Balanced and income ETFs: Navigating Fed uncertainty

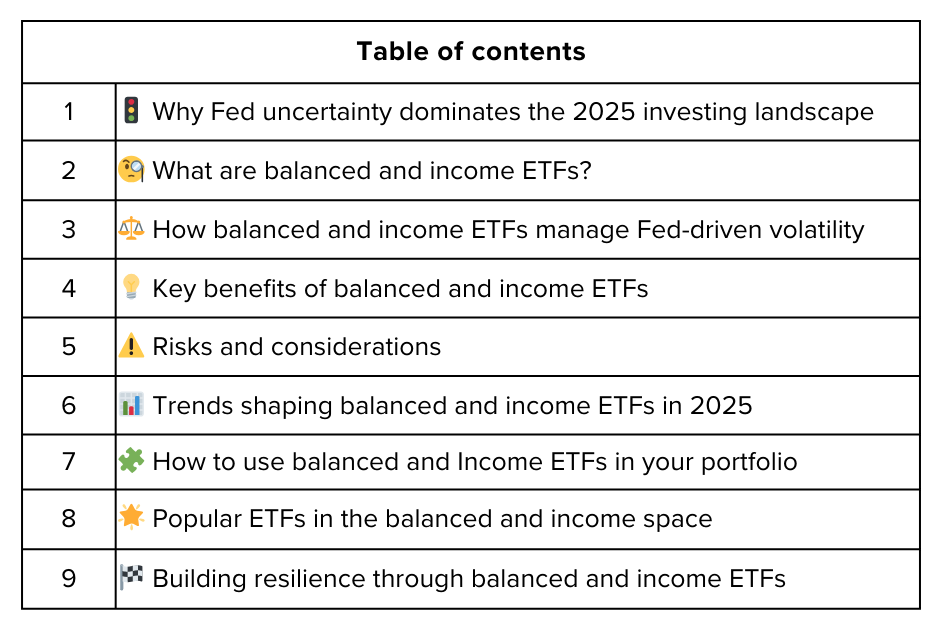

2025 has brought heightened anxiety and opportunity to investors, thanks to the persistent uncertainty surrounding the Federal Reserve’s interest rate policy. As shifting Fed signals ripple through bond, equity, and alternative markets, Balanced and Income ETFs have surged in popularity—offering a way to preserve value, generate cash flow, and adapt dynamically. Whether you’re planning for retirement, seeking monthly distributions, or defending against market swings, these ETFs are increasingly vital tools for weathering volatility and building resilient portfolios. In this article, we’ll explore why Balanced and Income ETFs matter now, their mechanics, their benefits and risks, and which funds stand out in today’s complex market backdrop.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.