ETF flow watch: How to read weekly flow data to spot crowded trades and fresh themes

ETF flows have become one of the cleanest “tells” in modern markets. Prices tell you what has happened; flows hint at where capital is moving now. Late in the cycle, when narratives shift quickly and headline noise is constant, learning how to read weekly ETF flow data can help distinguish crowded consensus trades from genuinely emerging themes, and avoid being the last buyer into a hot idea.

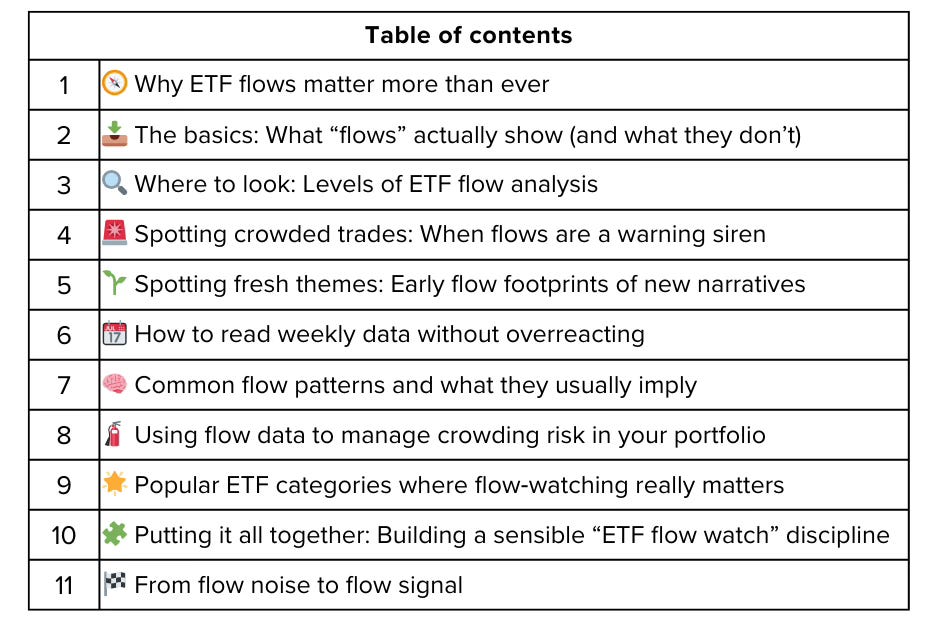

This article breaks down how to interpret weekly ETF flows, what to watch at the asset‑class, sector, and thematic level, how to spot crowding vs. early adoption, and how to actually use this information in a portfolio without turning into a short‑term tourist.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.