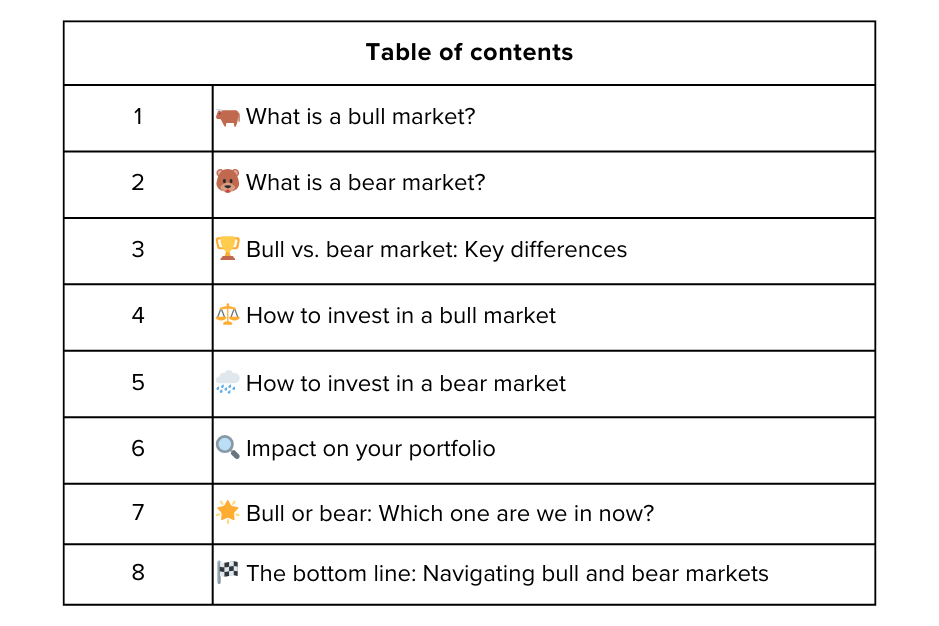

Bull market vs. bear market: What’s the difference?

The stock market is often described as either a bull or a bear, but what does that actually mean? If you’ve ever felt confused by these terms, don’t worry—you’re not alone. Understanding the difference between a bull market and a bear market is crucial for navigating the ups and downs of investing. Let’s simplify these concepts and see how they impact your portfolio.

What is a bull market? 🐂

A bull market occurs when stock prices are rising or expected to rise. It’s a time of optimism, confidence, and growth, often accompanied by strong economic performance.

Key features of a bull market:

Rising stock prices: A bull market is marked by a sustained increase in stock prices, typically by 20% or more from a recent low.

High investor confidence: Optimism drives buying activity as investors expect prices to keep climbing.

Economic growth: Bull markets often coincide with strong GDP growth, low unemployment, and rising corporate profits.

Abundant liquidity: With easy access to capital, both businesses and consumers are more likely to spend and invest.

Famous bull markets:

1990s Dot-com boom: Fueled by the rise of internet companies, this was one of the most notable bull markets in history.

2009-2020 post-crisis rally: Following the 2008 financial crisis, global markets saw a decade-long bull run driven by economic recovery and innovation in tech.

What is a bear market? 🐻

In contrast, a bear market happens when stock prices fall by 20% or more from recent highs. It’s a period of pessimism and caution, often tied to economic slowdowns.

Key features of a bear market:

Falling stock prices: Prices decline sharply over a prolonged period, often leading to reduced investor activity.

Low investor confidence: Fear and uncertainty dominate, causing many investors to sell their holdings.

Economic contraction: Bear markets often coincide with recessions, higher unemployment, and declining corporate earnings.

Tight liquidity: Businesses and consumers cut back on spending as access to capital becomes more difficult.

Famous bear markets:

2008 financial crisis: Triggered by the collapse of the housing market, this was one of the most severe bear markets in modern history.

COVID-19 pandemic crash (2020): A rapid market decline caused by the uncertainty and economic impact of the global pandemic.

Bull vs. bear market: Key differences🏆

How to invest in a bull market ⚖️

A bull market presents opportunities for growth, but it’s important to stay strategic. Here are some tips:

Ride the wave: Take advantage of rising prices by investing in growth stocks or broad market ETFs. Sectors like technology, consumer discretionary, and financials often lead the charge in bull markets.

Rebalance your portfolio: As asset values increase, adjust your allocations to maintain your target risk level. For example, if equities outperform, you might need to shift funds into bonds or other stable investments.

Avoid overconfidence: Don’t assume prices will always rise. Market corrections can occur even during a bull run, so stay diversified and avoid excessive risk.

Focus on long-term goals: While gains are exciting, ensure your investments align with your financial objectives. Use bull markets to build wealth steadily rather than chasing speculative opportunities.

How to invest in a bear market 🌧️

Bear markets can be intimidating, but they also offer unique opportunities for disciplined investors:

Stick to a plan: Avoid panic selling. Markets are cyclical, and downturns often pave the way for future growth. Sticking to a well-thought-out strategy helps you stay focused.

Look for value: Bear markets often create opportunities to buy quality stocks at discounted prices. Focus on companies with strong balance sheets and competitive advantages.

Diversify: Spread your investments across asset classes to reduce risk. Include bonds, gold, or other defensive assets to provide stability.

Focus on defensive sectors: Consider industries like healthcare, utilities, and consumer staples that tend to perform well during downturns. These sectors provide essential goods and services, making them more resilient.

Keep cash ready: Having liquidity allows you to take advantage of opportunities as they arise. Use a systematic investment plan (SIP) approach to average out costs and reduce risks.

Review dividend stocks: Some companies continue paying dividends even in bear markets, offering a steady income stream.

Impact on your portfolio 🔍

During a bull market:

Growth-focused investments shine: Stocks, especially in sectors like technology, consumer discretionary, and financials, tend to perform well. Investments in emerging markets also see robust growth.

Higher portfolio value: Rising prices increase the value of your investments, giving you more flexibility for future planning.

Opportunity for rebalancing: Gains in some assets may require adjustments to keep your portfolio balanced. This is a good time to lock in profits from overperforming stocks and diversify into other asset classes.

During a bear market:

Portfolio value may decline: Stock-heavy portfolios often see temporary losses. However, this is normal and doesn’t mean permanent damage.

Importance of diversification: Balanced portfolios with bonds or defensive stocks typically fare better. For instance, U.S. Treasury bonds often perform well during economic uncertainty.

Opportunities for long-term investors: Use the downturn to buy quality assets at lower prices. Historically, bear markets have been followed by strong recoveries, making them an excellent time for value investing.

Risk of emotional decisions: Fear often drives poor choices. Having a clear plan helps prevent impulsive actions that could harm your long-term returns.

Bull or bear: Which one are we in now? 🌟

The market’s direction isn’t always clear-cut. A bull market can experience short-term corrections, while a bear market might see temporary rallies. To determine the current phase:

Look at stock indices: Are they consistently rising or falling? Sustained trends usually indicate a bull or bear market.

Analyze economic data: Indicators like GDP growth, unemployment rates, and corporate earnings provide clues about the broader economic environment.

Monitor investor sentiment: Surveys and market data, like the VIX (Volatility Index), reveal whether optimism or fear is dominating.

Consider global events: Major geopolitical or economic disruptions often shift market conditions.

Currently, markets may be influenced by factors like inflation, interest rate changes, or global supply chain issues. Staying informed and flexible is key to navigating this landscape.

The bottom line: Navigating bull and bear markets 🏁

Whether the market is bullish or bearish, it’s important to stay focused on your goals. Bull markets are exciting but require discipline to avoid overexposure. Bear markets can be challenging but offer opportunities for patient investors.

By understanding the dynamics of bull and bear markets, you can adapt your strategies, manage risks, and make the most of changing market conditions. After all, the market’s behavior might change, but your long-term objectives shouldn’t.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, your capital is at risk. Terms & Conditions apply.