Dividend and Covered Call ETFs: Chasing yield in volatile markets

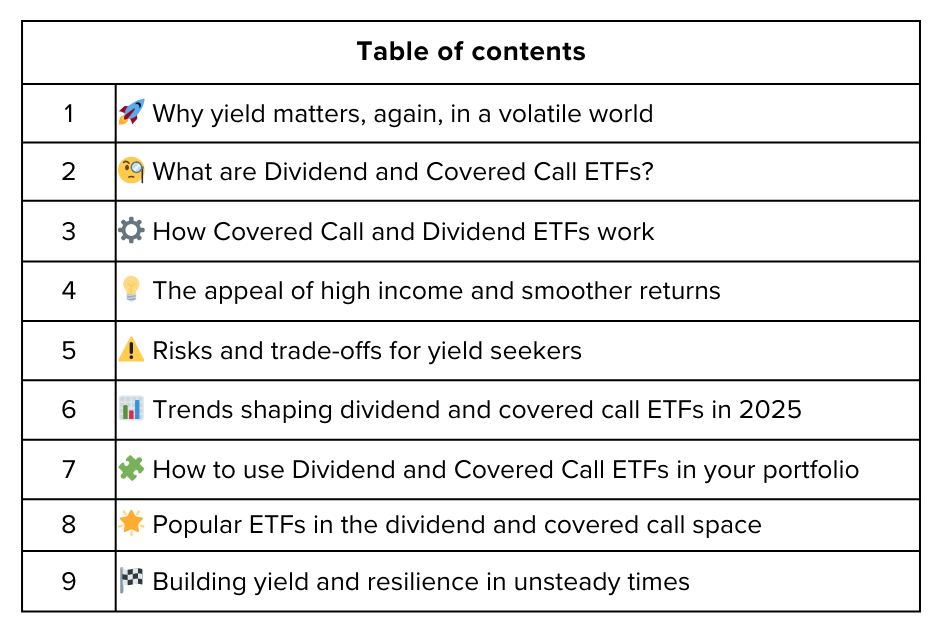

In a world where market volatility has become the norm rather than the exception, investors are increasingly searching for ways to boost yield and protect their portfolios. Dividend and covered call ETFs have emerged as among the most popular solutions, offering consistent income streams, the potential for downside cushion, and a simplified approach to complex options strategies. In 2025, as rate uncertainty, geopolitical risk, and rapid sector rotations shake traditional investing wisdom, these ETFs stand out as powerful tools for income hunters and defensive-minded investors alike. This article explores the resurgence of these strategies, their construction, their potential benefits and risks, and the leading funds dominating this ever-evolving space.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.