Blackrock and Morgan Stanley: “Owning the flows” in a high‑valuation market

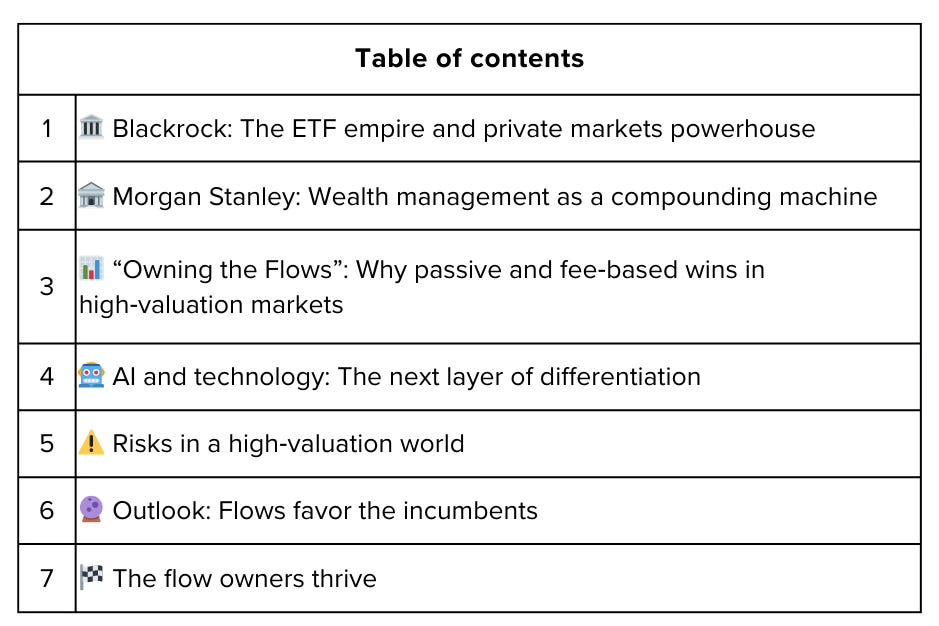

In a market where the “Magnificent Seven” and AI‑themed growth stocks dominate headlines, two financial giants have quietly positioned themselves as the primary beneficiaries of capital flows: BlackRock (BLK) and Morgan Stanley (MS). While retail investors chase individual winners, these firms own the plumbing—the ETFs, index products, wealth platforms, and institutional distribution networks that channel trillions into those same names. In 2025’s high‑valuation environment, where passive indexing and fee‑based assets have never been more dominant, BLK and MS exemplify how “owning the flows” has become one of the most profitable strategies in finance.

This article compares their business models, growth drivers, and risks, with a focus on how they thrive even as individual stock valuations stretch to extremes.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.