in ETF premiums and discounts, especially in high-yield credit and emerging markets.

Investors are more data-driven—more tools and transparency are available to help you trade smart.

Regulators are watching how ETF mechanisms hold up in times of strain, but for now, major U.S. equity ETFs typically remain tight.

Key takeaways and practical checklist 🌟

Always know the NAV of your ETFs before buying or selling and compare it to market price.

Choose ETFs with a history of low, stable premiums/discounts, especially for long-term holdings.

Use limit orders and trade in liquid markets.

Pay more attention to gaps in bond, international, and niche sector funds.

Watch for news of halt or suspension in creation/redemptions—this is a red flag.

Remember: it’s not just the average gap that matters, but its volatility over time.

By staying alert to ETF pricing quirks and using these smart trading strategies, you can minimize hidden costs, protect your returns, and make ETFs the simple, powerful tool they’re meant to be.

Poll 📊

🚀 Join 60,000+ investors—become a paying subscriber or download the Winvesta app and fund your account to get insights like this for free!

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and consider seeking professional financial advice before making any investment decisions.