Buybacks vs. Dividends: Which benefits investors more?

When companies have extra cash, they often return it to shareholders through buybacks or dividends. Both methods reward investors, but they work in different ways. Understanding how each method impacts your investments can help you make better decisions to achieve your financial goals.

Think of buybacks and dividends as two sides of the same coin. Buybacks reduce the number of shares in the market, potentially increasing their value. Dividends, on the other hand, provide a steady income stream, making them particularly appealing to certain types of investors. Each approach has its pros and cons, and their effectiveness depends on factors like market conditions, company strategy, and your personal financial needs.

If you’ve ever wondered whether to choose a stock because of its buyback program or its dividend history, this guide breaks it down for you. We’ll explore what buybacks and dividends are, their benefits and drawbacks, and how to balance them in your portfolio for the best results.

What are buybacks? 🔄

Buybacks, also called share repurchases, happen when a company buys its own shares from the market. This reduces the number of shares available and increases the value of the remaining ones.

Why companies use buybacks:

Increase earnings per share (EPS): Fewer shares mean higher EPS, making the company look more attractive to investors. For example, if a company has 1 million shares and buys back 100,000 of them, the earnings are spread across fewer shares, boosting EPS.

Show confidence: Companies repurchase shares when they think their stock is undervalued, signaling to investors that they believe in their growth potential.

Flexibility: Unlike dividends, buybacks aren’t a long-term commitment. Companies can pause or stop buybacks during tough times without alarming investors.

Example:

Apple is a great example of buybacks. In 2023, Apple spent $90 billion on share repurchases. This boosted its EPS and showed confidence in its future, helping to increase its stock value and attract more investors.

What are dividends? 🎉

Dividends are cash payments companies make regularly to shareholders. They’re popular with investors who want steady income.

Why companies pay dividends:

Share profits: Dividends allow companies to give back a portion of their earnings to shareholders. For instance, if a company earns $1 billion and distributes $200 million as dividends, investors receive a direct benefit from its success.

Attract income investors: Reliable dividends appeal to those looking for consistent returns, especially retirees and income-focused investors.

Show financial health: Companies that pay regular dividends signal stability and profitability, showing they can sustain operations while rewarding shareholders.

Example:

Coca-Cola has been paying and increasing its dividends for over 60 years. This long history of consistent payouts has made it a favorite for investors who value reliable income.

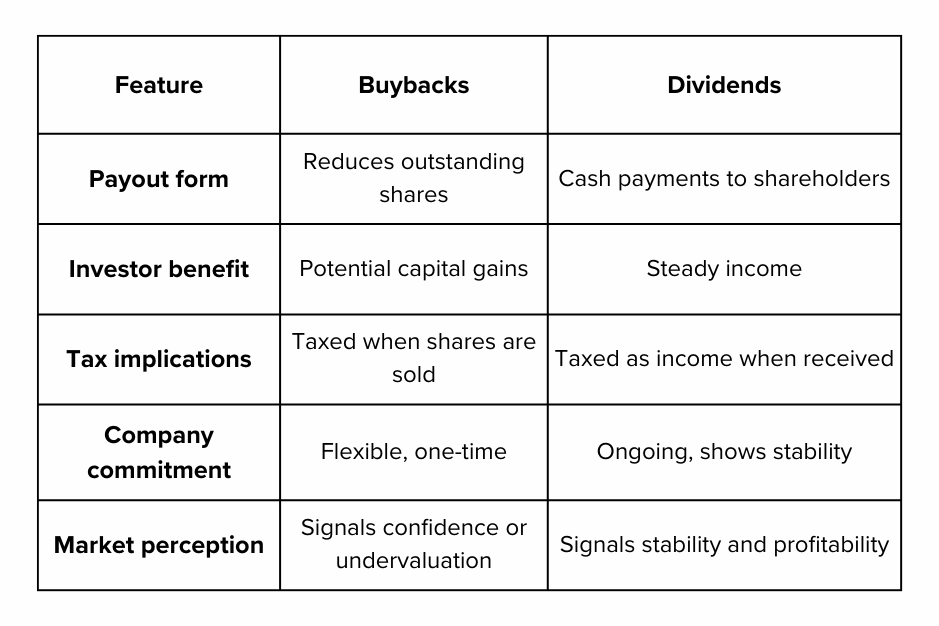

Buybacks vs. dividends: Key differences ⚖️

Pros and cons of buybacks 🚀

Pros:

Tax efficiency: Investors are taxed only when they sell shares, which can mean more savings compared to dividends. This is especially beneficial for long-term investors who defer selling.

Increase in share value: Fewer shares in the market often lead to a higher stock price, directly benefiting shareholders who hold onto their shares.

Flexibility for companies: Companies can decide the timing and size of buybacks based on their financial situation, giving them control over capital use.

Cons:

Bad timing risk: If companies buy back shares at high prices, it can hurt long-term value, especially if the stock later drops in value.

Missed growth opportunities: Excessive buybacks might mean the company isn’t investing enough in new projects, research, or acquisitions.

Unequal benefit: Investors who sell shares during buybacks might benefit more immediately, while long-term holders rely on potential future gains.

Pros and cons of dividends 🌍

Pros:

Steady income: Dividends provide regular cash payouts, making them ideal for retirees or investors who need predictable returns.

Lower risk: Dividend-paying companies are often stable, reducing market volatility and offering a safer investment option.

Reinvestment options: Many companies offer dividend reinvestment plans (DRIPs), allowing investors to buy more shares without additional transaction costs.

Cons:

Tax burden: Dividends are taxed as income, which can reduce what investors take home, especially for those in higher tax brackets.

Less money for growth: Paying dividends leaves less cash for the company to reinvest in expansion or innovation.

Market reaction to cuts: If a company reduces or stops paying dividends, its stock price often drops, damaging investor confidence.

Which benefits investors more? 🔍

The better choice depends on your financial goals, risk tolerance, and investment timeline.

Buybacks may suit you if:

You’re looking for long-term growth in stock value and are okay with delayed rewards.

You want a tax-efficient way to benefit from company profits.

You believe the company’s stock is undervalued and has growth potential.

Dividends may suit you if:

You prefer steady, predictable income to support daily expenses or retirement.

You’re in or near retirement and need regular cash flow.

You value stable companies with a history of paying dividends and don’t mind paying taxes on income.

Impact on portfolio performance 🌐

Buybacks:

Buybacks often lead to higher stock prices, boosting the value of your investments over time. For instance, Apple’s regular buybacks have significantly increased its share price, making it a top choice for long-term investors. By reducing the number of outstanding shares, buybacks amplify the earnings allocated to each share, creating more value for remaining shareholders.

Dividends:

Dividends provide reliable income and reduce the impact of market downturns. Companies in stable industries like utilities and consumer goods often pay consistent dividends, offering a safety net during uncertain times. For example, investors in dividend-paying stocks like Procter & Gamble often benefit from regular income even when the stock market is volatile.

Additionally, reinvesting dividends can compound returns, meaning your money grows faster over time. This strategy works well for younger investors who don’t need the income immediately.

How to balance buybacks and dividends in your portfolio ⚙️

Diversify investments: Include both dividend-paying stocks and companies that do buybacks. For example, you might invest in stable dividend-paying companies like Coca-Cola for regular income and growth-oriented firms like Apple for long-term capital gains.

Know your goals: Define what you need from your investments. Younger investors might prioritize buybacks for growth, while retirees or those nearing retirement could focus on dividend-paying stocks for a steady income stream.

Monitor performance: Regularly review how your investments are performing. If your portfolio becomes too reliant on one strategy (like buybacks), consider rebalancing to add dividend-paying stocks or vice versa.

Consider market conditions: During a bull market, buyback-heavy companies might outperform as stock prices rise. In contrast, dividend-paying stocks can provide stability and income during bear markets or periods of high volatility.

Balance risk and reward: A balanced portfolio combines the stability of dividends with the growth potential of buybacks. For instance, allocating 60% to dividend-paying companies and 40% to growth-focused buyback companies could provide both income and capital appreciation.

Adapt to life stages: Younger investors with a longer time horizon can afford to take more risks with buyback-heavy stocks. As you approach retirement, shift toward dividend-paying stocks to ensure consistent income.

Conclusion: Finding the right fit 🔒

Buybacks and dividends both offer valuable benefits to investors, and the best choice depends on your financial goals and life stage. If you’re seeking long-term growth and tax efficiency, buybacks might align with your strategy. On the other hand, if consistent income and stability are your priorities, dividends could be a better fit.

Many successful portfolios combine both strategies to create balance. By including dividend-paying stocks for income and stability, alongside buyback-heavy stocks for growth potential, you can enjoy the best of both worlds. It’s essential to regularly evaluate your investments, understand market trends, and adjust your portfolio as your financial needs evolve.

Ultimately, the decision comes down to what works best for your unique goals. Whether you prioritize growth, income, or a mix of both, understanding how buybacks and dividends impact your investments will help you make informed decisions and build a robust portfolio for the future.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.