Consumer staples & low volatility ETFs: Defensive shelters

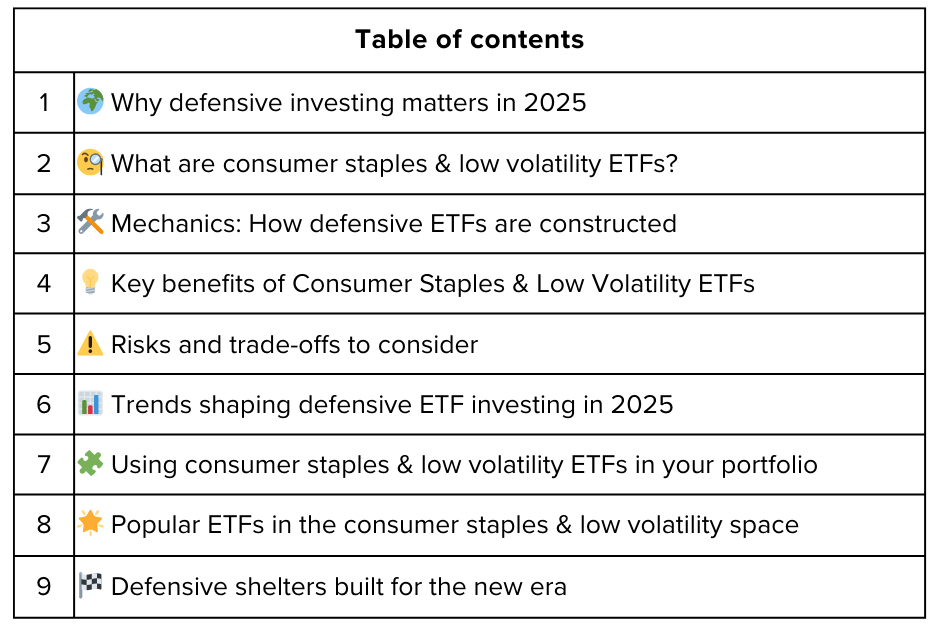

In the stormy sea of financial markets, defensive investing has resurfaced as a central strategy for 2025. With geopolitical uncertainty, inflation aftershocks, and shifting central bank signals, investors are once again prioritizing stability and resilience. Consumer Staples and Low Volatility ETFs, classic defensive choices, are enjoying renewed interest as reliable, accessible shelters for portfolios. These funds promise smoother returns, consistent dividends, and a buffer against market cycles. In this article, we revisit these defensive themes, explore their mechanics, advantages, risks, and spotlight the ETFs leading this sector into the future.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.