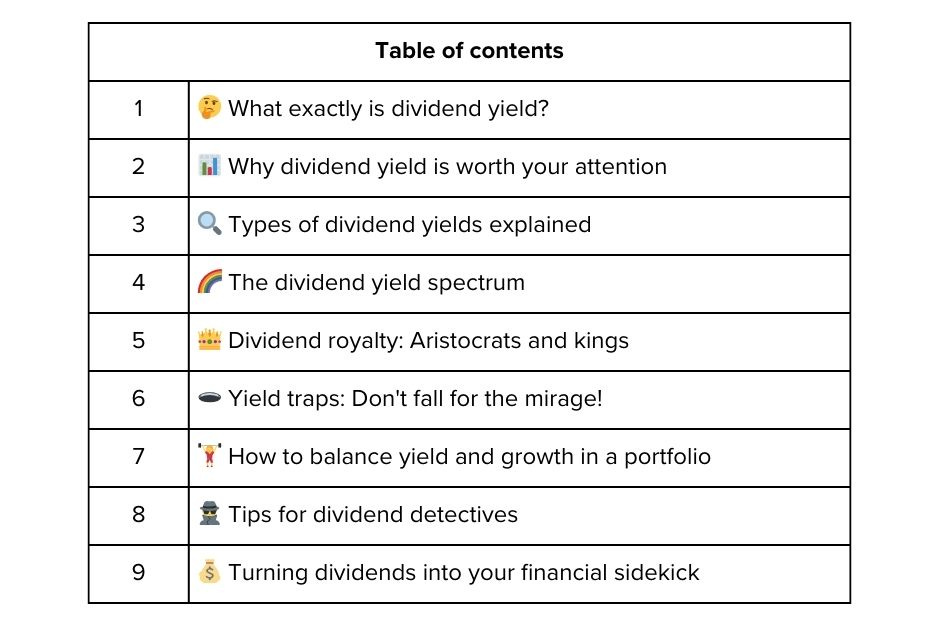

Cash flow boost: How dividends can pad your paycheck

Hey there, dividend hunters! Ready to dive into the world of dividend yields? Grab your favourite beverage, and let's break it down in a way that won't make your eyes glaze over.

🤔 What exactly is dividend yield?

Think of dividend yield as the financial world's version of a cash-back reward on your stock purchase. It tells you how much cash you're getting back relative to the stock's price. Essentially, it's a percentage that shows how much a company pays out in dividends each year relative to its stock price. Think of it as the “extra” you’re getting just for being a shareholder.

🧮 The magic formula

Here's the magic formula:

Dividend Yield = (Annual Dividend per Share / Current Stock Price) × 100 Let's look at a fictional company, Dividend Delight Inc. (DDI):

The stock price is $100 and they give an annual dividend of $5. So that makes your dividend yield at 5%.

This means for every $100 you invest in DDI, you're getting $5 back in dividends annually. Not too shabby!

📊 Why dividend yield is worth your attention

Dividend yield is like a financial litmus test. Here's what it tells you:

High yield: It might be a cash cow, or the stock price could be in trouble. For instance, a company with a 10% yield might seem attractive, but it could be a sign that things aren’t smooth sailing, inflating the yield.

Low yield: This could indicate a growth-focused company or an overvalued stock. Take tech giants – they often have lower yields because they’re busy reinvesting profits into growth.

Consistent yield: Likely the hallmark of a stable, mature company. Think Coca-Cola or Johnson & Johnson – they’re steady dividend payers with solid business models.

🤔 Why should you care?

Income stream: It's like having a mini money fountain in your portfolio. Dividends can provide a steady cash flow, which is especially useful for retirees or those seeking passive income.

Company health: High yields can be a sign of a stable company (or a red flag if too high). A consistently growing dividend often indicates financial strength.

Reinvestment power: Reinvest those dividends and watch your investment grow like a well-watered plant. This compound growth can significantly boost your returns over time.

🔍 Types of dividend yields explained

Current yield: Based on the latest dividend payment – like a snapshot of where things stand right now. If Company A's stock is trading at $50 and its last quarterly dividend was $0.50, the current annual dividend yield would be 4% ((0.50 × 4) / 50 × 100).

Forward yield: Based on expected future dividends. This is what the company might pay in the coming year. If Company B announces it will increase its quarterly dividend from $0.30 to $0.35 next quarter, and its stock price is $40, the forward yield would be 3.5% ((0.35 × 4) / 40 × 100)

Trailing yield: Based on the total dividends paid over the past year. It's like looking in the rearview mirror of dividend payments.

If Company C paid quarterly dividends of $0.25, $0.25, $0.30, and $0.30 over the past year, and its current stock price is $60, the trailing yield would be 1.83% ((0.25 + 0.25 + 0.30 + 0.30) / 60 × 100).

🌈 The dividend yield spectrum

Remember, a super high yield can be like a "too good to be true" online dating profile – attractive at first glance but potentially hiding some red flags!

👑 Dividend royalty: Aristocrats and kings

Imagine a company that's been handing out increasing dividends longer than some of us have been alive. That's what dividend aristocrats and kings are all about!

Dividend aristocrats: These are S&P 500 companies that have increased their dividend payouts for at least 25 consecutive years. They're like the Iron Man of dividends – reliable and long-lasting.

Dividend kings: These take it a step further, having increased dividends for 50+ years straight. They're the Yoda of dividends – wise, ancient, and still kicking!

Example: Johnson & Johnson has been increasing its dividend for 60 years straight. That's older than the internet!

🕳️ Yield traps: Don't fall for the mirage!

A yield trap is like a financial mirage – it looks amazing from afar but disappears when you get close. Here's what to watch out for:

Unsustainably high yields: If it looks too good to be true, it probably is. A 20% yield might be a red flag, not a goldmine.

Declining stock price: Sometimes a high yield is just masking a falling stock price. It's like putting a fancy hat on a sinking ship.

Unstable payout ratio: If a company is paying out more in dividends than it's earning, that's a recipe for trouble.

Imagine a company with a stock price that's dropped from $100 to $50, but it's still paying the same $5 dividend. The yield looks great at 10%, but the company might be in trouble!

🏋️♀️ How to balance yield and growth in a portfolio

Balancing yield and growth is like being a financial tightrope walker. Here's how to keep your balance:

Diversify across sectors: Mix high-yield sectors (like utilities) with growth sectors (like tech). It's like having a financial fruit salad!

Consider your life stage: Younger investors might focus more on growth, while retirees might lean towards higher yields for income.

Use the barbell strategy: Invest in both high-yield and high-growth stocks, with fewer middle-of-the-road options. It's like having your cake and eating it too!

🕵️♂️ Tips for dividend detectives

Compare within industries: Different sectors have varying norms for dividend yields. For instance, utility companies often boast higher yields compared to tech firms. A 3% yield might be outstanding in the tech sector but mediocre for a utility. Always benchmark a company's dividend yield against its industry peers to get a true sense of its relative generosity.

Check the payout ratio: This crucial metric shows what percentage of a company's earnings are being paid out as dividends. A payout ratio below 50% generally indicates sustainability, while anything above 80% might be a red flag. It's like checking if your friend can actually afford those rounds they're buying everyone. A company with a high payout ratio might struggle to maintain its dividend if earnings dip.

Look for growth: A growing dividend is like a plant that keeps producing more fruit each season. Companies that consistently increase their dividends year after year are often financially healthy and confident about their future prospects. This trend, known as dividend growth, can be more valuable than a high but stagnant yield. Look for firms with a track record of raising dividends annually, as they often outperform in the long run.

💰 Turning dividends into your financial sidekick

Think of dividend investing as giving your money a second job. By picking stocks that pay dividends, you can create a steady stream of extra cash without working more hours. This extra money can help with monthly bills, save for a vacation, or boost your retirement savings.

Remember, it's not about chasing the highest payouts, but finding solid companies that can keep paying dividends for a long time. With some patience and smart choices, you could be earning a "second salary" from your investments.

So why not put your money to work and let dividends become your financial helper? Your future self (and your wallet) will be grateful!

Understanding dividend yield is like having a secret decoder ring for income investments. It's not just about the numbers; it's about what those numbers mean for your investment strategy. Whether you're looking for steady income or long-term growth, dividend yield can be a powerful tool in your investment arsenal.

Remember, a high dividend yield isn't always better. Sometimes it's like a cat offering to babysit your pet fish – sounds great, but you might want to look deeper!

Now go forth and dividend conquer! May your yields be high and your traps be few!

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.