Doordash: Is logistics dominance compatible with real profitability?

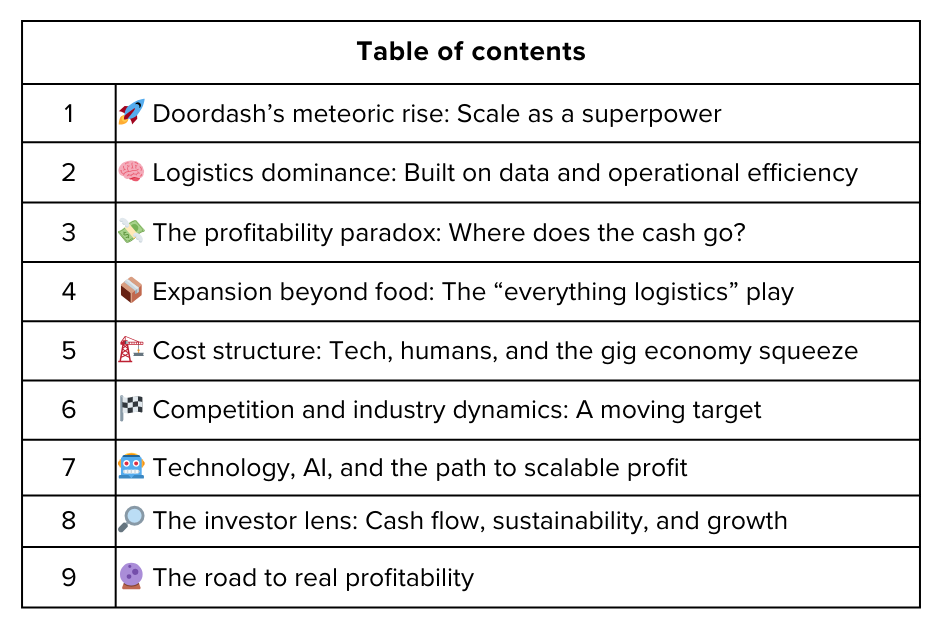

In 2025, DoorDash stands as a logistics and delivery juggernaut—its logo and app icon as ubiquitous in North America as any major food brand. DoorDash’s dominance has shaped how millions of people experience food delivery while expanding rapidly into groceries, convenience, alcohol, and even non-food essentials. Yet, in an era where investors are scrutinizing every dollar of free cash flow, a nagging question remains: can DoorDash’s unmatched logistics network and user base deliver not just top-line growth but also sustained, real profitability? This article traces DoorDash’s journey, the drivers of its platform strength, the margin challenges it faces, its push into new sectors, and the path to long-term profit.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.