Costco (COST): Membership moat, trade‑down consumer, and the price of safety

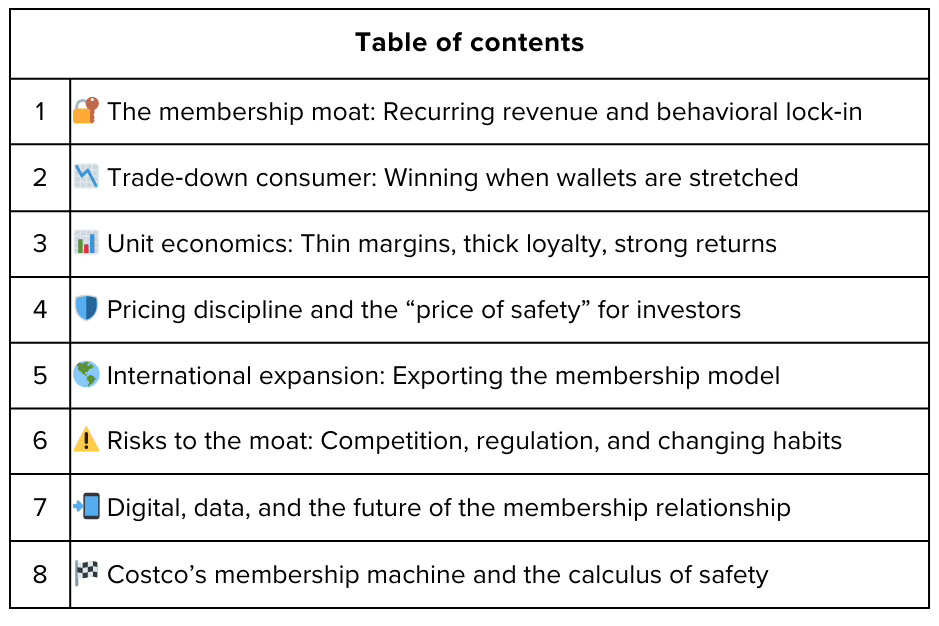

Costco sits at the intersection of three powerful forces in 2025: lingering inflation, a cautious but still‑spending consumer, and investors’ search for “safe” compounders in an uncertain macro backdrop. Its model—membership fees, extreme operational discipline, and almost fanatical focus on value—has turned a big‑box warehouse into one of the most admired business models in retail. The big questions now are how durable that membership moat really is, how Costco benefits from the trade‑down consumer without wrecking its margins, and what investors are actually paying for when they treat the stock as a safe haven.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.